Notes to the consolidated financial statements

Note 1

General information

Abengoa, S.A. was incorporated in Seville, Spain on January 4, 1941 as a Limited Liability Company and was subsequently transformed into a Limited Liability Corporation (‘S.A.’ in Spain) on March 20, 1952. Its registered office is Campus Palmas Altas, C/ Energía Solar nº 1, 41014 Seville.

The Group’s corporate purpose is set out in Article 3 of its Bylaws. It covers a wide range of activities, although Abengoa is principally an applied engineering and equipment manufacturer, providing integrated project solutions to customers in the following sectors: energy, telecommunications, transport, water utilities, environmental, industrial and service.

Abengoa’s shares are represented by class A and B shares which are listed on the Madrid and Barcelona stock exchanges and on the Spanish Stock Exchange Electronic Trading System (Electronic Market) and Class B shares are included in the IBEX 35. Class A shares have been listed since November 29, 1996 and class B shares since October 25, 2012. Additionally, Class B shares are also listed on the NASDAQ Global Select Market in the form of American Depositary Shares from October 29, 2013 following the capital increase carried out on October 17, 2013. The Company presents mandatory financial information quarterly and semiannually.

Following the initial public offering of our subsidiary Abengoa Yield (see Note 6.2), of which Abengoa held a 64.28% interest as of December 31, 2014, Abengoa Yield’s shares are also listed in the NASDAQ Global Select Market from June 13, 2014.

Abengoa is an international company that applies innovative technology solutions for sustainability in the energy and environment sectors, generating electricity from renewable resources, converting biomass into biofuels and producing drinking water from sea water. The Company supplies engineering projects under the ‘turnkey’ contract modality and operates assets that generate renewable energy, produce biofuel, manage water resources, desalinate sea water and treat sewage.

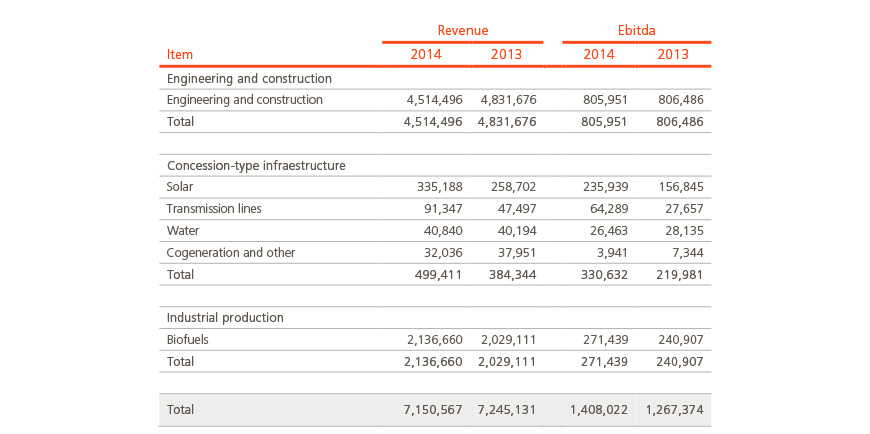

Abengoa`s business and the internal and external management information are organized under the following three activities:

- Engineering and construction: includes the traditional engineering activities in the energy and water sectors, with more than 70 years of experience in the market and the development of solar technology. Abengoa is specialized in carrying out complex turn-key projects for thermo-solar plants, solar-gas hybrid plants, conventional generation plants, biofuels plants and water infrastructures, as well as large-scale desalination plants and transmission lines, among others.

- Concession-type infrastructures: groups together the company’s extensive portfolio of proprietary concession assets that generate revenues governed by long term sales agreements, such as take-or-pay contracts, tariff contracts or power purchase agreements. This activity includes, the operation of electric (solar, cogeneration or wind) energy generation plants and transmission lines. These assets generate low demand risk and the Company focuses on operating them as efficiently as possible.

- Industrial production: covers Abengoa’s businesses with a high technological component, such as development of biofuels technology. The Company holds an important leadership position in these activities in the geographical markets in which it operates.

These Consolidated Financial Statements were approved by the Board of Directors on February 23, 2015.

All public documents of Abengoa may be viewed at www.abengoa.com.

Note 2

Significant accounting policies

2.1. Basis of presentation

The Consolidated Financial Statements as of December 31, 2014 have been prepared in accordance with International Financial Reporting Standards adopted by de European Union (IFRS-EU) and they present the Group’s equity and financial position as of December 31, 2014 and the consolidated results of its operations, the changes in the consolidated net equity and the consolidated cash flows for the financial year ending on that date.

Unless otherwise stated, the accounting policies set out below have been applied consistently throughout all periods presented within these Consolidated Financial Statements.

The Consolidated Financial Statements have been prepared under the historical cost convention, modified by the revaluation of certain available-for-sale non-current financial assets under IFRS 1 and with the exception of those situations where IFRS-EU requires that financial assets and financial liabilities are measured at fair value.

The preparation of the Consolidated Financial Statements under IFRS-EU requires the use of certain critical accounting estimates. It also requires that Management exercises its judgment in the process of applying Abengoa’s accounting policies. Note 3 provides further information on those areas which involve a higher degree of judgment or areas of complexity for which the assumptions or estimates made are significant to the financial statements.

The amounts included within the Consolidated Financial Statements (Consolidated Statement of Financial Position, Consolidated Income Statement, Consolidated Statement of Comprehensive Income, Consolidated Statement of Changes in Equity, Consolidated Cash Flow Statement and notes herein) are, unless otherwise stated, all expressed in thousands of Euros (€).

Any presented percentage of interest in subsidiaries, joint ventures (including temporary joint operations) and associates includes both direct and indirect ownership.

2.1.1. Application of new accounting standards

a) Standards, interpretations and amendments effective from January 1, 2014 under IFRS-EU, applied by the Group:

- IAS 32 (Amendment) ’Offsetting of financial assets and financial liabilities’. The IAS 32 amendment is mandatory for periods beginning on or after January 1, 2014 under IFRS-EU and under the IFRS approved by the International Accounting Standards Board, hereinafter IFRS-IASB, and is to be applied retroactively.

- IAS 36 (Amendment) ‘Recoverable Amount Disclosures for Non-Financial Assets’. The IAS 36 amendment is mandatory for periods beginning on or after January 1, 2014 under IFRS-EU and IFRS-IASB.

- IAS 39 (Amendment) ‘Novation of Derivatives and Continuation of Hedge Accounting’. The IAS 39 amendment is for periods beginning on or after January 1, 2014 under IFRS-EU and IFRS-IASB.

The applications of these amendments have not had any material impact on these Consolidated Financial Statements

b) In preparing these Consolidated Financial Statements as of December 31, 2014, the Group has applied the following interpretation that came into effect on January 1, 2014 under IFRS-IASB, and which have been applied early under IFRS-EU:

- IFRIC 21 (Interpretation) ‘Levies’. The IFRIC 21 is mandatory for periods beginning on or after January 1, 2014 under IFRS-IASB and for periods beginning on or after June 17, 2014 under IFRS – EU.

The interpretation effective from January 1, 2014 has not had any significant impact on these Consolidated Financial Statements.

c) Standards, interpretations and amendments published by the IASB that will be effective for periods beginning on or after January 1, 2015:

- Annual Improvements to IFRSs 2010-2012 and 2011-2013 cycles. These improvements are mandatory for periods beginning on or after July 1, 2014 under IFRS-IASB and have not yet been adopted by the EU.

- Annual Improvements to IFRSs 2012-2014 cycle. These improvements are mandatory for periods beginning on or after January 1, 2016 under IFRS-IASB and have not yet been adopted by the EU.

- IFRS 9 ’Financial Instruments’. This Standard will be effective from January 1, 2018 under IFRS-IASB and has not yet been adopted by the EU.

- IFRS 15 ’Revenues from contracts with Customers’. IFRS 15 is applicable for periods beginning on or after 1 January 2017. Earlier application is permitted. IFRS 15 has not yet been adopted by the EU.

- IAS 16 (Amendment) ’Property, Plant and Equipment’ and IAS 38 ’Intangible Assets’, regarding acceptable methods of amortization and depreciation. This amendment is mandatory for periods beginning on or after January 1, 2016 under IFRS-IASB, earlier application is permitted, and has not yet been adopted by the EU.

- IAS 27 (Amendment) ‘Separate financial statements’ regarding the reinstatement of the equity method as an accounting option n separate financial statements. This amendment is mandatory for periods beginning on or after January 1, 2016 under IFRS-IASB and has not yet been adopted by the EU.

- IFRS 10 (Amendment) ‘Consolidated financial statements’ and IAS 28 ‘Investments in associates and joint ventures’ regarding the exemption from consolidation for investment entities. These amendments are mandatory for periods beginning on or after January 1, 2016 under IFRS-IASB and have not yet been adopted by the EU.

- IFRS 11 (Amendment) ’Joint Arrangements’ regarding acquisition of an interest in a joint operation. This amendment is mandatory for periods beginning on or after January 1, 2016 under IFRS-IASB, earlier application is permitted, and has not yet been adopted by the EU.

The Group is currently in the process of evaluating the impact on the Consolidated Financial Statements derived from the application of the new standards and amendments that will be effective for periods beginning after December 31, 2014.

2.1.2. IFRIC 12 – Service concession arrangements

As stated in the consolidated financial statements for 2011 and as a result of IFRIC 12 ‘Service Concession Arrangements’ that came into effect in 2010, the Company carried out an analysis of other agreements in the Group and identified further infrastructures, specifically thermo-solar plants in Spain included under the special arrangements of RD 661/2007 and recorded in the pre-assignment register in November 2009, which could potentially be classified as service concession arrangements.

At the end of 2010, the company decided that it needed to carry out a more in-depth analysis of the issue since the reasons that justified the accounting application of the interpretation had not been sufficiently proven based on the information available at that date.

During 2010 and 2011, the Spanish government issued several laws and resolutions that regulate the market for renewable energy in Spain in general, and thermo-solar activities in particular. In early 2011, when Abengoa received a set of individual rulings from the Spanish Ministry of Industry for each of its thermo-solar assets,the Company returned to work on the analysis of applying IFRIC 12 to its thermo-solar plants in Spain. In September 2011 the Company concluded that it was required to start applying IFRIC 12 to its thermo-solar plants in Spain included under the special scheme of Royal Decree 661/2007 and recorded in the pre-assignment register in November 2009, just as it was doing for its other concession assets, based on all available information and the newly acquired knowledge from the analysis performed.

As explained in the preceding paragraphs, it was not possible to allow application on January 1, 2010 of IFRIC 12 to those thermo-solar plants and, as indicated in Paragraph 52 of IAS 8 on Accounting Policy and Changes to Accounting Estimates, the application became prospective as from September 1, 2011.

At the time of application of IFRIC 12, the Company reclassified all capitalized costs under the heading of ‘other assets in projects’ relating to thermo-solar plants into ‘concession assets in projects’ for an amount of €1.6 billion. Similarly, from September 1, 2011, all revenues and costs related to the construction of these plants were recorded based on the percentage of completion method in accordance with IAS 11, from the date of the prospective application of IFRIC 12 to the end of the construction of these assets which were estimated for completion in 2013. This treatment deferred recognition of the costs, margins and revenues generated up to that date and previously eliminated in consolidation prospectively, pro rata, over the term of the remaining construction period.

During 2013, the Company re-evaluated the assumptions made in 2011 that justified the application of IFRIC 12 to thermo-solar plants in Spain as described above. On June 30, 2013 and based on the provisions of IAS 8.14, the Directors deemed it necessary to change the accounting policy applied to these plants. It is believed that financial statements will provide more reliable and comparable information about the application of IFRIC 12 to thermo-solar plants in Spain. The accounting change modified the method in which we initially applied IFRIC 12, as well as the date on which IFRIC 12 was applied (January 1, 2011 instead of September 1, 2011).

