Consolidated management report

1.- Entity´s position

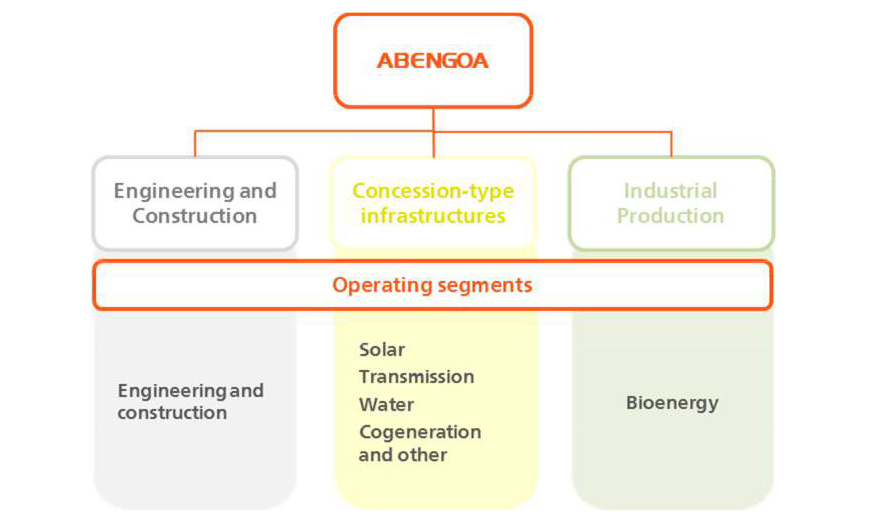

1.1. Organizational structure

Abengoa, S.A. is a technology company, and the head of a group of companies, which at the end of 2014 comprised the following:

- The holding parent company itself.

- 607 subsidiaries.

- 17 associates and 28 joint businesses as well as certain companies of the Group being involved in 244 temporary joint ventures. Furthermore, the Group’s companies have shareholdings of less than 20% in other entities.

Independent of the legal structure, Abengoa is managed as outlined below.

Abengoa is an international company that applies innovative technology solutions for sustainability in the energy and environment sectors, generating electricity from renewable resources, converting biomass into biofuels and producing drinking water from sea water. The Company supplies engineering projects under the ‘turnkey’ contract modality and operates assets that generate renewable energy, produce biofuel, manage water resources, desalinate sea water and treat sewage.

Abengoa’s activities are focused on the energy and environmental sectors, and integrate operations throughout the value chain including R&D+i, project development, engineering and construction, and operations and maintenance of its own assets and for third parties.

Abengoa’s business is organized into the following three activities:

- Engineering and construction: includes our traditional engineering activities in the energy and water sectors, with more than 70 years of experience in the market. Abengoa is specialized in carrying out complex turn-key projects for thermo-solar plants, solar-gas hybrid plants, conventional generation plants, biofuels plants and water infrastructures, as well as large-scale desalination plants and transmission lines, among others.

- Concession-type infrastructures: groups together the company’s extensive portfolio of proprietary concession assets that generate revenues governed by long term sales agreements, such as take-or-pay contracts, tariff contracts or power purchase agreements. This activity includes the operation of electric (solar, cogeneration or wind) energy generation plants and transmission lines. These assets generate low demand risk and we focus on operating them as efficiently as possible.

- Industrial production: covers Abengoa’s businesses with a high tehnological component, such as development of biofuels technology. The Company holds an important leadership position in these activities in the geographical markets in which it operates.

Abengoa’s Chief Operating Decision Maker (‘CODM’) assesses the performance and assignment of resources according to the above identified segments. The CODM in Abengoa considers the revenues as a measure of the activity and the EBITDA (Earnings before interest, tax, depreciation and amortization) as measure of the performance of each segment. In order to assess performance of the business, the CODM receives reports of each reportable segment using revenues and EBITDA. Net interest expense evolution is assessed on a consolidated basis given that the majority of the corporate financing is incurred at the holding level and that most investments in assets are held at project companies which are financed through project debt. The depreciation, amortization and impairment charges are assessed on a consolidated basis in order to analyze the evolution of net income and to determine the dividend pay-out ratio. These charges are not taken into consideration by CODM for the allocation of resources because they are non-cash charges.

The process to allocate resources by the CODM takes place prior to the award of a new project. Prior to presenting a bid, the company must ensure that the project debt for the new project has been obtained. These efforts are taken on a project by project basis. Once the project has been awarded, its evolution is monitored at a lower level and the CODM receives periodic information (revenues and EBITDA) on each operating segment’s performance.

1.2. Operation

a) Information by activities

Abengoa’s activity is grouped under the following three activities which are in turn composed of six operating segments:

- Engineering and construction; includes our traditional engineering business in the energy and water sectors, with more than 70 years of experience in the market. Since the beginning of 2014, this activity comprises one operating segment Engineering and Construction (previously, the operating segment of Technology and Other was also included in the operating segment of Engineering and Construction, in accordance with IFRS8 ‘Operating Segment’).

Abengoa specializes in carrying out complex turn-key projects for thermo-solar plants, solar-gas hybrid plants, conventional generation plants, biofuels plants and water infrastructures, as well as large-scale desalination plants and transmission lines, among others. In addition, this segment includes activities related to the development of thermo-solar technology, water management technology and innovative technology businesses such as hydrogen energy or the management of energy crops.

