Other information of interest

1. Provide a brief detail of any other relevant aspects in the matter of the corporate governance of the company or entities of the group that have not been included in the other sections of this report, but that the inclusion of which is necessary for the compiling of a more complete and reasonable information on the structure and practices of governance in the entity or group.

In 2013 Abengoa started compiling a “corporate compliance” programme.

The concept of “corporate compliance” was introduced in adherence to international practices and to specific compulsory legal rules and regulations, especially practised in Anglo-Saxon Law and, from December 2014 onwards, in Spain. Up until the Transparency Law and, most recently, Law 31/2014, of December 3, which amends the Corporate Law to improve corporate governance, became effective and enforceable in Spain, good governance recommendations were only as such, recommendations. They were not binding even though, on the international markets, companies were legally obliged to comply with certain codes of conduct to prevent fraud, among other bad practices. Notwithstanding the above, due to the increase in getting closer to the international markets as well as to the recent promulgation of Law 31/2014, it is now necessary, on the one hand, to harmonize the international practice with the Spanish laws, thus introducing the concept of criminal liability for legal entities and, on the other, to adapt the various company standards to the new amendments introduced in the Corporate Law.

The goal and objective that Abengoa hopes to attain by creating this programme and by adapting its standards to the recent amendments in the Corporate Law on the aspect of corporate governance is for the board of directors and the management to apply and practice ethics, legality and efficacy in business transactions (good governance), with the organization’s systematic focus on evaluating and managing risks, and to ensure that the organization and its employees comply with the existing laws, regulations and standards, including the company’s behavioural standards (regulatory compliance), with Abengoa exercising the due control and providing a strategic vision to tackle the legal needs of the organization. The creation of a regulatory compliance monitoring programme by introducing an effective system of good governance and crime prevention is an inevitable resource for the reputation of Abengoa.

Abengoa’s corporate compliance programme establishes standards and procedures for detecting and preventing bad corporate practices, with the board of directors acting as the authority in supervising the implementation and improvement of the compliance programme and creating the internal post of compliance officer. An appropriate “corporate compliance programme” requires an evaluation of the criminal, social and corporate good governance risks, a monitoring authority, a follow-up, action and surveillance programme as well as a significant task of continuous training of employees.

2. In this section, you may also include any other information, clarification or detail related to the above sections of the report, to the extent that these are deemed relevant and not reiterative.

Specifically, indicate whether the company is subject to non-Spanish legislation with regard to corporate governance and, if so, include the information it is obliged to provide and which is different from that required in this report.

Admission to trade on Nasdaq

The ADS (American Depositary Shares) of Abengoa, SA purchased for Class B Shares were officially admitted to trade on Nasdaq, electronics stock market of American shares, on October 17, 2013. Consequently, Abengoa has to comply with the SEC requirements on the aspect of providing information, which implies reporting to the SEC all relevant information that the CNMV may publish in Spain, as well as having to make certain financial information available to SEC on yearly basis.

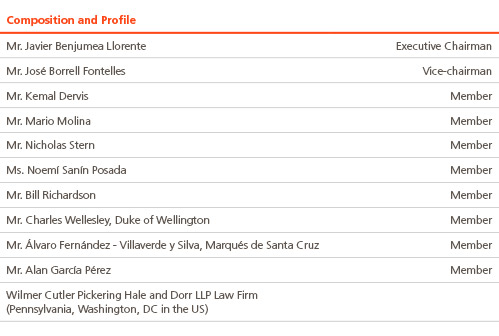

International Advisory Board

In 2010, Abengoa, becoming aware of its growing international implications in business transactions, created the International Advisory Board, with the board of directors empowered to select its members. The Advisory Board is a non-ruled voluntary body that renders technical and advisory consultancy services to the board of directors, to which it is organically and functionally subordinate, as consultant and strictly professional adviser; its main function is to serve as support to the board of directors within the scope of the latter’s own power and authority, collaborating and advising, basically focusing its activities on responding to inquiries made by the Board of Directors in connection to all issues on which the board of directors may seek advice, or even suggesting and making proposals considered as the outcome of their experience and analysis. This task of providing consultancy in matters of strategy, the environment and corporation, is in line with the greater knowledge Abengoa holds in the needs of the various interest groups. It is one of the best indicators of the needs of interest groups

In 2014 Ms. Noemí Sanín Posada replaced Mr. Ricardo Hausmann.