The revised accounting treatment consisted in applying IFRIC 12 prospectively from January 1, 2011 by derecognizing, our thermo-solar plant assets previously recognized at cost as ‘‘Property, Plant and Equipment in Projects’’ and recognizing those thermo-solar plant assets at fair value as ‘‘Concession Assets in Projects’’. The difference of €165 million was recorded in that moment in ‘‘Other Operating Income’’ on the consolidated income statement. From January 1, 2011, only the remaining contract revenue, costs and margins generated after such date for the ongoing construction of the plants began to be recognized based on the ‘‘percentage of completion’’ accounting method in accordance with IAS 11. In addition, the revenue and operating profit that were previously deferred upon original adoption of IFRIC 12 and recognized prospectively during fiscal years 2011 and 2012 were eliminated. The change in application date resulted in the recognition of revenues and costs associated with the construction activities that occurred between January 1, 2011 and September 1, 2011, that were previously eliminated.

This change in accounting policy for the application of IFRIC 12 to the thermo-solar plants in Spain, reflects the spirit of Paragraph 45 of IAS 1 which justifies changes in the presentation (in addition to the classification) of annual accounts. As a result of the change, there is an improved presentation of the financial statements. They better reflect the plant construction operations underway in each financial year, without altering the trend of the group's earnings. They also facilitate comparisons between periods.

2.2. Principles of consolidation

In order to provide information on a consistent basis, the same principles and standards applied to the parent company have been applied to all other consolidated entities.

All subsidiaries, associates and joint ventures included in the consolidated group for the year 2014 (2013) that form the basis of these Consolidated Financial Statements are set out in Appendices I (XII), II (XIII) and III (XIV), respectively.

Note 6 of these Consolidated Financial Statements reflects the information on the changes in the composition of the Group.

a) Subsidiaries

Subsidiaries are those entities over which Abengoa has control.

Control is achieved when the Company:

- has power over the investee;

- is exposed, or has rights, to variable returns from its involvement with the investee; and

- has the ability to use its power to affect its returns.

The Company reassesses whether or not it controls an investee when facts and circumstances indicate that there are changes to one or more of the three elements of control listed above.

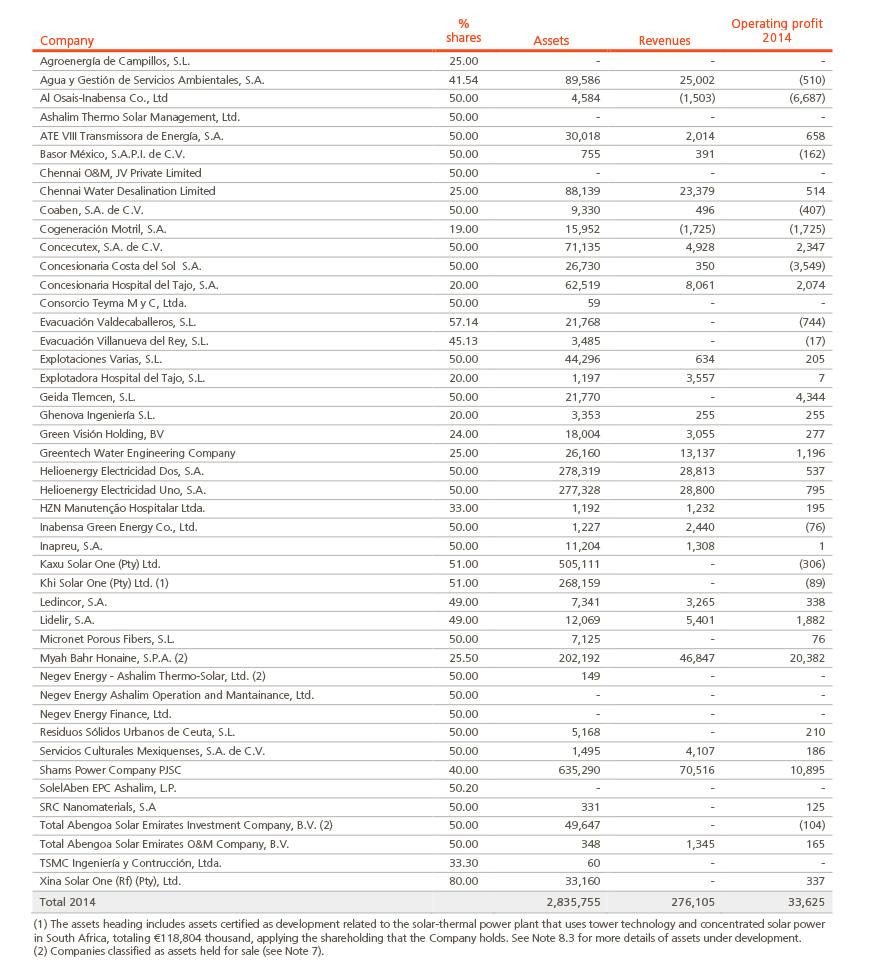

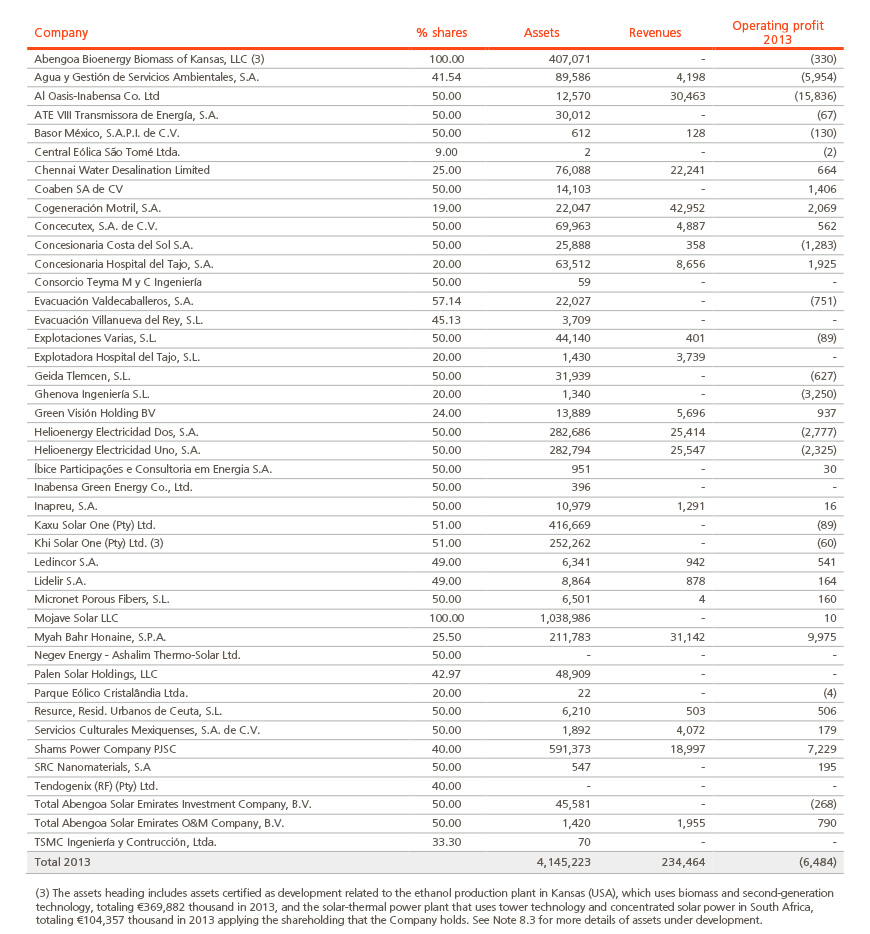

The Company operates an integrated business model in which it provides complete services form initial design, construction and engineering to operation and maintenance of infrastructure assets. In order to evaluate the existence of control, we need to distinguish two independent stages in these projects in terms of decision making process: the construction phase and the operation phase. In some of these projects (such as Solana and Mojave thermo-solar plants in the United States, Hugoton second generation biofuels plant in the United States and solar plants currently under construction in South Africa), all the relevant decisions during the construction phase are subject to the approval and control of a third party. As a result, Abengoa does not have control over these assets during this period and records these companies as associates under the equity method. Once the project is in operation, Abengoa gains control over these companies which are then fully consolidated.

When the Company has less than a majority of the voting rights of an investee, it has power over the investee when the voting rights are sufficient to give it the practical ability to direct the relevant activities of the investee unilaterally. The Company considers all relevant facts and circumstances in assessing whether or not the Company’s voting rights in an investee are sufficient to give it power, including:

- the size of the Company’s holding of voting rights relative to the size and dispersion of holdings of the other vote holders;

- potential voting rights held by the Company, other vote holders or other parties;

- rights arising from other contractual arrangements; and

- any additional facts and circumstances that indicate that the Company has, or does not have, the current ability to direct the relevant activities at the time that decisions need to be made, including voting patterns at previous shareholders’ meetings.

Consolidation of a subsidiary begins when the Company obtains control over the subsidiary and ceases when the Company loses control of the subsidiary.

The Group uses the acquisition method to account for business combinations. According to this method, the consideration transferred for the acquisition of a subsidiary corresponds to the fair value of the assets transferred, the liabilities incurred and the equity interests issued by the Group and includes the fair value of any asset or liability resulting from a contingent consideration arrangement. Any contingent consideration is recognized at fair value at the acquisition date and subsequent changes in its fair value are recognized in accordance with IAS 39 either in profit or loss or as a change to other comprehensive income. Acquisition related costs are expensed as incurred. Identifiable assets acquired, liabilities and contingent liabilities assumed in a business combination are measured initially at their fair values at the acquisition date. The Group recognizes any non controlling interest in the acquiree either at the non controlling interest’s proportionate share of the acquirer’s net assets on an acquisition basis.

The value of non controlling interest in equity and the consolidated results are shown, respectively, under ‘Non controlling interests’ of the Consolidated Statements of Financial Position and ‘Profit attributable to non controlling interests’ in the Consolidated Income Statements.

Profit for the period and each component of other comprehensive income are attributed to the owners of the Company and to the non controlling interests. Total comprehensive income of subsidiaries is attributed to the owners of the Company and to the non controlling interests even if this results in the non controlling interests having a total negative balance.

When necessary, adjustments are made to the financial statements of subsidiaries to bring their accounting policies in line with the Group’s accounting policies.

All intragroup assets and liabilities, equity, income, expenses and cash flows relating to transactions between members of the Group are eliminated in full on consolidation.

In compliance with Article 155 of Spanish Corporate Law (Ley de Sociedades de Capital), the parent company has notified all these companies that, either by itself or through another subsidiary, it owns more than 10 per 100 shares of their capital. Appendix VIII lists the Companies external to the Group which have a share equal to or greater than 10% of a subsidiary of the parent company under consolidation scope.

b) Associates and joint ventures

An associate is an entity over which the Group has significant influence. Significant influence is the power to participate in the financial and operating policy decisions of the investee but is not control or joint control over those policies.

A joint venture, as opposed to a joint operation described in section c) below, is a joint arrangement whereby the parties that have joint control of the arrangement have rights to the net assets of the joint arrangement. Joint control is the contractually agreed sharing of control of an arrangement, which exists only when decisions about the relevant activities require unanimous consent of the parties sharing control.