- Concession-type infrastructures; groups together the company’s proprietary concession assets that generate revenues governed by long term sales agreements, such as take-or-pay contracts or power purchase agreements. This activity includes the operating segment of Abengoa Yield (ABY), the operation of electric (solar, cogeneration or wind) energy generation plants, desalination plants and transmission lines. These assets generate low demand risk and we focus on operating them as efficiently as possible.

During June 2014, the Company listed one of its subsidiaries, Abengoa Yield Plc. in the US (ABY). ABY groups ten assets previously reported in different operating segments within the Concession-type infrastructures activity. As such, ABY became a new operating segment within the activity of Concessionsfrom its IPO and so it has been reported at the quarterly financial information.

At the end of 2014 the operating segment Abengoa Yield was considered as discontinued operations (see Note 7). As a result, the Concession-type infrastructures activity again comprises four operating segment as it was reported until the first half of 2014:- Solar – Operation and maintenance of solar energy plants, mainly using thermo-solar technology.

- Transmission – Operation and maintenance of high-voltage transmission power line infrastructures.

- Water – Operation and maintenance of facilities aimed at generating, transporting, treating and managing water, including desalination and water treatment and purification plants.

- Cogeneration and other – Operation and maintenance of conventional cogeneration electricity plants.

- Industrial production; covers Abengoa’s businesses with a high technological component, such as development of biofuels technology. The company holds an important leadership position in these activities in the geographical markets in which it operates.

This activity is comprised of one operating segment:

- Biofuels – Production and development of biofuels, mainly bioethanol for transport, which uses cellulosic plant fiber cereals, sugar cane and oil seeds (soya, rape and palm) as raw materials.

b) Competitive position

Over the course of our 70-year history, we have developed a unique and integrated business model that applies our accumulated engineering expertise to promoting sustainable development solutions, including delivering new methods for generating power from the sun, developing biofuels, producing potable water from seawater, efficiently transporting electricity. A cornerstone of our business model has been investment in proprietary technologies, particularly in areas with relatively high barriers to entry. Thanks to it, ee have a developed portfolio of businesses focused on EPC and concession project opportunities, many of which are based on customer contracts or long-term concession projects attractive and growing energy and environmental markets.

We have developed a leadership position in the energy sector in recent years, as highlighted by the following:

- We have been recognized for the eight consecutive year by the prestigious magazine Engineering News-Record (ENR) as the leading ‘International contractor in transmission and distribution’ in 2014. Moreover, we have been also recognized as the top international contractor for solar energy for the fourth consecutive year and we ranked second position in both the cogeneration power sector and the water treatment and desalination sector.

- In the field of solar power, Abengoa is an international leader for solar-thermal plants, with innovative projects such as Atacama-1, which has 18 hours of energy storage and will be the first solar-thermal plant in Latin America; Solana, in the USA, which is the world’s largest parabolic-trough plant; or Khi Solar One in South Africa, which will be the first plant to use tower technology in Africa. The company has a global capacity of 2,200 MW with a further 300 MW under construction in solar plants around the world.

- We are a global leader in the biofuels industry, with plants in Europe, the United States and Brazil. We ranked first in Europe and seventh in the United States in first-generation bioethanol in terms of installed capacity (source: Ethanol Producer Magazine and ePURE) and enjoy a global leadership position in the development of technology for the production of second-generation bioethanol on a commercial scale.

Abengoa has also been recognized internationally for its achievements in the water desalination sector, winning awards such as “Company of the Year 2012 in the desalination sector”, “Desalination Project of the Year 2010” or “Company of the Year 2009 in the desalination sector” in the Global Water Awards presented by Global Water Intelligence (GWI) to our desalination plant in Nungua (Ghana); our water desalination project in Qingdao (China); and the desalination plant projects in Tenes, Honaine and Skikda in Algeria, respectively.

These desalination plants have been developed using the latest advances in desalination technology based on reverse osmosis and the BOT model. According to a report by Bluefield Research, Abengoa’s success in these types of projects between 2009 and 2013 ranks it as the world’s leading privately-owned company, in terms of ownership of desalination plants (by installed capacity).

Furthermore, Abengoa recently rose to second place in the ranking of water treatment and desalination contractors, by the magazine Engineering News-Record. Our business therefore continues to grow in the sector for constructing and managing water and sanitation infrastructures for municipal and industrial clients. For example, in the municipal sector in 2014 Abengoa was awarded the drinking water supply project for the City of San Antonio (Texas, USA) under a BOT format; the smart network project for drinking water distribution and sewerage for the city of Denizli in Turkey, as well as being awarded the Agadir desalination plant in Morocco, for which it has also completed the financing. In the industrial sector, it was awarded the water supply contract for the AES Gener power plant in Chile and the water treatment plants for a combined cycle plant in Carty (Oregon, USA).

Abengoa continues to expand its presence in the environment sector through these activities, producing, treating and regenerating water for a more sustainable world.

2.- Evolution and business results

2.1. Financial situation

a) Plan to further optimize Abengoa Financial Structure

On December 15, 2014, Abengoa´s Board of Directors approved a plan to further improve its financial structure through three main initiatives:

- Reduce its stake in Abengoa Yield

- Accelerate the sale of assets to Abengoa Yield

- The creation of a joint venture with external equity partners that will invest in a portfolio of contracted assets under construction as well as in new contracted assets under development.

The impacts of these initiatives and their main effects in relation to the reclassification to heading ‘Assets held for sale and discontinued operations’ as of December 31, 2014 are described below.

