Our management model

Value chain

Growth at Abengoa is achieved through five strategic focal points:

- Creating new lines of business that help combat climate change and push towards sustainable development.

- Maintaining a highly competitive human team.

- Permanent strategy of creating value by generating new options as we define current and future lines of business through a structured procedure.

- Geographic diversification in markets offering the greatest potential.

- Driving investment in research, development and innovation.

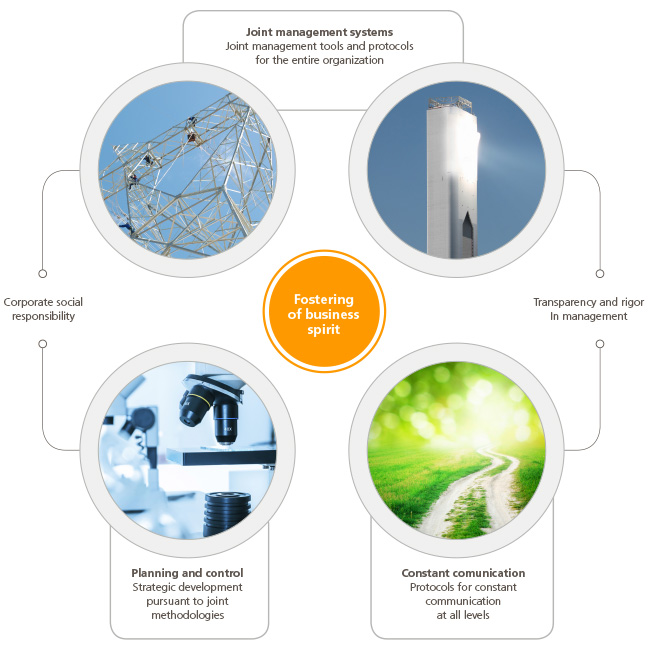

These focal points are targeted through a management model rooted in three key concepts:

- Corporate social responsibility.

- Transparent and exhaustive management.

- Fostering a culture of enterprise.

Financing model

Abengoa relies on various sources of corporate financing, the main ones being the capital markets and loans from banks, as well as long-term non-recourse financing associated with concession-based ventures. At present, the capital markets account for more than 50 % of Abengoa’s corporate financing, with the company offering seven high-yield bonds, two convertible bonds and a short-term commercial paper facility. On the subject of loans with banks, the main source of corporate financing is a five-year syndicated loan secured from a pool of banks, plus a number of loans and credit facilities with institutional bodies such as the Spanish Instituto de Crédito Oficial and various export credit agencies. The company also relies on non-recourse loans to finance its assets under concession. Non-recourse financing is generally used for the construction and/or acquisition of an asset. In these cases, the only collateral is the assets and cash flows of the company or group of companies engaged in the business for which the asset in question is to be used.

- Abengoa Yield

Abengoa Yield is a Nasdaq-listed vehicle that has its own sources of financing unrelated to Abengoa’s. Abengoa Yield invests, manages and acquires assets in the fields of renewable energies, conventional power generation, power transmission lines and other assets under concession. It currently owns and manages 13 concession-based assets and holds a pre-emptive right to acquire certain other assets from Abengoa. Abengoa Yield has long-term non-recourse financing for all its assets under concession. Moreover, Abengoa Yield has additional debt capacity in its corporate area due to the available cash it retains from its concession-based assets after dividend pay-outs. Abengoa Yield has access to the capital markets and to bank financing.

- Abengoa Projects Warehouse 1

Abengoa Projects Warehouse 1 is a new company which, along with the investor in energy infrastructures EIG Global Energy Partners (EIG), is set to acquire a portfolio of Abengoa projects under construction, including both renewable and conventional power generation facilities, and power transmission and water management assets in different regions, including the United States, Mexico, Brazil and Chile. The aim is to raise funds to obtain sufficient permanent capital to finance the construction of the new concession-based projects awarded to Abengoa. Abengoa Projects Warehouse 1 will make the company’s business and financing model more efficient as it seeks to lower the cost of project financing and bring the construction phase forward, effectively meaning that the assets can be brought online and start generating revenue that much sooner.

-

A business model poised to generate positive free-cash-flow.

H1 Cash Generation

- Conventional power plants

- Electricity transmission systems

- Solar thermal power plants with mature technologies (power tower

and parabolic trough) - Photovoltaic plants

- Bioenergy (1G and 2G)

- Water desalination and reuse

- Other renewable energies: wind and waste to energy

H2 Growth

- Engineering and construction

of new products and in new regions - Electricity transmission systems

in new regions - Rail transport infrastructures

- First-of-a-kind solar thermal power plants (power tower and parabolic trough)

- High concentration photovoltaic plants (HCPV)

- Energy storage for electricity systems (molten salts and batteries)

- Waste to biofuels

- Bioethanol processing system for submarines

- Pellets plant

- Water reuse and treatment for industry

H3 Future Options

- Engineering and construction in new sectors

- Hydrogen: other applications

- Marine energy

- Solar thermal power plants featuring new technologies and in new regions

- New photovoltaic technologies

- Biorefining (new bioproducts)

- Energy crops

- New membrane technologies