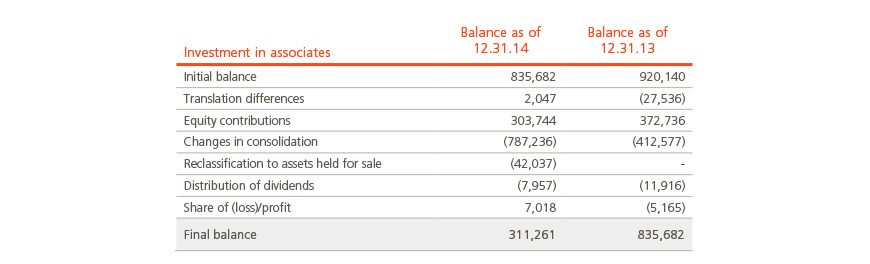

The results and assets and liabilities of associates or joint ventures are incorporated in these Consolidated Financial Statements using the equity method of accounting. Under the equity method, an investment in an associate or a joint venture is initially recognized in the consolidated statement of financial position at cost and adjusted thereafter to recognize the Group’s share of the profit or loss and other comprehensive income of the associate or joint venture. When the Group’s share of losses of an associate or a joint venture exceeds the Group’s interest in that associate or joint venture, the Group discontinues recognizing its share of further losses. Additional losses are recognized only to the extent that the Group has incurred legal or constructive obligations or made payments on behalf of the associate or joint venture.

An investment in an associate or a joint venture is accounted for using the equity method from the date on which the investee becomes an associate or a joint venture.

Profits and losses resulting from the transactions of the Company with the associate or joint venture are recognized in the Group’s Consolidated Financial Statements only to the extent of interests in the associate or joint venture that are not related to the Group.

In compliance with Article 155 of Spanish Corporate Law (Ley de Sociedades de Capital), the parent company has notified all these companies that, either by itself or through another subsidiary, it owns more than 10 per 100 shares of their capital.

As of December 31, 2014 and 2013 there are no significant contingent liabilities in the Group’s interests in associeates and joint ventures.

c) Interest in joint operations and temporary joint operations (UTE)

A joint operation is a joint arrangement whereby the parties that have joint control of the arrangement have rights to the assets, and obligations for the liabilities, relating to the arrangement. Joint control is the contractually agreed sharing of control of an arrangement, which exists only when decisions about the relevant activities require unanimous consent of the parties sharing control.

When a group entity undertakes its activities under joint operations, the Group as a joint operator recognises in relation to its interest in a joint operation:

- Its assets, including its share of any assets held jointly.

- Its liabilities, including its share of any liabilities incurred jointly.

- Its share of the revenue from the sale of the output by the joint operation.

- Its expenses, including its share of any expenses incurred jointly.

When a group entity transacts with a joint operation in which a group entity is a joint operator (such as a purchase of assets), the Group does not recognize its share of the gains and losses until it resells those assets to a third party.

‘Unión Temporal de Empresas’ (UTE) are temporary joint operations generally formed to execute specific commercial and/or industrial projects in a wide variety of areas and particularly in the fields of engineering and construction and infrastructure projects. They are normally used to combine the characteristics and qualifications of the UTE’s partners into a single proposal in order to obtain the most favorable technical assessment possible. UTE are normally limited as standalone entities with limited action, since, although they may enter into commitments in their own name, such commitments are generally undertaken by their partners, in proportion to each investor’s share in the UTE.

The partners’ shares in the UTE normally depend on their contributions (quantitative or qualitative) to the project, are limited to their own tasks and are intended solely to generate their own specific results. Each partner is responsible for executing its own tasks and does so in its own interests.

The fact that one of the UTE’s partners acts as project manager does not affect its position or share in the UTE. The UTE’s partners are collectively responsible for technical issues, although there are strict pari passu clauses that assign the specific consequences of each investor’s correct or incorrect actions.

UTE are not variable interest or special purpose entities. UTE do not usually own assets or liabilities on a standalone basis. Their activity is conducted for a specific period of time that is normally limited to the execution of the project. The UTE may own certain fixed assets used in carrying out its activity, although in this case they are generally acquired and used jointly by all the UTE’s investors, for a period similar to the project’s duration, or prior agreements are signed by the partners on the assignment or disposal of the UTE’s assets upon completion of the project.

UTE in which the Company participates are operated through a management committee comprised of equal representation from each of the temporary joint operation partners, and such committee makes all the decisions about the temporary joint operation’s activities that have a significant effect on its success. All the decisions require consent of each of the parties sharing power, so that all the parties together have the power to direct the activities of the UTE. Each partner has rights to the assets and obligations relating to the arrangement. As a result, these temporary joint operations are consolidated proportionally.

The proportional part of the UTE’s Consolidated Statement of Financial Position and Consolidated Income Statement is integrated into the Consolidated Statement of Financial Position and the Consolidated Income Statement of the Company in proportion to its interest in the UTE on a line by line basis.

As of December 31, 2014 and 2013 there are no significant material contingent liabilities in relation to the Group’s shareholdings in the UTE, additional to those described in Note 22.2.

d) Transactions with non-controlling interests

Transactions with non-controlling interests are accounted for as transactions with equity owners of the group. When the Group acquires non-controlling interests, the difference between any consideration paid and the carrying value of the proportionate share of net assets acquired is recorded in equity. Gains or losses on disposals of non-controlling interests are also recorded in equity.

When the group ceases to have control or significant influence, any retained interest in the entity is remeasured to its fair value, and any difference between fair value and its carrying amount is recognized in profit or loss. In addition, any amount previously recognized in other comprehensive income in respect of that entity is accounted for as if the group had directly disposed of the related assets or liabilities.

Companies and entities which are third parties the Group and which hold a share equal to or larger than 10% in the share capital of any company included in the consolidation group are disclosed in Appendix VIII.

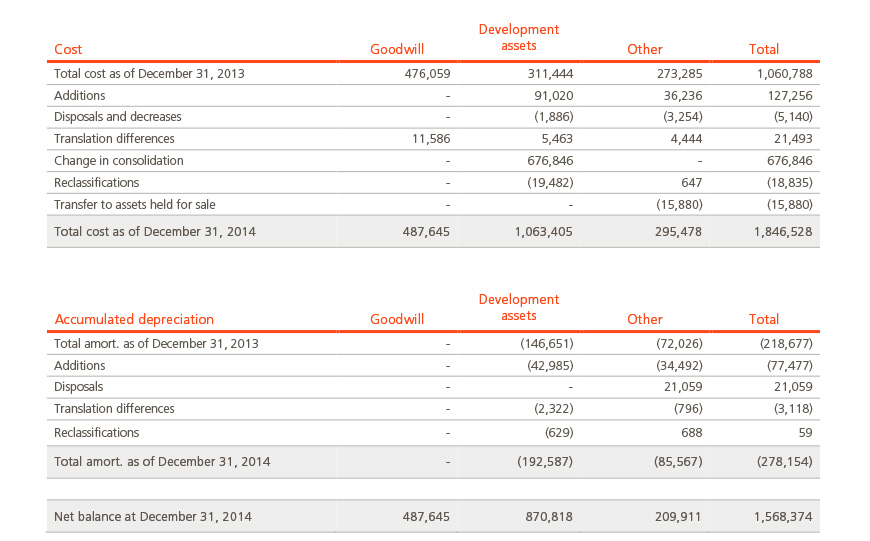

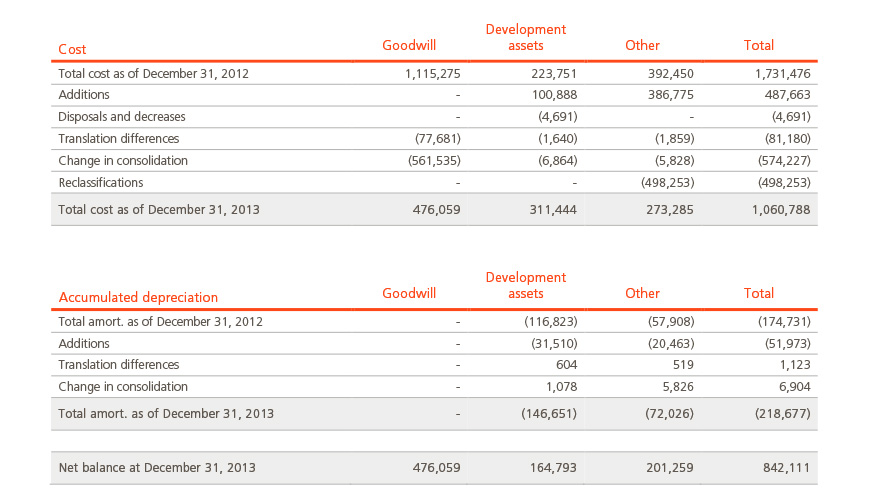

2.3. Intangible assets

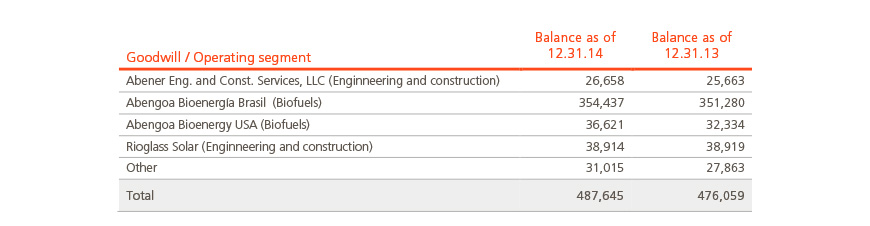

a) Goodwill

Goodwill is recognized as the excess between (A) and (B), where (A) is the sum of the considerations transferred, the amount of any non-controlling interest in the acquiree and in the case of a business combination achieved in stages, the fair value on the acquisition date of the previously held interest in the acquiree and (B) the net value, at the acquisition date, of the identifiable assets acquired, the liabilities and contingent liabilities assumed, measured at fair value. If the resulting amount is negative, in the case of a bargain purchase, the difference is recognized as income directly in the Consolidated Income Statement.

Goodwill relating to the acquisition of subsidiaries is included in intangible assets, while goodwill relating to associates is included in investments in associates.

Goodwill is carried at initial value less accumulated impairment losses (see Note 2.8). Goodwill is allocated to Cash Generating Units (CGU) for the purposes of impairment testing, these CGU’s being the units which are expected to benefit from the business combination that generated the goodwill.

b) Computer programs

Costs paid for licenses for computer programs are capitalized, including preparation and installation costs directly associated with the software. Such costs are amortized over their estimated useful life. Maintenance costs are expensed in the period in which they are incurred.

Costs directly related with the production of identifiable computer programs are recognized as intangible assets when they are likely to generate future economic benefit for a period of one or more years and they fulfill the following conditions:

- it is technically possible to complete the production of the intangible asset;

- management intends to complete the intangible asset;

- the Company is able to use or sell the intangible asset;

- there are technical, financial and other resources available to complete the development of the intangible asset; and

- disbursements attributed to the intangible asset during its development may be reliably measured.

Costs directly related to the production of computer programs recognized as intangible assets are amortized over their estimated useful lives which do not exceed 10 years.

Costs that do not meet the criteria above are recognized as expenses in the Consolidated Income Statement when incurred.

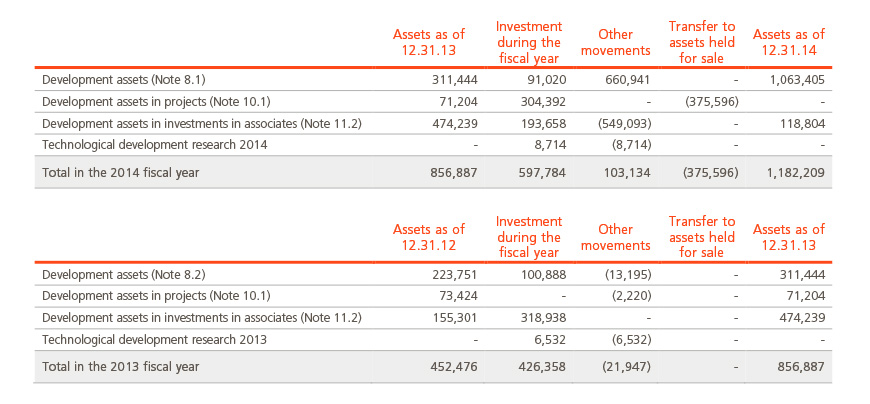

c) Research and development cost

Research costs are recognized as an expense when they are incurred.