Reduce its stake in Abengoa Yield

The plan to reduce the stake in Abengoa Yield was initiated at year end 2014 with the approval of the Abengoas’s Board of Directors and is expected to be completed within one year, through the completion of following steps:

- An initial stage to divest a 13% stake ended on January 16, 2015, via the sale in an underwritten public offering of 10,580,000 ordinary shares in Abengoa Yield (including 1,380,000 shares sold pursuant to the exercise in full of the underwritters’ over-allotment option) at a price of USD31 per share, bringing the holding in Abengoa Yield to 51%. This sale generated USD 328 million for Abengoa, before fees.

- The second step will consist of the divestment of an additional shareholding in Abengoa Yield and the strengthening of the Right Of First Offer (ROFO) agreement between the two companies, as well as a review of the corporate governance of Abengoa Yield to reinforce the role of the independent directors so that control is effectively transferred when the second sale takes place.

Taking into account that Abengoa Yield was presented as an operating segment within the Concession-Type Infrastructures activity during part of the year 2014 and due to the significance that the activities carried out by Abengoa Yield have for Abengoa, the sale of this shareholding is considered as a discontinued operation in accordance with the stipulations and requirements of IFRS 5, ‘Non-Current Assets Held for Sale and Discontinued Operations’.

In accordance with this standard, the results of Abengoa Yield for the year 2014 are included under a single heading in Abengoa’s Consolidated Financial Statements for the year ended December 31, 2014.

Likewise, the Consolidated Income Statement for the year, 2013, which is included for comparison purposes in Abengoa’s Consolidated Financial Statements for the year ended December 31, 2014 also includes the results generated by Abengoa Yield recorded under a single heading (‘Profit (loss) from discontinued operations, net of tax’), for the activities which are now considered discontinued.

Accelerate the sale of assets to Abengoa Yield

The plan to accelerate the sale of assets to Abengoa Yield under the Right of First Offer (ROFO) agreement was launched at the start of 2014 with the approval of Abengoa’s board of directors, with the aim of divesting certain concession project companies that own desalination plants in Algeria (Skikda and Honnaine), transmission lines in Peru (ATN2) and an STE plant in Abu Dhabi (Shams). Given that as of December 31, 2014, the previous companies are available for immediate sale and the sale is highly probable, the Company has classified the associated assets and liabilities as held for sale in the Consolidated Statement of Financial Position as of December 31, 2014. Until closing of the sale transaction, the assets will be classified as held for sale in accordance with the stipulations and requirements of IFRS 5, ‘Non-Current Assets Held for Sale and Discontinued Operations’.

A definitive agreement was reached with Abengoa Yield on February 9, 2015 for a total of USD142 million following approval by Abengoa’s board of directors. It includes the divestment of the aforementioned assets (classified as assets held for sale at the end of 2014) and 30% of the stake held in Helioenergy 1 and 2 (a thermo-solar assets in Spain) at the end of the year. Since the agreement to divest Helioenergy 1 and 2 was performed during January 2015, such assets have not been classified as assets held for sale. Related to desalination plants in Argeria, we also entered into a two year call and put option agreement with Abengoa Yield by which they have put option rights to require Abengoa to purchase back these assets at the same price paid by them and Abengoa has call option rights to require them to sell back these assets if certain indemnities and guarantees provided by Abengoa related to past circumstances reach a certain threshold.

The creation of a joint venture with external equity partners that will invest in a portfolio of contracted assets under construction and development.

On December 11, 2014, the company reached a non-binding agreement with the infrastructure fund EIG Global Energy Partners to jointly invest in a new company (Newco) to which Abengoa will contribute its shareholdings in a series of companies. These project companies own concessions for conventional generation and renewable energy assets and transmission lines in different regions, including the USA, Mexico, Brazil and Chile. The new company will be jointly managed, although EIG will hold a majority stake in the new company. Once the agreement has been completed and the projects have been transferred to Newco, Abengoa will no longer have a controlling interest in these assets. Given that as of December 31, 2014, the companies associated with previous projects are available for immediate sale and the sale is highly probable, the Company has classified the associated assets and liabilities as held for sale in the Consolidated Statement of Financial Position as of December 31, 2014. Until closing of the sale transaction, the assets will be reported as held for sale in accordance with the stipulations and requirements of IFRS 5, ‘Non-Current Assets Held for Sale and Discontinued Operations’.

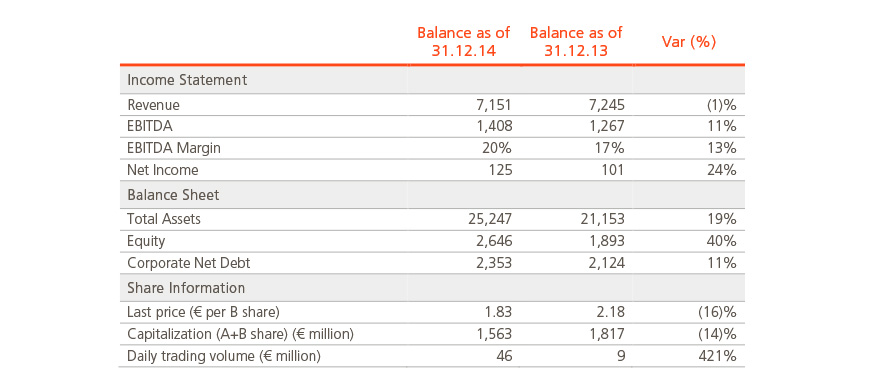

b) Main figures

Financial Data

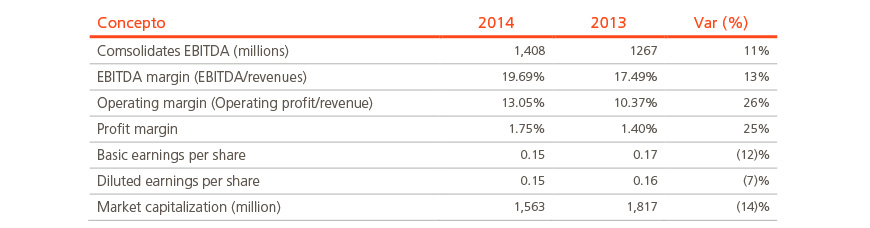

- Revenues of €7,151 million, a decrease of 1% compared to 2013.