The international advisory board comprises of persons of renowned prestige in various matters at international level. The most suitable profiles are selected based on the criteria of qualifications regardless of gender. The procedure for selecting them is based on professional merits and profiles and not on specific interests.

The members of the advisory board serve for two years, with the board of directors empowered to select its members who can also be re-selected. We now have a woman, Ms. Noemí Sanín Posada, on the board.

Whistleblowing Channel

Abengoa and its business units have been operating a whistleblower channel since 2007 pursuant to the requirements of the Sarbanes-Oxley Act, whereby interested parties may report possible irregularities on accounting, auditing or internal controls over financial reporting, to the audits Commission. A register is kept of all communications received in relation to the whistleblower, subject to the necessary guarantees of confidentiality, integrity and availability of the information.

In highly technical cases, the company secures the assistance of independent experts, thus ensuring at all times that it has the sufficient means of conducting a thorough investigation and guaranteeing sufficient levels of objectivity when performing the work.

Rights inherent in Class A and B Shares

Abengoa en el artículo 8 de sus estatutos regula los diferentes derechos de sus acciones clase A y B. La junta general extraordinaria de accionistas celebrada en segunda convocatoria el día 30 de septiembre de 2012 acordó modificar el artículo 8 de los estatutos sociales de Abengoa para incluir un mecanismo de conversión voluntaria de acciones clase A en acciones clase B. A continuación se detalla el mencionado sub-apartado del mencionado artículo 8 que contempla el derecho de conversión voluntaria:

“ […] A.3)Derecho de conversión en acciones clase B

Article 8 of Abengoa’s Bylaws regulates the different rights inherent in its Class A and B shares. The extraordinary general shareholders’ meeting held on the second call on September 30, 2012, agreed to amend Article 8 of Abengoa’s Bylaws to include a mechanism for voluntarily converting class A shares into class B shares. Below is the aforementioned sub-section of the aforementioned Article 8 which includes the right of voluntary conversion:

“ […] A.3) The Right of conversion into Class B Shares

Each Class A Share entitles its owner the right to convert it into a Class B Share until December 31, 2017.

Owner may exercise its right of conversion by notifying the company or, better still, as the case may be, the agency designated for such, through the corresponding participating entity of the Securities Registration, Compensation and Liquidation Management Company (Iberclear), by any media that permits the issuance of remittance and reception receipts, of notification, deemed irrevocably and unconditionally submitted, reflecting the total number of class A shares owned by said owner and the exact number of class A shares over which said owner wishes to exercise the inherent rights of conversion, in order for the Company to execute the agreements necessary for effecting the aforementioned conversion and to subsequently inform the CNMV by issuing the corresponding Notice of Significant Event.

The aforementioned notice shall include the corresponding Certificate of Ownership and Legitimacy for the Class A Shares issued by an entity that must be participant in the Iberclear Management Systems, or through an intermediary or depository or financial entity managing the shares under the terms set forth in the regulations governing securities representation by means of book-entry or through any other equivalent means of accreditation to which the Company grants sufficient validity for that purpose.

The exercise of the inherent conversion rights of a class A shares shall be understood as the company’s stock capital being reduced in the amount of the difference between the nominal value of the class A shares for which the inherent rights are exercised and the nominal value of the same number of class B shares, an amount that will increase the restricted reserve which the company would already have set aside for that purpose and in accordance with Article 335.c) of the Corporate Law.

The Board of Directors, with the specific faculty of substitution by the Chairman or the Chief Executive, shall be empowered to determine the period, frequency and procedure for exercising the inherent conversion rights, including, if applicable, the decision of adequacy of the aforementioned equivalent means of accreditation, as well as all other aspects that may be deemed necessary for the proper and correct exercise of said right, which shall all be appropriately communicated through the corresponding notice of significant event. […]