Development costs (relating to the design and testing of new and improved products) are recognized as an intangible asset when all the following criteria are met:

- it is probable that the project will be successful, taking into account its technical and commercial feasibility, so that the project will be available for its use or sale;

- it is probable that the project generates future economic benefits;

- management intends to complete the project;

- the Company is able to use or sell the intangible asset;

- there are appropriate technical, financial or other resources available to complete the development and to use or sell the intangible asset; and

- the costs of the project/product can be measured reliably.

Once the product is in the market, capitalized costs are amortized on a straight-line basis over the period for which the product is expected to generate economic benefits, which is normally 5 years, except for development assets related to the thermo-solar plant using tower technology and the second-generation biofuels plant, which are amortized according to its useful life.

Development costs that do not meet the criteria above are recognized as expenses in the Consolidated Income Statement when incurred.

Grants or subsidized loans obtained to finance research and development projects are recognized as income in the Consolidated Income Statement consistently with the expenses they are financing (following the rules described above).

2.4. Property, plant and equipment

Property, plant and equipment includes property, plant and equipment of companies or project companies which have been self-financed or financed through external financing with recourse facilities or through non-recourse project financing.

In general, property, plant and equipment is measured at historical cost, including all expenses directly attributable to the acquisition, less depreciation and impairment losses, with the exception of land, which is presented net of any impairment losses.

Subsequent costs are capitalized when it is probable that future economic benefits associated with that asset can be separately and reliably identified.

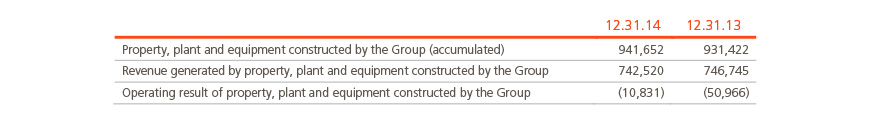

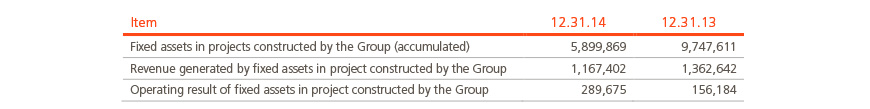

Work carried out by a company on its own property, plant and equipment is valued at production cost. In construction projects of the Company’s owned assets carried out by its Engineering and Construction segment which are not under the scope of IFRIC 12 on Service Concession Arrangements (see Note 2.5), internal margins are eliminated. The corresponding costs are recognized in the individual expense line item in the accompanying income statements. The recognition of an income for the sum of such costs through the line item ‘Other income- Work performed by the entity and capitalized and other’ results in these costs having no impact in net operating profit. The corresponding assets are capitalized and included in property, plant and equipment in the accompanying balance sheets.

All other repair and maintenance costs are charged to the Consolidated Income Statement in the period in which they are incurred.

Costs incurred during the construction period may also include gains or losses from foreign-currency cash-flow hedging instruments for the acquisition of property, plant and equipment in foreign currency, transferred from equity.

With regard to investments in property, plant and equipment located on land belonging to third parties, an initial estimate of the costs of dismantling the asset and restoring the site to its original condition is also included in the carrying amount of the asset. Such costs are recorded at their net present value in accordance with IAS 37.

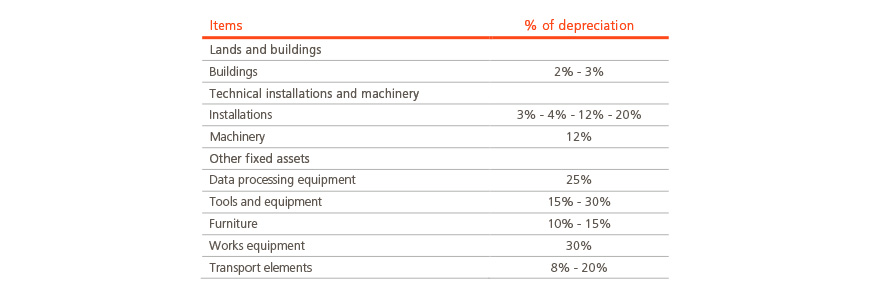

The annual depreciation rates of property, plant and equipment (including property, plant and equipment in projects) are as follows:

The assets’ residual values and useful economic lives are reviewed, and adjusted if necessary, at the end of the accounting period of the company which owns the asset.

When the carrying amount of an asset is higher than its recoverable amount, the carrying amount is reduced immediately to reflect the lower recoverable amount.

2.5. Fixed assets in projects

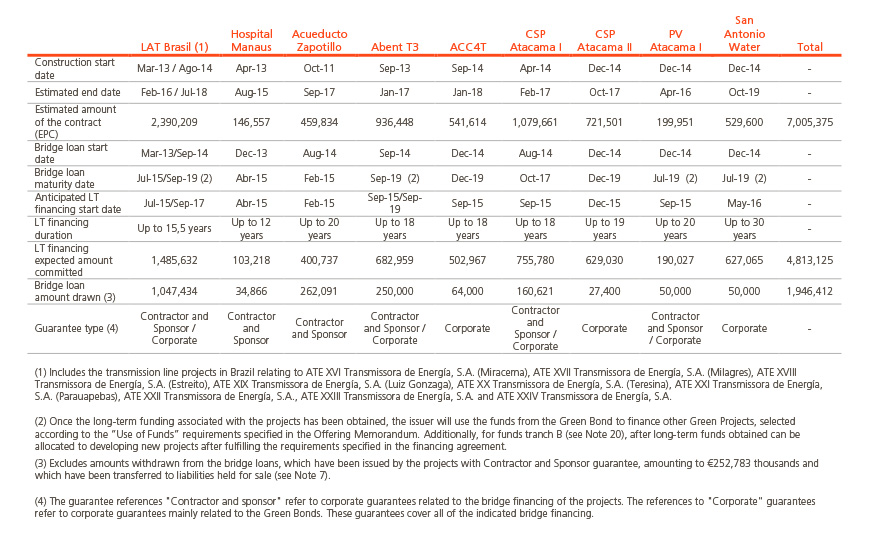

This category includes property, plant and equipment, intangible assets and financial assets of consolidated companies which are financed through project debt (see Note 19), that are raised specifically and solely to finance individual projects as detailed in the terms of the loan agreement.

These assets financed through project debt are generally the result of projects which consist of the design, construction, financing, application and maintenance of large-scale complex operational assets or infrastructures, which are owned by the company or are held under a concession agreement for a period of time. The projects are initially financed through medium-term bridge loans (non-recourse project financing in process) and later by a long-term project finance.

In this respect, the basis of the financing agreement between the Company and the bank lies in the allocation of the cash flows generated by the project to the repayment of the principal amount and interest expenses, excluding or limiting the amount secured by other assets, in such a way that the bank recovers the investment solely through the cash flows generated by the project financed, any other debt being subordinated to the debt arising from the non-recourse financing applied to projects until the project debt has been fully repaid. For this reason, fixed assets in projects are separately reported on the face of the Consolidated Statement of Financial Position, as is the related project debt (project finance and bridge loan) in the liability section of the same statement.

Non-recourse project financing (project finance) typically includes the following guarantees:

- Shares of the project developers are pledged.

- Assignment of collection rights.

- Limitations on the availability of assets relating to the project.

- Compliance with debt coverage ratios.

- Subordination of the payment of interest and dividends to meet loan financial ratios.

Once the project finance has been repaid and the project debt and related guarantees fully extinguished, any remaining net book value reported under this category is reclassified to the Property, Plant and Equipment or Intangible Assets line items, as applicable, in the Consolidated Statement of Financial Position.

Assets in the ‘fixed assets in projects’ line item of the Consolidated Statement of Financial Position are sub-classified under the following two headings, depending upon their nature and their accounting treatment:

2.5.1. Concession assets in projects

This heading includes fixed assets financed through project debt related to Service Concession Arrangements recorded in accordance with IFRIC 12. IFRIC 12 states that service concession arrangements are public-to-private arrangements in which the public sector controls or regulates the services to be provided using the infrastructure and their prices, and is contractually guaranteed to gain, at a future time, ownership of the infrastructure through which the service is provided. The infrastructures accounted for by the Group as concessions are mainly related to the activities concerning power transmission lines, desalination plants and generation plants (both renewable as conventional). The infrastructure used in a concession can be classified as an intangible asset or a financial asset, depending on the nature of the payment entitlements established in the agreement.

a) Intangible asset

The Group recognizes an intangible asset when the demand risk to the extent that it has a right to charge final customers for the use of the infrastructure. This intangible asset is subject to the provisions of IAS 38 and is amortized linearly, taking into account the estimated period of commercial operation of infrastructure which generally coincides with the concession period.

The Group recognizes and measures revenue, costs and margin for providing construction services during the period of construction of the infrastructure in accordance with IAS 11 ‘Construction Contracts’. As indicated in Note 2.7, the interest costs derived from financing the project incurred during construction are capitalized during the period of time required to complete and prepare the asset for its predetermined used.

Once the infrastructure is in operation, the treatment of income and expenses is as follows:

Revenues from the updated annual royalty for the concession, as well as operations and maintenance services are recognized in each period according to IAS 18 ‘Revenue’ in Revenue.

Operating and maintenance costs and general overheads and administrative costs are charged to the Consolidated Income Statement in accordance with the nature of the cost incurred (amount due) in each period.

Financing costs are classified within heading finance expenses in the Consolidated Income Statement.

b) Financial asset

The Group recognizes a financial asset when there is demand risk is assumed by the grantor to the extent that the concession holder has an unconditional right to receive payments for construction or improvement services. This asset is recognized at the fair value of the construction or improvement services provided.

The Group recognizes and measures revenue, costs and margin for providing construction services during the period of construction of the infrastructure in accordance with IAS 11 ‘Construction contracts’.

The financial asset is subsequently recorded at amortized cost method calculated according to the effective interest method, the corresponding income from updating the flows of collections is recognized as revenue in the Consolidated Income Statement according to the effective interest rate.

The finance expenses of financing these assets are classified under the financial expenses heading of the Consolidated Income Statement.

As indicated above for intangible assets, income from operations and maintenance services is recognized in each period as Revenue according to IAS 18 ‘Revenue’.

2.5.2. Other assets in projects

This heading includes tangible fixed and intagible assets which are financed through a project debt and are not subject to a concession agreement. Their accounting treatment is described in Notes 2.3 and 2.4.

2.6. Current and non-current classification

Assets are classified as current assets if they are expected to be realized in less than 12 months after the date of the Consolidated Statements of Financial Position. Otherwise, they are classified as non-current assets.

Liabilities are classified as current liabilities unless an unconditional right exists to defer their repayment by at least 12 months following the date of the Consolidated Statement of Financial Position.

2.7. Borrowing costs

Interest costs incurred in the construction of any qualifying asset are capitalized over the period required to complete and prepare the asset for its intended use. A qualifying asset is an asset that necessarily takes a substantial period of time to get ready for its internal use or sale, which in Abengoa is considered to be more than one year.

Costs incurred relating to non-recourse factoring are expensed when the factoring transaction is completed with the financial institution.

Remaining borrowing costs are expensed in the period in which they are incurred.

2.8. Impairment of non-financial assets

Annually, Abengoa perfoms an analysis of impairment losses of goodwill to determine the recoverable amount.

In addition, Abengoa reviews its property, plant and equipment, fixed assets in projects and intangible assets with finite and indefinite useful life to identify any indicators of impairment. The periodicity of this review is annually or when an event involving as indication of impairment is detected.