- Ebitda of €1,408 million, an increase of 11% compared to 2013.

Operating Data

- 88% of our revenues from international markets outside of Spain.

- North America (USA and Mexico) became the first country in revenues with 32% of total revenues.

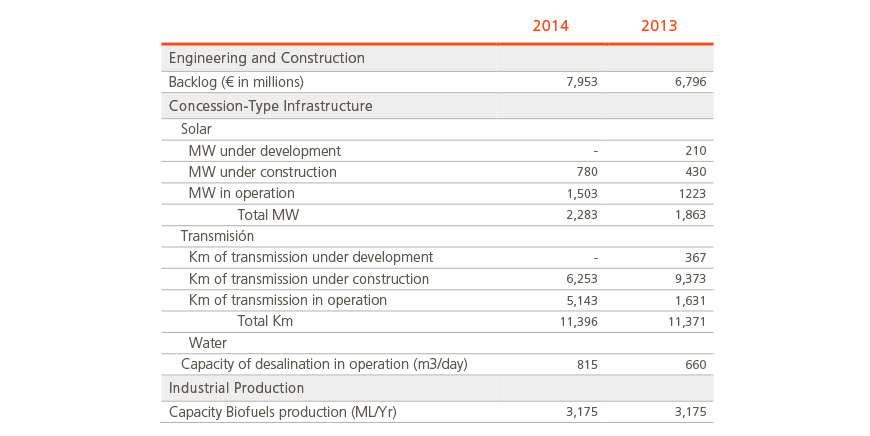

- Engineering and Construction backlog up to €7,953 million, as of December 31, 2014.

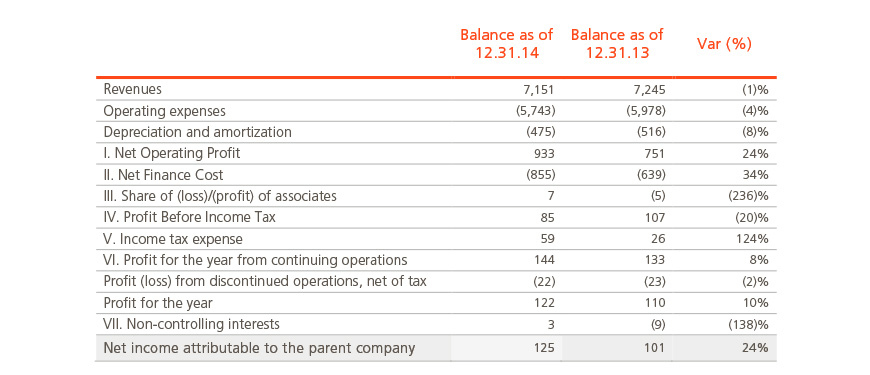

c) Consolidated income statement

Revenues

Abengoa’s consolidated revenues in the year 2014 have reached €7,151 million, representing a 1.3% decrease from the previous year. The decrease is mainly due to the revenue increase in Engineering and Construction, where we can highlight the construction of co-generation plants in Mexico, the transmission lines in Brazil and the Atacama thermo-solar plants in Chile. This decrease was partially offset by an increase in our Concessions-Type Infrastructure and Industrial Production activities in 2014 compared to 2013.

Ebitda

Ebitda for the year ended December 31, 2014 reached €1,408 million, an 11% increase from the previous year. This increase was mainly due to the contribution of new concessions assets in operation (attributable to the solar plants in Spain that entered into operation in the fourth quarter of 2013 -Solaben 1 and 6- and to the entry into operation of the Norte Brazil power transmission line), as well as the margin recovery in the Bioenergy business.

Net Finance Cost

Net financial expenses increased in €216 million, mainly due to an increase in the financial expenses, a lower interest capitalization due to the entry into operation of new concessions and our new notes issued, and mainly due to the decrease of the negative valuation of the embedded derivative in the convertible bonds and related options with respect to the previous year.

Income Tax Expense

Corporate income tax benefit reached €59 million in 2014, from €26million from previous year. This figure was affected by various incentives for exporting goods and services from Spain, for investment and commitments to R&D+i activities, the contribution to Abengoa’s profit from results from other countries, as well as prevailing tax legislation.

Profit for the year from continuing operations

Given the above, Abengoa’s income from continuing operations increased by 8% from €133 million in 2013 to €144 million in 2014.

Profit from discontinued operations, net of tax

As indicated in Note 7.1., the results generated by Abengoa Yield for the years 2014 and 2013 are recorded under the heading ‘Profit (loss) from discontinued operations, net of tax’. As well, the sale of Befesa is considered as a discontinued operation in 2013.

Profit for the year attributable to the parent company

As a result of the above, the profit attributable to Abengoa’s parent company increased by 24% from €101 million achieved in 2013, to €125 million in 2014.