Reinforcement to guarantee minority rights

In the interest of reinforcing minority rights, Abengoa submitted a series of bylaw amendments to the extraordinary general shareholders’ meeting for approval for the purpose of ensuring that the so-called “defence of minority rights” does not suffer infringements for the mere fact that two different classes of shares exist with different nominal values simply because the lesser nominal value of the class B shares would entail that it is more difficult to obtain the percentages of the stock capital required for the exercise of some policy rights. Thus, the general shareholders’ meeting approved the amendments of Abengoa’s bylaws in the manner set forth below to envisage that all rights are exercised considering the number of shares as basis for the percentage, and not the stock capital. These rights, like, for example, the right to convene a shareholders meeting or to request the exercise of a corporate liability action, requires the ownership of a specific percentage of stock capital in the nominal sense (in the cited case, 5% at present) though, as a consequence of the enforceability of Law 31/2014, which amends the Corporate Law with regards to Corporate Governance, Abengoa is currently revising its internal rules and regulations which will imply, among other things, the reducing of the aforementioned percentage down to 3%).

In particular, the extraordinary general shareholders’ meeting approved the amendment of the bylaws so that it may reflect: that shareholders be required to own three hundred and seventy-five (375) shares, regardless of whether class A or B, to attend the general meeting of the company’s shareholders; that shareholders be allowed to request the publication of a supplement to the call for an ordinary general meeting of shareholders including one or more points on the agenda and to submit proposals of decisions on issues already included or that should be included on the agenda of the convened meeting based on the number of shares owned by the shareholders; that (i) shareholders who own one percent of the voting shares be able to request the presence of Notary Public to endorse the minutes of the shareholders’ general meeting on the basis of the number of shares that they may own; (ii) shareholders who own five percent of voting shares be able to request the convening of the shareholders’ general meeting that should decide on the corporate liability action against directors or to exercise the corporate liability action without or against the decision of the shareholders’ general meeting; that the company’s board of directors convene shareholders’ general meeting if requested as such by shareholders representing five percent of the company’s voting shares; that the company’s board of directors extend the shareholders’ general meeting if requested as such by the shareholders representing five percent of the company’s voting shares and that the company’s board chairman suspends the rights to information as established in Article 197 of the Corporate Laws if requested as such by shareholders representing less than twenty-five percent of the company’s voting shares.

Notwithstanding all of the above, as already previously mentioned, the bylaws and other rules regulating the operation of the company and its internal organs are being revised for adaptation to the new legal requirements introduced in Law 31/2014 which amends the Corporate Laws with regards to matters of Corporate Governance. The expected amendments include, among others, the decrease in the percentage from 5% referred to above down to 3%.

3. The company may also indicate whether it voluntarily adhered to other codes of the principles of ethics or other good practices, international, sector or otherwise. As the case may be, the company shall identify the code in question and the date of adherence.

As a result of the company’s commitment to transparency, and for the purpose of continuing to ensure the reliability of the financial report prepared by the company, the report was adapted to the requirements established in section 404 of the 2007 United States Sarbanes-Oxley Act (SOX). For another year, the internal control system of the whole group was voluntarily submitted to an independent evaluation process conducted by external auditors under the PCAOB (Public Company Accounting Oversight Board) audit standards.

This standard is a compulsory law for all companies listed in the United States and is aimed at ensuring the reliability of the financial reporting of these companies and at protecting the interests of their shareholders and investors, by setting up an appropriate internal control system. This way, and even though none of the Business Units are under obligation to comply with the SOX Law, Abengoa believes it is best for all its companies to comply with said requirements, since said rules complete the risks control model that the company uses.

Likewise, in 2002 Abengoa signed the United Nations World Pact, an international initiative aimed at achieving the voluntary commitments of entities regarding social responsibility, by way of implementing ten principles based on the fights against corruption and on human, labour and environmental rights.

In 2006 Abengoa Peru signed the United Nations World Agreement, an agreement that is part of the principles of strategy, culture, and the daily transactions of our company, and we strive to make a clearer declaration of our commitments – both to our employees, colleagues, clients, as well as to the public in general.

Also, in 2007, the company signed the Caring for Climate initiative, also from the United Nations. Consequently, Abengoa put in motion a system of reporting on greenhouse gas (GHG) emissions which would permit it to register its greenhouse gas emissions, know the traceability of all its supplies and certify its products and services.

This Annual Corporate Governance Report was approved by the company’s Board of Directors at its meeting held on:

Indicate whether Board Members voted against or abstained from voting for or against the approval of this Report.

No