If there are indications of impairment, Abengoa calculates the recoverable amount of an asset as the higher of its fair value less costs to sell and its value in use, defined as the present value of the estimated future cash flows to be generated by the asset. In the event that the asset does not generate cash flows independently of other assets, Abengoa calculates the recoverable amount of the Cash-Generating Unit to which the asset belongs.

When the carrying amount of the Cash Generating Unit to which these assets belong is lower than its recoverable amount assets are impaired.

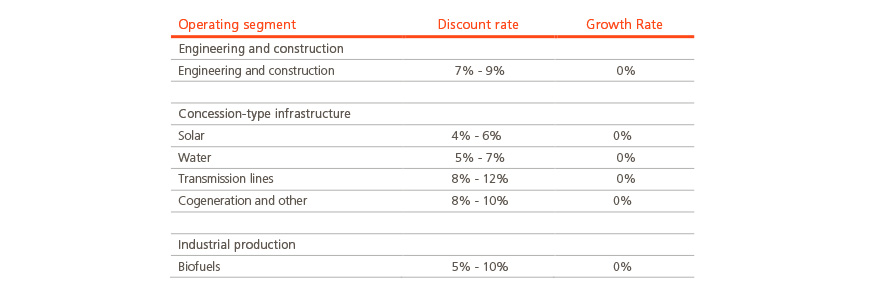

Assumptions used to calculate value in use include a discount rate, growth rates and projected changes in both selling prices and costs. The discount rate is estimated by Management, to reflect both changes in the value of money over time and the risks associated with the specific Cash-Generating Unit. Growth rates and changes in prices and costs are projected based upon internal and industry projections and management experience respectively. Financial projections range between 5 and 10 years depending on the growth potential of each Cash Generating Unit.

To calculate the value in use of the major goodwill balances, the following assumptions were made:

- 10-year financial projections were used for those Cash-Generating Units (CGUs) that have high growth potential based on cash flows taken into account in the strategic plans for each business unit, considering a residual value based on the cash flow in the final year of the projection.

The use of these 10-year financial projections was based on the assumption that it is the minimum period necessary for the discounted cash flow model to reflect all potential growth in the CGUs in each business segment showing significant investments.

The aforementioned estimated cash flows were considered to be reliable due to their capacity to adapt to the real market and/or business situation faced by the CGU in accordance with the business's margin and cash-flow experience and future expectations.

These cash flows are reviewed and approved every six months by Senior Management so that the estimates are continually updated to ensure consistency with the actual results obtained.

In these cases, given that the period used is reasonably long, the Group then applies a zero growth rate for the cash flows subsequent to the period covered by the strategic plan.

- For concession assets with a defined useful life and with a project debt, cash flow projections until the end of the project are considered and no terminal value is assumed.

Concession assets have a contractual structure that permit the Company to estimate quite accurately the costs of the project (both in the construction and in the operations periods) and revenue during the life of the project.

Projections take into account real data based on the contract terms and fundamental assumptions based on specific reports prepared by experts, assumptions on demand and assumptions on production. Additionally, assumptions on macro-economic conditions are taken into account, such as inflation rates, future interest rates, etc.

- 5-year cash flow projections are used for all other CGUs, considering the residual value to be the cash flow in the final year projected.

- Cash flow projections of CGUs located in other countries are calculated in the functional currency of those CGUs and are discounted using rates that take into consideration the risk corresponding to each specific country and currency. Present values obtained with this method are then converted to Euros at the year-end exchange rate of each currency.

- Taking into account that in most CGUs the specific financial structure is linked to the financial structure of the projects that are part of those CGUs, the discount rate used to calculate the present value of cash-flow projections is based on the weighted average cost of capital (WACC) for the type of asset, adjusted, if necessary, in accordance with the business of the specific activity and with the risk associated with the country where the project is performed.

- In any case, sensitivity analyses are performed, especially in relation with the discount rate used, residual value and fair value changes in the main business variables, in order to ensure that possible changes in the estimates of these items do not impact the possible recovery of recognized assets.

- Accordingly, the following table provides a summary of the discount rates used (WACC) and growth rates to calculate the recoverable amount for Cash-Generating Units with the operating segment to which it pertains:

In the event that the recoverable amount of an asset is lower than its carrying amount, an impairment charge for the difference is recorded in the Consolidated Income Statement under the item ‘Depreciation, amortization and impairment charges’. With the exception of goodwill, impairment losses recognized in prior periods which are later deemed to have been recovered are credited to the same income statement heading.

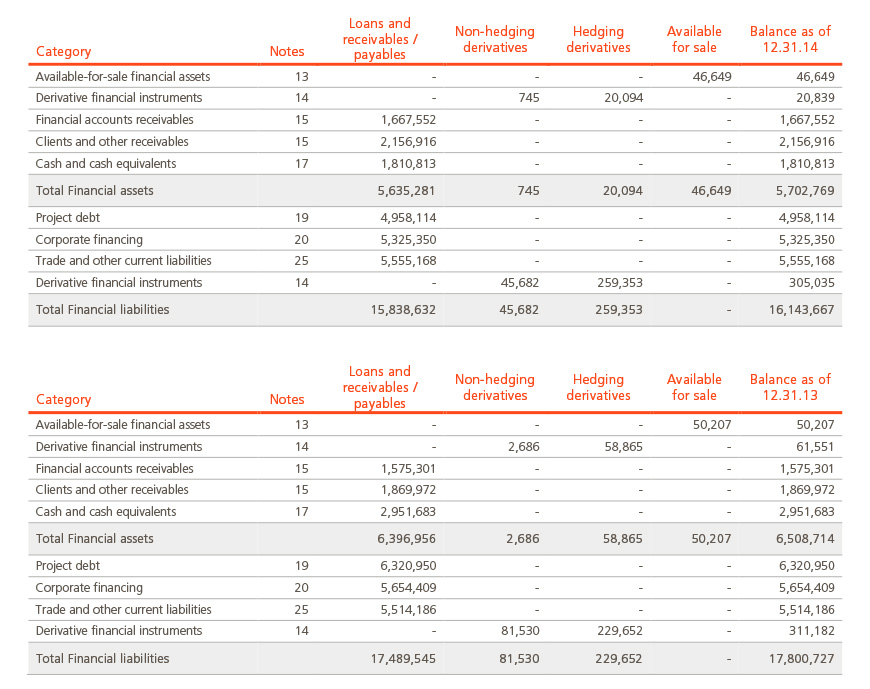

2.9. Financial Investments (current and non-current)

Financial investments are classified into the following categories, based primarily on the purpose for which they were acquired:

- financial assets at fair value through profit and loss;

- loans and accounts receivable; and

- available for sale financial assets.

Classification of each financial asset is determinated by management upon initial recognition, and is reviewed at each year end.

a) Financial assets at fair value through profit and loss

This category includes the financial assets acquired for trading and those initially designated at fair value through profit and loss. A financial asset is classified in this category if it is acquired mainly for the purpose of sale in the short term or if it is so designated by Management. Financial derivatives are also classified at fair value through profit and loss when they do not meet the accounting requirements to be designated as hedging instruments.

These financial assets are recognized initially at fair value, without including transaction costs. Subsequent changes in fair value are recognized under ‘Gains or losses from financial assets at fair value’ within the ‘Finance income or expense’ line of the Consolidated Income Statement for the period.

b) Loans and accounts receivable

Loans and accounts receivable are non-derivative financial assets with fixed or determinable payments, not listed on an active market.

In accordance with IFRIC 12, certain assets under concessions qualify as financial receivables (see Note 2.5).

Loans and accounts receivable are initially recognized at fair value plus transaction costs and are subsequently measured at amortized cost in accordance with the effective interest rate method. Interest calculated using the effective interest rate method is recognized under ‘Interest income from loans and credits’ within the ‘Finance income’ line of the Consolidated Income Statement.

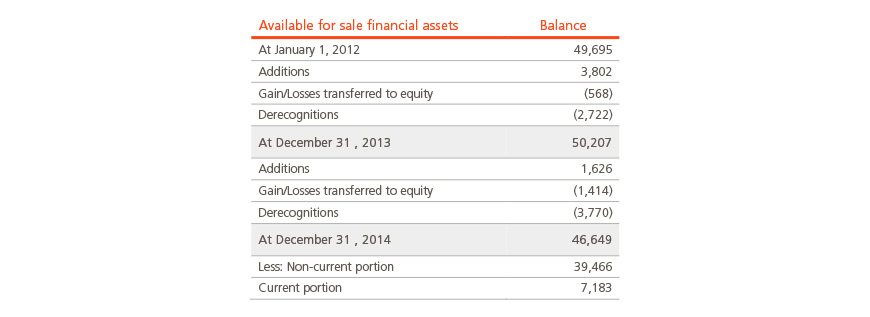

c) Available for sale financial assets

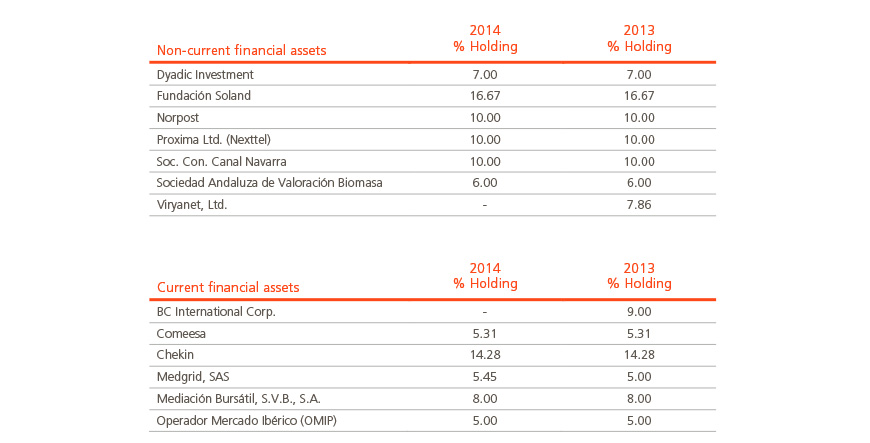

This category includes non-derivative financial assets which do not fall within any of the previously mentioned categories. For Abengoa, they primarily comprise shares in companies that, pursuant to the regulations in force, have not been included in the scope of consolidation for the years ended December 31, 2014 and 2013 and in which the Company's stake is greater than 5% and lower than 20%.

Financial assets available for sale are initially recognized at fair value plus transaction costs and subsequently measured at fair value, with changes in fair value recognized directly in equity, with the exception of translation differences of monetary assets, which are charged to the Consolidated Income Statement. Dividends from available-for-sale financial assets are recognized under ‘Other finance income’ within the ‘Other net finance income/expense’ line of the Consolidated Income Statement when the right to receive the dividend is established.

When available for sale financial assets are sold or impaired, the accumulated amount recorded in equity is transferred to the Consolidated Income Statement. To establish whether the assets have been impaired, it is necessary to consider whether the reduction in their fair value is significantly below cost and whether it will be for a prolonged period of time. The cumulative gain or loss reclassified from equity to profit or loss when the financial assets are impaired is the difference between their acquisition cost (net of any principal repayment and amortization) and current fair value, less any impairment loss on that financial asset previously recognized in profit or loss. Impairment losses recognized in the Consolidated Income Statement are not subsequently reversed through the Consolidated Income Statement.

Acquisitions and disposals of financial assets are recognized on the trading date, i.e. the date upon which there is a commitment to purchase or sell the asset. Available for sale financial assets are derecognized when the right to receive cash flows from the investment has expired or has been transferred and all the risks and rewards derived from owning the asset have likewise been substantially transferred.