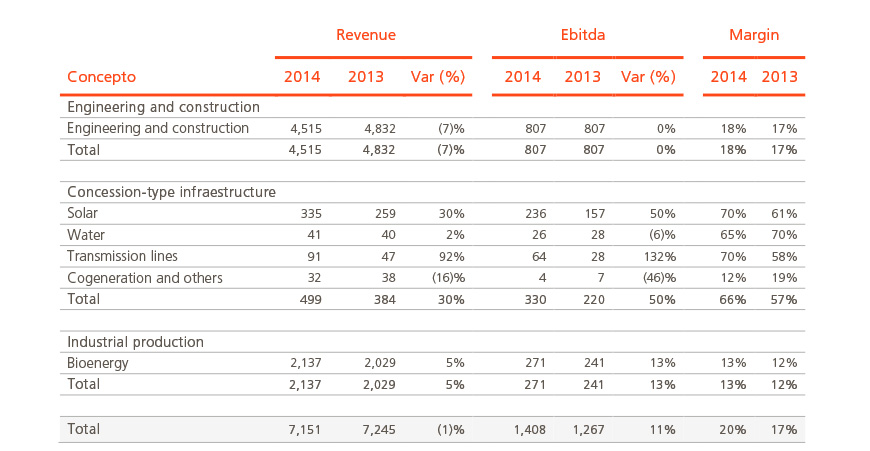

d) Results by activities

The Segment revenues, EBIDTA and margins for the years 2014 and 2013 is as follows:

Engineering and Construction

Revenues in Engineering and Construction decreased by 7% compared to the previous year, to €4,515 million (€4,832 million in 2013), while Ebitda was flat amounting to €806 million. The decrease in revenues was mainly driven by:

- Lower activity of construction resulting from the completion of the Mojave and Solana thermo-solar plants, as well as thermo-solar plants Solaben 1 and Solaben 6 (Spain),

- Lower construction activity on the Kaxu and Khi thermo-solar plants in South Africa.

- Lower construction activity on the transmission lines in Brazil and the execution of combined-cycle plants in Poland and Mexico.

This effect was partially offset by:

- Higher construction activity related to the co-generation plants in Mexico

- Higher construction activity related to the Atacama thermo-solar plants in Chile.

Concession-type Infrastructures

Revenues in the Concession-type Infrastructures area increased by 30% compared to the previous year, to €499 million (€384 million in 2013), while Ebitda rose by 50% to €330 million compared to €220 million in 2013. The increase in revenue was primarily attributable to the entry into operation of new assets (attributable to the solar plants in Spain that entered into operation in the fourth quarter of 2013 -Solaben 1 and 6- and to the entry into operation of the Norte Brazil power transmission line) and the strong performance of assets already in operation.

Industrial Production

Revenues in Bioenergy Business increased by 5% compared to the previous year, to €2,137 million (€2,029 million in 2013), while Ebitda rose by 13% to €271 million compared to €241 million in 2013. The increase was mainly due to an increase in the volume of ethanol sold in Europe and in the United States and an increase in the volume of sugar sold in Brazil.

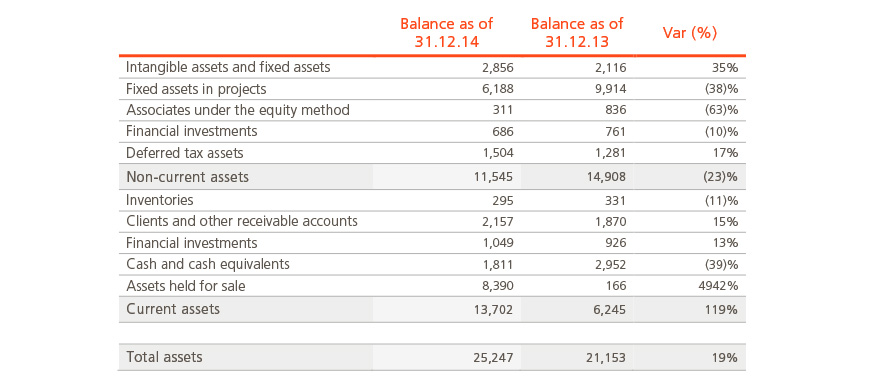

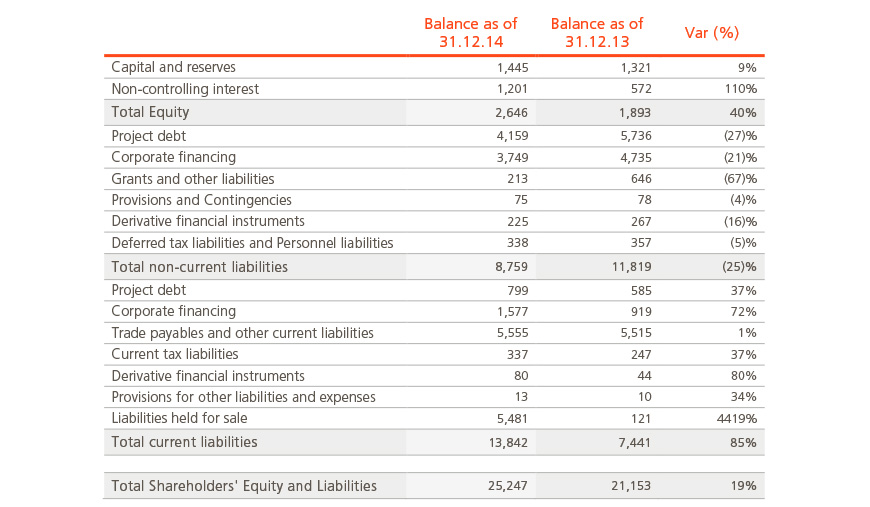

e) Consolidated statement of financial position

Consolidated statements of financial position

A summary of Abengoa’s consolidated balance sheet for 2014 and 2013 is given below, with main variations:

- Reduction in non-current assets of 23% primarily due to the transfer of all the assets included in the financial structure optimization plan to “Assets held for sale” (see Note 2.1.a). This reduction was partially offset by the increase in transmission assets under construction in Brazil and control and consolidation of the Hugoton project.