At the date of each Consolidated Statement of Financial Position, the Group evaluates if there is any objective evidence that the value of any financial asset or any group of financial assets has been impaired. This process requires significant judgment. To make this judgment, the Group assesses, among other factors, for how long and to what extent the fair value of an investment will be below its cost, considering the financial health and short-term prospects of the company issuing the securities, including factors such as the industry and sector return, changes in the technology and cash flows from operating and financing activities.

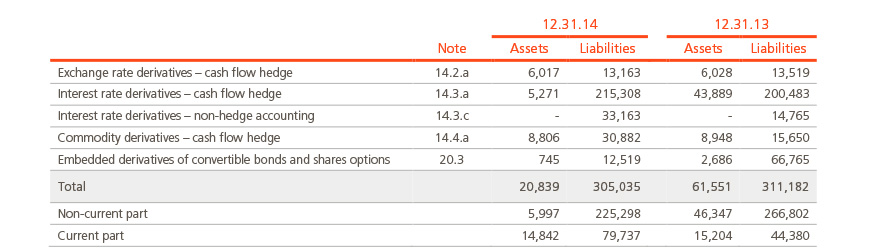

2.10. Derivative financial instruments and hedging activities

Derivatives are recorded at fair value. The Company applies hedge accounting to all hedging derivatives that qualify to be accounted for as hedges under IFRS.

When hedge accounting is applied, hedging strategy and risk management objectives are documented at inception, as well as the relationship between hedging instruments and hedged items. Effectiveness of the hedging relationship needs to be assessed on an ongoing basis. Effectiveness tests are performed prospectively and retrospectively at inception and at each reporting date, following the dollar offset method or the regression method, depending on the type of derivatives.

The Company has three types of hedges:

a) Fair value hedge for recognized assets and liabilities

Changes in fair value of the derivatives are recorded in the Consolidated Income Statement, together with any changes in the fair value of the asset or liability that is being hedged.

b) Cash flow hedge for forecasted transactions

The effective portion of changes in fair value of derivatives designated as cash flow hedges are recorded temporarily in equity and are subsequently reclassified from equity to profit or loss in the same period or periods during which the hedged item affects profit or loss. Any ineffective portion of the hedged transaction is recorded in the Consolidated Income Statement as it occurs.

When options are designated as hedging instruments (such as interest rate options described in Note 14), the intrinsic value and time value of the financial hedge instrument are separated. Changes in intrinsic value which are highly effective are recorded in equity and subsequently reclassified from equity to profit or loss in the same period or periods during which the hedged item affects profit or loss. Changes in time value are recorded in the Consolidated Income Statement, together with any ineffectiveness.

When the hedged forecasted transaction results in the recognition of a non-financial asset or liability, gains and losses previously recorded in equity are included in the initial cost of the asset or liability.

When the hedging instrument matures or is sold, or when it no longer meets the requirements to apply hedge accounting, accumulated gains and losses recorded in equity remain as such until the forecast transaction is ultimately recognized in the Consolidated Income Statement. However, if it becomes unlikely that the forecasted transaction will actually take place, the accumulated gains and losses in equity are recognized immediately in the Consolidated Income Statement.

c) Net investment hedges in foreign operation

Hedges of a net investment in a foreign operation, including the hedging of a monetary item considered part of a net investment, are recognized in a similar way to cash flow hedges. The foreign currency transaction gain or loss on the non-derivative hedging instrument that is designated as, and is effective as, an economic hedge of the net investment in a foreign operation shall be reported in the same manner as a translation adjustment. That is, such foreign currency transaction gain or loss shall be reported in the cumulative translation adjustment section of equity to the extent it is effective as a hedge, as long as the following conditions are met: the notional amount of the non-derivative instrument matches the portion of the net investment designated as being hedged and the non-derivative instrument is denominated in the functional currency of the hedged net investment. In that circumstance, no hedge ineffectiveness would be recognized in earnings.

Amounts recorded in equity will be reclassified to the Consolidated Income Statement when the foreign operation is sold or otherwise disposed of.

Contracts held for the purposes of receiving or making payment of non-financial elements in accordance with expected purchases, sales or use of goods (‘own-use contracts’) of the Group are not recognized as derivative instruments, but as executory contracts. In the event that such contracts include embedded derivatives, they are recognized separately from the host contract, if the economic characteristics of the embedded derivative are not closely related to the economic characteristics of the host contract. The options contracted for the purchase or sale of non-financial elements which may be cancelled through cash outflows are not considered to be own-use contracts.

Changes in fair value of derivative instruments which do not qualify for hedge accounting are recognized immediately in the Consolidated Income Statement. Trading derivatives are classified as a current assets or liabilities.

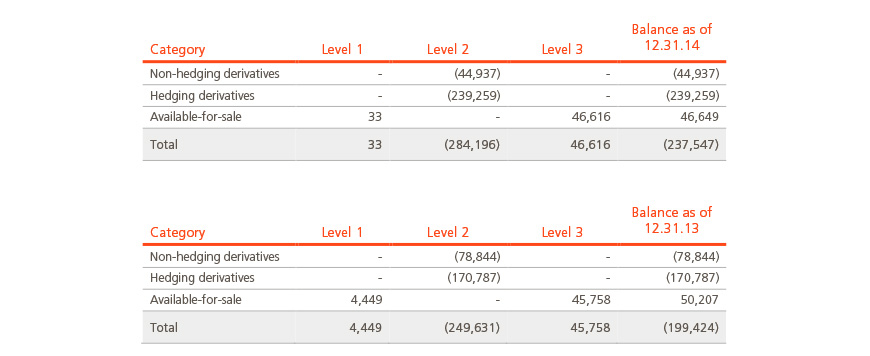

2.11. Fair value estimates

Financial instruments measured at fair value are presented in accordance with the following level classification based on the nature of the inputs used for the calculation of fair value:

- Level 1: Inputs are quoted prices in active markets for identical assets or liabilities.

- Level 2: Fair value is measured based on inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices).

- Level 3: Fair value is measured based on unobservable inputs for the asset or liability.

In the event that prices cannot be observed, the management shall make its best estimate of the price that the market would otherwise establish based on proprietary internal models which, in the majority of cases, use data based on observable market parameters as significant inputs (Level 2) but occasionally use market data that is not observed as significant inputs (Level 3). Different techniques can be used to make this estimate, including extrapolation of observable market data. The best indication of the initial fair value of a financial instrument is the price of the transaction, except when the value of the instrument can be obtained from other transactions carried out in the market with the same or similar instruments, or valued using a valuation technique in which the variables used only include observable market data, mainly interest rates. According to current legislation (IFRS-EU), differences between the transaction price and the fair value based on valuation techniques that use data that is not observed in the market, are not initially recognized in the income statement.

a) Level 2 valuation

The majority of Abengoa's portfolio comprises financial derivatives designated as cash flow hedges, is classified as level 2 and corresponds mainly to the interest rate swaps (see Note 14).

Credit risk effect on the valuation of derivatives is calculated for each of the instruments in the portfolio of derivatives classified within level 2, using the own risk of the Abengoa companies and financial counterparty risk.

Description of the valuation method

- Interest rate swaps

Interest rate swap valuations are made by valuing the swap component of the contract and valuing the credit risk.

The most common methodology used by the market and applied by Abengoa to value interest rate swaps is to discount the expected future cash flows according to the parameters of the contract. Variable interest rates, which are needed to estimate future cash flows, are calculated using the curve for the corresponding currency and extracting the implicit rates for each of the reference dates in the contract. These estimated flows are discounted with the swap zero curve for the reference period of the contract 1, 3 or 6 months.

The effect of the credit risk on the valuation of the interest rate swaps depends on its settlement. If the settlement is favorable for the Company, the counterparty credit spread will be incorporated to quantify the probability of default at maturity. If the expected settlement is negative for the company, its own credit risk will be applied to the final settlement.

Classic models for valuing interest rate swaps use deterministic valuation of variable rates, based on future outlooks. When quantifying credit risk, this model is limited by considering only the risk for the current paying party, ignoring the fact that the derivative could change sign at maturity. A payer and receiver swaption model is used for these cases. This enables the associated risk in each swap position to be reflected. Thus, the model shows each agent's exposure, on each payment date, as the value of entering into the ‘tail’ of the swap, i.e. the live part of the swap.

- Interest rate Caps and Floors

Interest rate caps and floors are valued by separating the derivative in the successive caplets/floorlets that comprise the transaction. Each caplet or floorlet is valued as a call or put option, respectively, on the reference interest rate, for which the Black-Scholes approach is used for European-type options (exercise at maturity) with minor adaptations and following the Black-76 model.

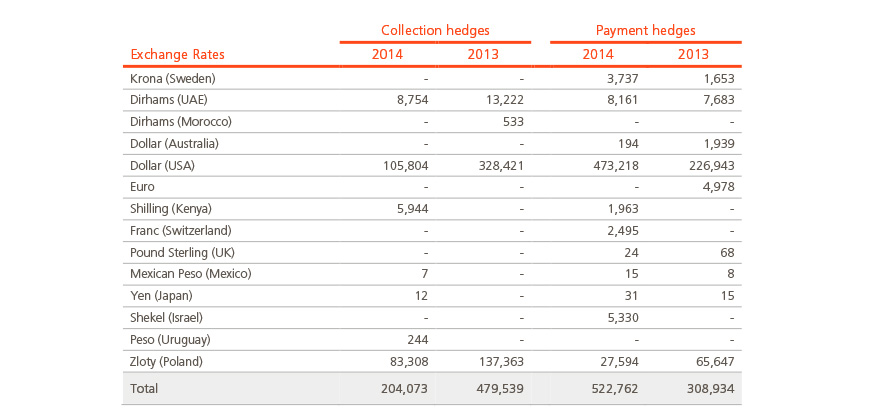

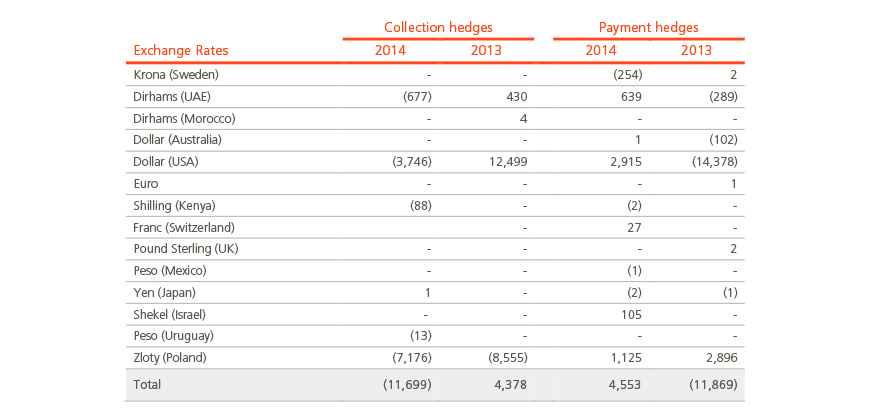

- Forward foreign exchange transactions

Forward contracts are valued by comparing the contracted forward rate and the rate in the valuation scenario at the maturity date. The contract is valued by calculating the cash flow that would be obtained or paid from theoretically closing out the position and then discounting that amount.

- Commodity swaps

Commodity swaps are valued in the same way as forward foreign exchange contracts, calculating the cash flow that would be obtained or paid from theoretically closing out the position.

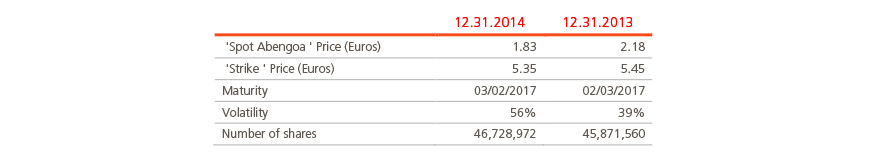

- Equity options

Equity options are valued using the Black-Scholes model for American-type options on equities.

- Embedded derivatives in convertible bonds

The embedded derivatives in convertible bonds consist of an option to convert the bond into shares in favor of the bondholder; call options for the issuer to repurchase the bonds at a specific price on specific dates; and put options for the bondholder to redeem the bonds at a specific price and on specific dates. Since these are Bermuda-type options (multiple exercise dates), they are valued using the Longstaff-Schwartz model and the Monte Carlo method.

Variables (Inputs)

Interest rate derivative valuation models use the corresponding interest rate curves for the relevant currency and underlying reference in order to estimate the future cash flows and to discount them. Market prices for deposits, futures contracts and interest rate swaps are used to construct these curves. Interest rate options (caps and floors) also use the volatility of the reference interest rate curve.

Exchange rate derivatives are valued using the interest rate curves of the underlying currencies in the derivative, as well as the corresponding spot exchange rates.

The inputs in equity models include the interest rate curves of the corresponding currency, the price of the underlying asset, as well as the implicit volatility and any expected future dividends.

To estimate the credit risk of the counterparty, the credit default swap (CDS) spreads curve is obtained in the market for important individual issuers. For less liquid issuers, the spreads curve is estimated using comparable CDSs or based on the country curve. To estimate proprietary credit risk, prices of debt issues in the market and CDSs for the sector and geographic location are used.

The fair value of the financial instruments that results from the aforementioned internal models, takes into account, among other factors, the terms and conditions of the contracts and observable market data, such as interest rates, credit risk, exchange rates, commodities and share prices, and volatility. The valuation models do not include significant levels of subjectivity, since these methodologies can be adjusted and calibrated, as appropriate, using the internal calculation of fair value and subsequently compared to the corresponding actively traded price. However, valuation adjustments may be necessary when the listed market prices are not available for comparison purposes.

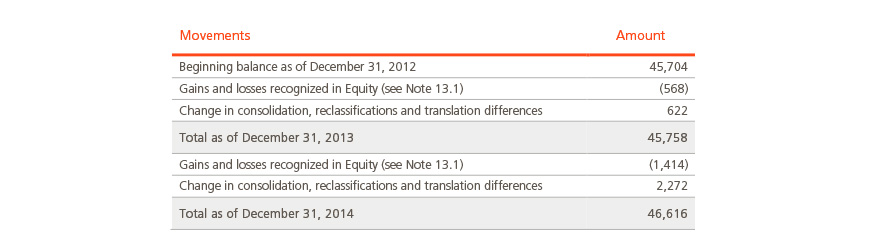

b) Level 3 valuation

Level 3 includes available for sale financial assets, as well as derivative financial instruments whose fair value is calculated based on models that use non observable or illiquid market data as inputs.

Fair value within these elements was calculated by taking as the main reference the value of the investment - the company's cash flow generation based on its current business plan, discounted at a rate appropriate for the sector in which each of the companies is operating. Valuations were obtained from internal models. These valuations could vary where other models and assumptions made on the principle variables had been used, however the fair value of the assets and liabilities, as well as the results generated by these financial instruments are considered reasonable.

Detailed information on fair values is included in Note 12.

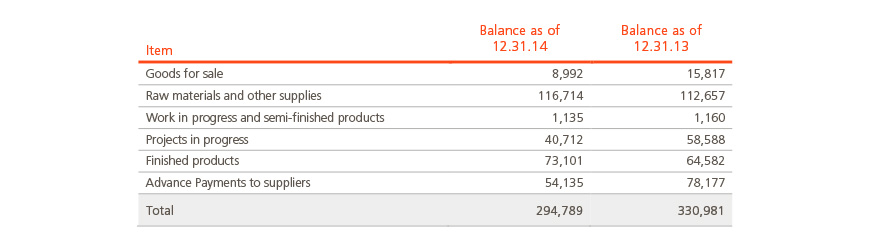

2.12. Inventories

Inventories are valued at the lower of cost or net realizable value. In general, cost is determined by using the first-in-first-out (FIFO) method. The cost of finished goods and work in progress includes design costs, raw materials, direct labor, other direct costs and general manufacturing costs (assuming normal operating capacity). Borrowing costs are not included. The net realizable value is the estimated sales value in the normal course of business, less applicable variable selling costs.

Cost of inventories includes the transfer from equity of gains and losses on qualifying cash-flow hedging instruments related with the purchase of raw materials or with foreign exchange contracts.

2.13. Biological assets

Abengoa recognizes sugar cane in production as biological assets. The production period of sugar cane covers the period from preparation of the land and sowing the seedlings until the plant is ready for first production and harvesting. Biological assets are classified as property, plant and equipment in the Consolidated Statement of Financial Position. Biological assets are recognized at fair value, calculated as the market value less estimated harvesting and transport costs.

Agricultural products harvested from biological assets, which in the case of Abengoa are cut sugar cane, are classified as inventories and measured at fair value less estimated sale costs at the point of sale or harvesting.

Fair value of biological assets is calculated using as a reference the forecasted market price of sugarcane, which is estimated using public information and estimates on future prices of sugar and ethanol. Fair value of agricultural products is calculated using as a reference the price of sugar cane made public on a monthly basis by the Cane, Sugar and Alcohol Producers Board (Consecana).

Gains or losses arising as a result of changes in the fair value of such assets are recorded within ‘Operating profit’ in the Consolidated Income Statement.

To obtain the fair value of the sugar cane while growing, a number of assumptions and estimates have been made in relation to the area of land sown, the estimated TRS (Total Recoverable Sugar contained within the cane) per ton to be harvested and the average degree of growth of the agricultural product in the different areas sown.

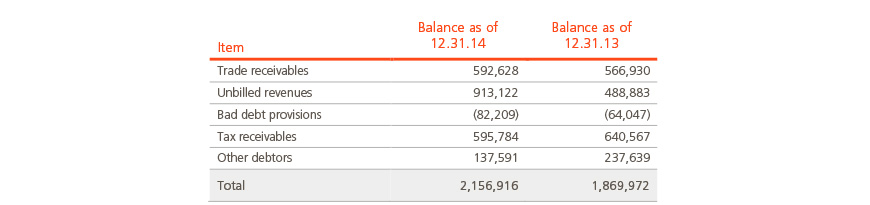

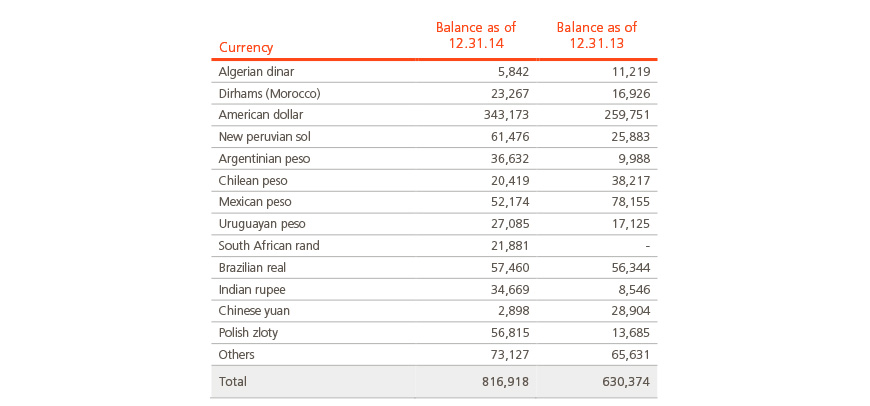

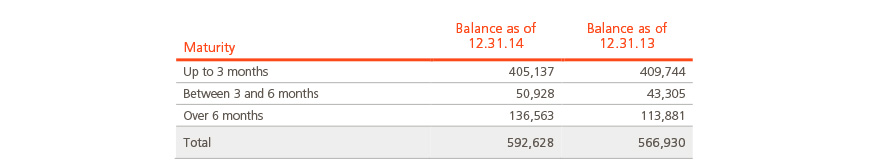

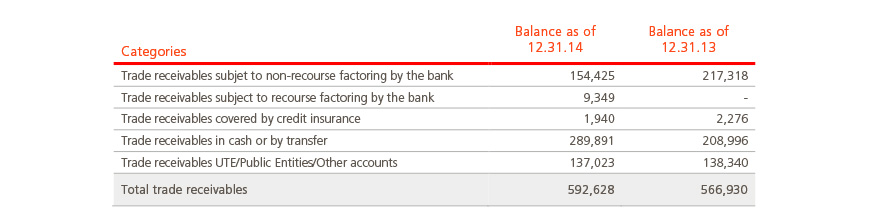

2.14. Clients and other receivables

Clients and other receivables relate to amounts due from customers for sales of goods and services rendered in the normal course of operation.

Clients and other receivables are recognized initially at fair value and are subsequently measured at amortized cost using the effective interest rate method, less provision for impairment. Trade receivables due in less than one year are carried at their face value at both initial recognition and subsequent measurement, provided that the effect of not discounting flows is not significant.

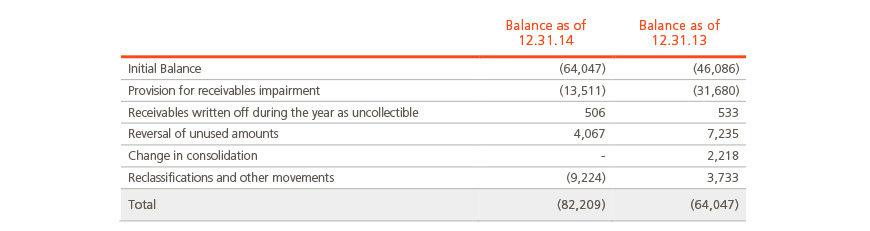

A provision for impairment of trade receivables is recorded when there is objective evidence that the Group will not be able to recover all amounts due as per the original terms of the receivables. The existence of significant financial difficulties, the probability that the debtor is in bankruptcy or financial reorganization and the lack or delay in payments are considered evidence that the receivable is impaired.

The amount of the provision is the difference between the asset’s carrying amount and the present value of estimated future cash flows discounted at the effective interest rate. When a trade receivable is uncollectable, it is written off against the bad debt provision.

Clients and other receivables which have been factored with financial entities are derecognized and hence removed from assets on the Consolidated Statement of Financial Position only if all risks and rewards of ownership of the related financial assets have been transferred, comparing the Company’s exposure, before and after the transfer, to the variability in the amounts and the calendar of net cash flows from the transferred asset. Once the Company’s exposure to this variability has been eliminated or substantially reduced, the financial asset has been transferred, and is derecognized from the Consolidated Statement of Financial Position (See Note 4.b).

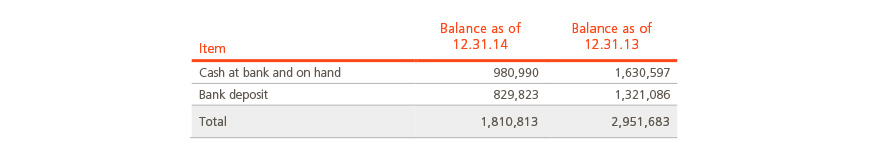

2.15. Cash and cash equivalents

Cash and cash equivalents include cash on hand, cash in bank and other highly-liquid current investments with an original maturity of three months or less which are held for the purpose of meeting short-term cash commitments.

In the Consolidated Statement of Financial Position, bank overdrafts are classified as borrowings within current liabilities.

2.16. Share capital

Parent company shares are classified as equity. Transaction costs directly attributable to new shares are presented in equity as a reduction, net of taxes, to the consideration received from the issue.

Treasury shares are classified in Equity-Parent company reserves. Any amounts received from the sale of treasury shares, net of transaction costs, are classified as equity.

2.17. Government grants

Non-refundable capital grants are recognized at fair value when it is considered that there is a reasonable assurance that the grant will be received and that the necessary qualifying conditions, as agreed with the entity assigning the grant, will be adequately met.