- Increase in current assets of 119% mainly attributable to the transfer of the aforementioned assets to “Assets held for sale”. The unavailability of €500 million relating to Tranche A of the syndicated loan should be taken into account in the lower figure for Cash and cash equivalents.

- Increase in equity of 40% primarily caused by the positive variation in translation differences due to the appreciation of the US Dollar, capital contributions from minority shareholders in certain projects, the positive result for the period, and the increase in minority shareholders following the IPO of the Abengoa Yield subsidiary, all of which was partially offset by the negative variation in the reserves for derivative instrument hedging.

- Reduction of 25% in non-current liabilities, mainly due to the transfer of all the liabilities included in the financial structure optimization plan to “Liabilities held for sale” (see Note 2.1.a) as well as a net reduction in corporate financing, mainly attributable to the lower syndicated loan amount; the reclassification of the €300 million note issue maturing in 2015 as short-term and the reclassification of the convertible bond maturing in 2017, for which the “put” option has been exercised in 2015.

- Net increase in current liabilities of 85%, mainly as a result of the transfer of the aforementioned liabilities to “Liabilities held for sale” and the net increase in corporate financing due to the reclassification of Abengoa’s ordinary note maturing in February 2015 and the convertible note maturing in 2017, from long-term to short-term.

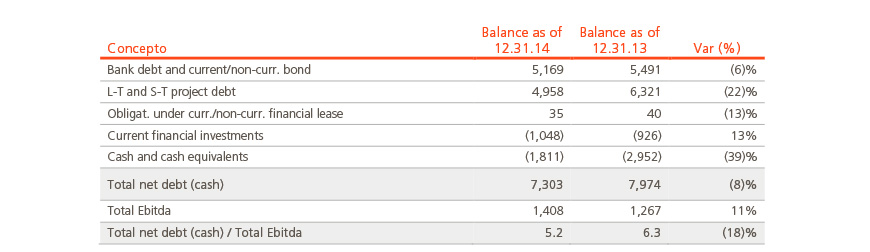

Net Debt Composition

f) Consolidated cash flow statements

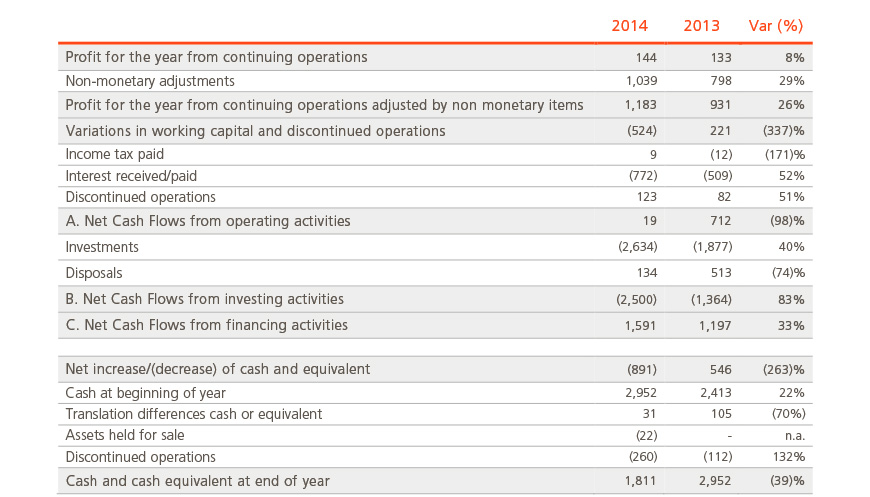

A summary of the Consolidated Cash Flow Statements of Abengoa for the years ended December 31, 2014 and 2013 with the main variations per item, are given below:

- Net cash flows from operations reached €9 million, mainly achieved by higher profit for the period from continuing operations adjusted by non-monetary items, which was offset by the consumption of working capital and by larger net interest paid.

- In terms of net cash flows from investing activities €2,500 million, the most significant investments were in the construction of co-generation projects in Mexico, various transmission lines in Brazil and Peru, the thermo-solar and PV plants in Chile and Hospital de Manaus in Brazil.

- In terms of net cash flows from financing activities, it is worth noting the net generation of cash as a concequence basically of the new corporate financing (bonds issuance, Euro Commercial Paper program and the new project bridge loan obtained by Abengoa Greenbridge through the 2014 Syndicated Loan Facility Agreement) and new non-recourse financing projects (Solar, Transmission Lines, Desalinations and Cogenerations), as well as the Abengoa Yield IPO carried out during the year.

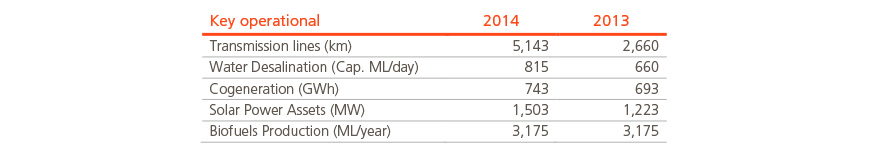

2.2. Financial and non-financial key indicators

The main operational and financial indicators for the years ended December 31, 2014 and 2013 are as follows:

The key performance indicators for each activity is detailed below for the years 2014 and 2013:

2.3. Matters relating to the environment and human resources

a) Environment

The principles of the environmental policies of Abengoa are based on compliance with the current legal regulations applicable, preventing or minimizing damaging or negative environmental consequences, reducing the consumption of energy and natural resources, and achieving ongoing improvement in environmental conduct.

In response to this commitment to the sustainable use of energy and natural resources, Abengoa, in its Management Rules and Guidelines for the entire Group, explicitly establishes the obligation to implement and certify environmental management systems in accordance with the ISO 14001 International Standard.

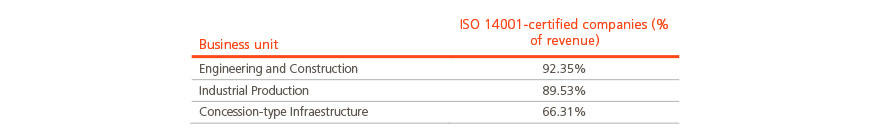

Consequently, by year-end 2014, the percentage of Companies with Environment Management Systems certified according to the ISO 14001 Standard per sales volume is 89.56% (92.92% in 2013).

The table below lists the percentage of distribution of the Companies with Certified Environmental Management Systems, broken down by business unit:

b) Human resources

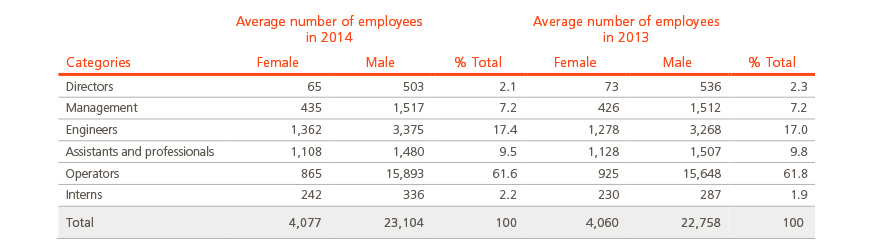

During 2014, Abengoa’s workforce decreased by 1.8% to 24,322 people of December 31, comparted to the previous year (24,763).

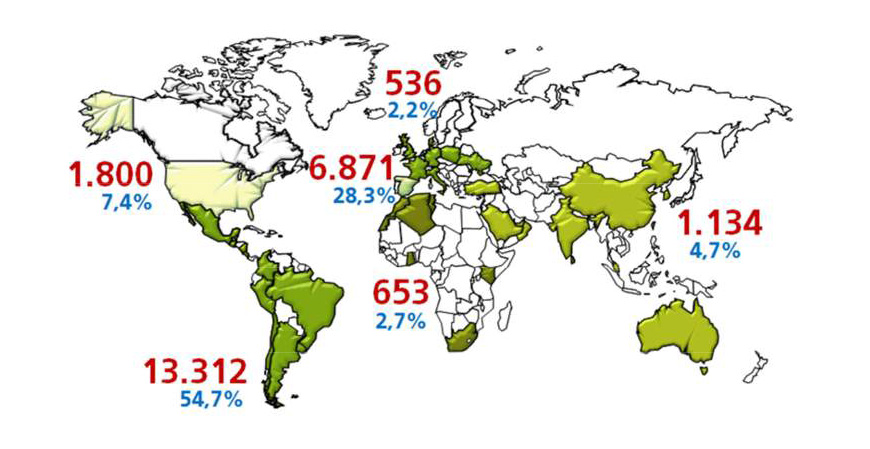

Geographical distribution of the workforce

The distribution of the average number of employees was 25 % in Spain and 75 % abroad.

lDistribution by professional groups

The average number of employees during 2014 and 2013 was:

3.- Liquidity and capital resources

Abengoa’s liquidity and financing policy is intended to ensure that the company keeps sufficient funds available to meet its financial obligations as they fall due. Abengoa uses two main sources of financing:

- Project debt (Non-recourse project financing), which is typically used to finance any significant investment. The repayment profile of each project is established on the basis of the projected cash flow generation of the business, allowing for variability depending on whether the cash flows of the transaction or project can be forecast accurately. This ensures that sufficient financing is available to meet deadlines and maturities, which mitigates the liquidity risk significantly. Despite having a commitment from a financial institution during the awarding phase of the project and since the financing is usually completed in the latter stages of a construction project –mainly because these projects require a significant amount of technical and legal documentation to be prepared and delivered that is specific to the project (licenses, authorizations, etc.)– bridge loan (Non-recourse project financing) needs to be available at the start of the construction period in order to begin construction activities as soon as possible and to be able to meet the deadlines specified in the concession agreements (see Note 19.2).

- Corporate Financing, used to finance the activities of the remaining companies which are not financed under the aforementioned financing model. This means of financing is managed through Abengoa S.A., which pools cash held by the rest of the companies so as to be able to re-distribute funds in accordance with the needs of the Group and to ensure that the necessary resources are obtained from the bank and capital markets.

To ensure there are sufficient funds available for debt repayment in relation to its cash-generating capacity, the Corporate Financial Department annually prepares and the Board of Directors reviews a Financial Plan that details all the financing needs and how such financing will be provided. We fund in advance disbursements for major cash requirements, such as capital expenditures, debt repayments and working capital requirements. In addition, as a general rule, we do not commit our own equity in projects until the associated long term financing is feasible.