Grants related to income are recorded as liabilities in the Consolidated Statement of Financial Position and are recognized in ‘Other operating income’ in the Consolidated Income Statement based on the period necessary to match them with the costs they intend to compensate.

Grants related to fixed assets are recorded as non-current liabilities in the Consolidated Statement of Financial Position and are recognized in ‘Other operating income’ in the Consolidated Income Statement on a straight-line basis over the estimated useful economic life of the assets.

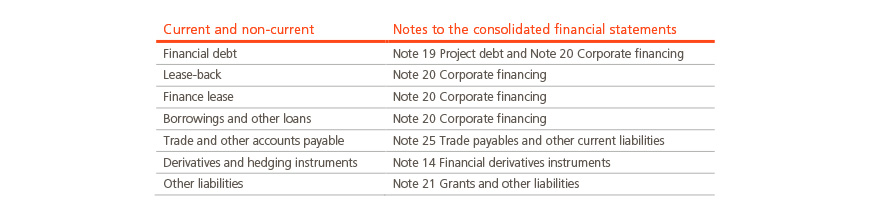

2.18. Loans and borrowings

External resources are classified in the following categories:

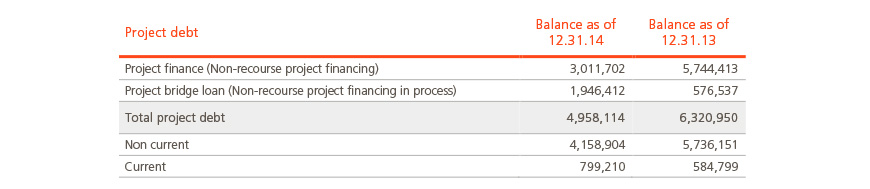

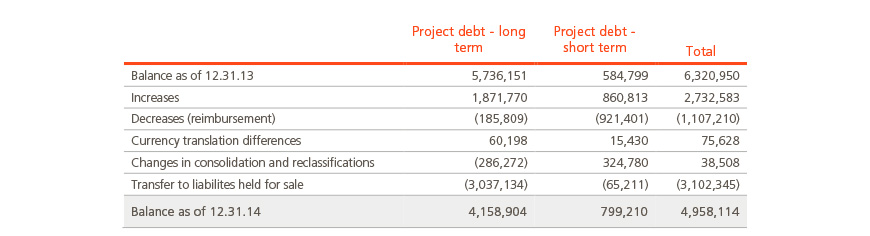

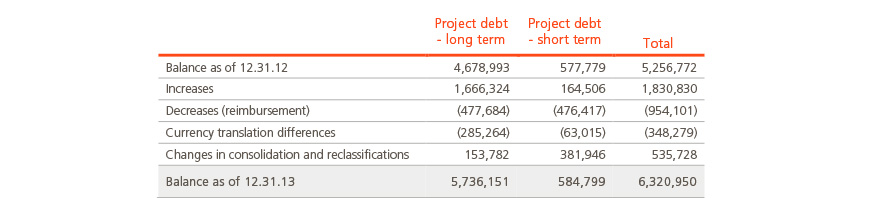

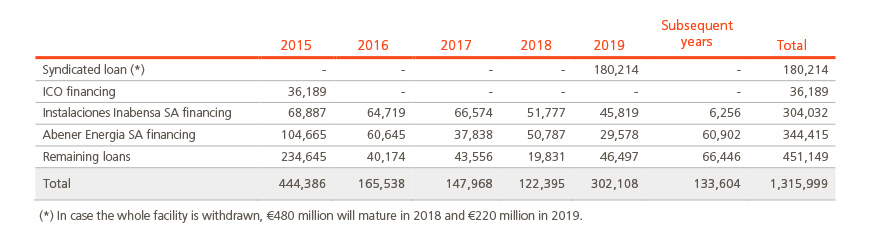

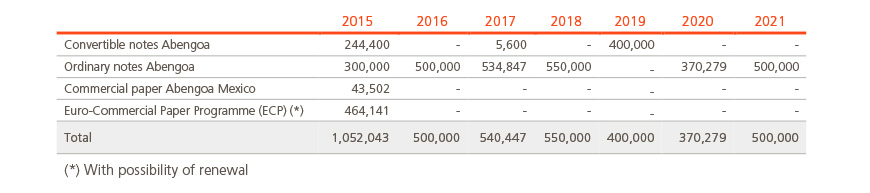

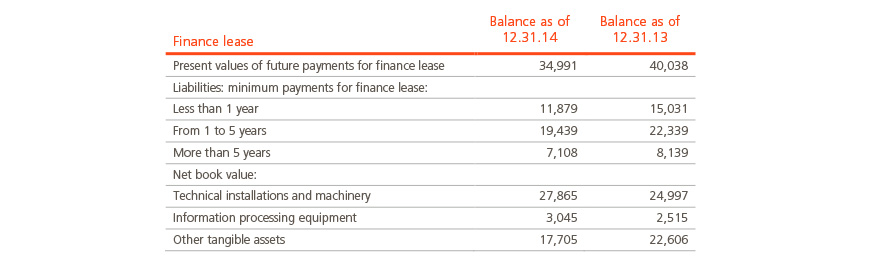

- project debt (see note 19);

- corporate financing (see Note 20).

Loans and borrowings are initially recognized at fair value, net of transaction costs incurred. Borrowings are subsequently measured at amortized cost and any difference between the proceeds initially received (net of transaction costs incurred in obtaining such proceeds) and the repayment value is recognized in the Consolidated Income Statement over the duration of the borrowing using the effective interest rate method.

Interest free loans and loans with interest rates below market rates, mainly granted for research and development projects, are initially recognized at fair value in liabilities in the Consolidated Statement of Financial Position. The difference between proceeds received from the loan and its fair value is initially recorded within ‘Grants and Other liabilities’ in the Consolidated Statement of Financial Position, and subsequently recorded in ‘Other operating income- Grants’ in the Consolidated income statement when the costs financed with the loan are expensed. In the case of interest free loans received for development projects where the Company record an intangible asset, income from the grant will be recognized according to the useful life of the asset, at the same rate as we record its amortization.

Commissions paid for obtaining credit lines are recognized as transaction costs if it is probable that part or all of the credit line will be drawn down. If this is the case, commissions are deferred until the credit line is drawn down. If it is not probable that all or part of the credit line will be drawn down, commission costs are expensed in the period.

2.18.1. Convertible notes

Pursuant to the Terms and Conditions of each of the convertible notes issued except for the 2019 notes, when investors exercise their conversion right, the Company may decide whether to deliver shares of the company, cash, or a combination of cash and shares (see Note 20.3 for further information).

In accordance with IAS 32 and 39, since Abengoa has a contractual right to choose the type of payment and one of these possibilities is paying through a variable number of shares and cash, the conversion option qualifies as an embedded derivative. Thus, the convertible bond is considered a hybrid instrument, which includes a component of debt and an embedded derivative for the conversion option held by the bondholder.

The Company initially measures the embedded derivative at fair value and classifies it under the derivative financial instruments liability heading. At the end of each period, the embedded derivative is re-measured and changes in fair value are recognized under ‘Other net finance income or expense’ within the ‘Finance expense net’ line of the Consolidated Income Statement. The debt component of the bond is initially recorded as the difference between the proceeds received for the notes and the fair value of the aforementioned embedded derivative. Subsequently, the debt component is measured at amortized cost until it is settled upon conversion or maturity. Debt issuance costs are recognized as a deduction in the value of the debt in the Consolidated Statement of Financial Position and included as part of its amortized cost.

In relation to the convertible bonds maturing in 2019, at the beginning of 2014, the Board of Directors expressly and irrevocably stated, with binding effect, that in relation to the right conferred on Abengoa to choose the type of payment, the Company shall not exercise the cash settlement option in the event that bondholders decide to exercise their conversion right early during the period granted for that effect and Abengoa, S.A. shall therefore only settle this conversion right in a fixed number of shares. Accordingly, the fair value at the beginning of the year of the derivative liability embedded in the convertible bond was reclassified as equity since after that date the conversion option meets the definition of an equity instrument.

2.18.2. Ordinary notes

The company initially recognizes ordinary notes at fair value, net of issuance costs incurred. Subsequently, notes are measured at amortized cost until settlement upon maturity. Any other difference between the proceeds obtained (net of transaction costs) and the redemption value is recognized in the Consolidated Income Statement over the term of the debt using the effective interest rate method.

2.19. Current and deferred income taxes

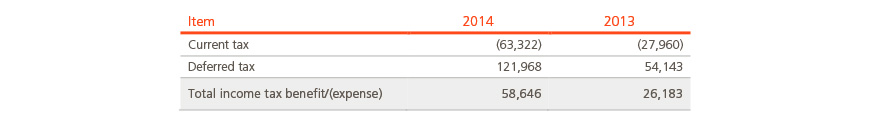

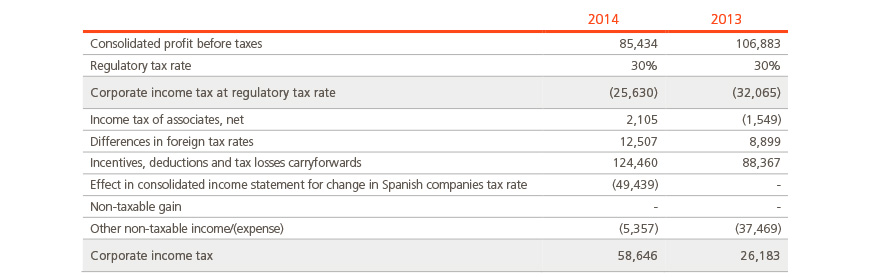

Income tax expense for the period comprises current and deferred income tax. Income tax is recognized in the Consolidated Income Statement, except to the extent that it relates to items recognized directly in equity. In these cases, income tax is also recognized directly in equity.

Current income tax expense is calculated on the basis of the tax laws in force or about to enter into force as of the date of the Consolidated Statement of Financial Position in the countries in which the subsidiaries and associates operate and generate taxable income.

Deferred income tax is calculated in accordance with the Consolidated Statement of Financial Position liability method, based upon the temporary differences arising between the carrying amount of assets and liabilities and their tax base. However, deferred income tax is not recognized if it arises from initial recognition of an asset or liability in a transaction other than a business combination that, at the time of the transaction, affects neither the accounting nor the taxable profit or loss. Deferred income tax is determined using tax rates and regulations which are enacted or substantially enacted at the date of the Consolidated Statement of Financial Position and are expected to apply and/or be in force at the time when the deferred income tax asset is realized or the deferred income tax liability is settled.

Deferred tax assets are recognized only when it is probable that sufficient future taxable profit will be available to use deferred tax assets.

Deferred taxes are recognized on temporary differences arising on investments in subsidiaries and associates, except where the timing of the reversal of the temporary differences is controlled by the Group and it is not probable that temporary differences will reverse in the foreseeable future.

2.20. Employee benefits

Bonus schemes

The Group records the amount annually accrued in accordance with the percentage of compliance with the plan’s established objectives as personnel expense in the Consolidated Income Statement

Expenses incurred from employee benefits are disclosed in Note 29

2.21. Provisions and contingencies

Provisions are recognized when:

- there is a present obligation, either legal or constructive, as a result of past events;

- it is more likely than not that there will be a future outflow of resources to settle the obligation; and

- the amount has been reliably estimated.

Provisions are initially measured at the present value of the expected outflows required to settle the obligation and subsequently valued at amortized cost following the effective interest method.

Contingent liabilities are possible obligations, existing obligations with low probability of a future outflow of economic resources and existing obligations where the future outflow cannot be reliably estimated. Contingences are not recognized in the Consolidated Statements of Financial Position unless they have been acquired in a business combination.

2.22. Trade payables and other liabilities