During 2014, Abengoa covered its financing needs through the following financial transactions:

- The refinancing of its syndicated loans upon Abengoa, S.A. signed a long term revolving financing agreement, as well as new financing transactions in subsidiaries which have the support of export credit agencies.

- Initial Public Offering of Abenga Yield Plc., in June 2014. This company completed the capital increase for a total amount of €611 million.

- Financing of certain projects through project debt.

- Ordinary notes issue for a total amount of €1,000 million.

Abengoa aims to maintain its strong liquidity position, extend the debt maturities of its existing corporate loans and bonds, continue to access the capital markets from time to time, as appropriate, and further diversify its funding sources. The Company aims to continue to raise equity funding at the project company level through partnerships.

In accordance with the foregoing, the sources of financing are diversified, in an attempt to prevent concentrations that may affect our liquidity risk.

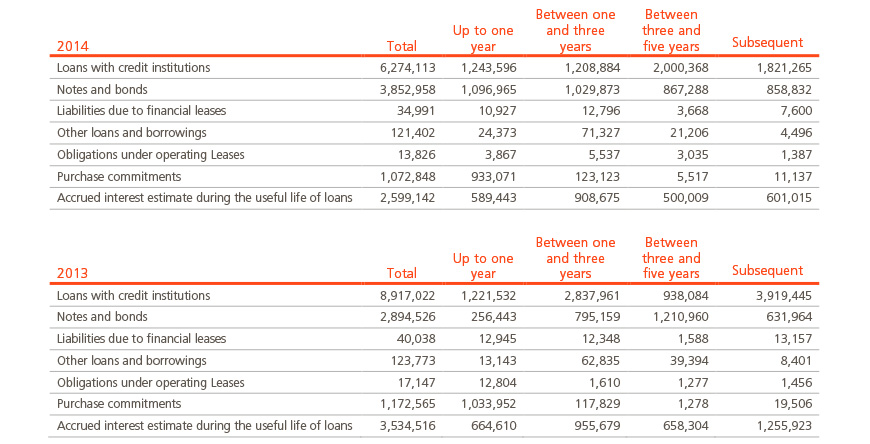

a) Contractual obligations and off-balance sheet

The following table shows the breakdown of the third-party commitments and contractual obligations as of December 31, 2014 and 2013 (in thousands of Euros):

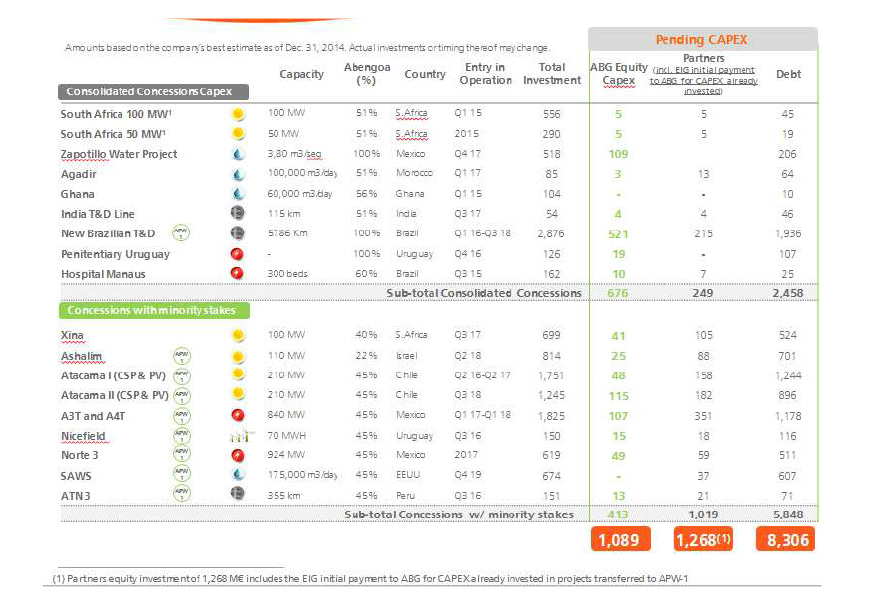

b) Investment plan

The nature and maturity of future investment commitments are detailed as follows:

4.- Principal risks and uncertainties

4.1. Operational risks

4.1.1. Regulatory risk

Risks derived from reductions in government budgets, subsidies and adverse changes in the law that could affect the company’s business and development of its current and future projects

The economic instability and difficult economic conditions in Spain have led to lower tax revenues among the company’s public administration clients at a time when the budget deficit is rising. These unfavorable conditions affecting government budgets threaten the continuity of public subsidies for activities that benefit the company, especially those related to renewable energy. These conditions may also give rise to adverse changes in legislation.

Furthermore, in the last few years a large part of the revenues generated by the company’s water infrastructures division has come from public sector contracts. Many of the public sector institutions that Abengoa works with are municipalities with limited budgets that are susceptible to annual fluctuations and in many cases rely on the collection of municipal taxes or those distributed by central government. Consequently, the funding available to municipalities for these types of projects can suddenly dry up. Moreover, the measures taken to correct the current financial situation in many of these public entities, have increased their budget deficits and there is no certainty that these types of projects will be funded again at the same levels as we have seen to date.

Risks derived from a high degree of dependency on certain regulations, subsidies and tax incentives that could be modified or opposed

The company’s industrial activities have a certain degree of reliance on environmental and other types of legislation, including regulations that require reductions in carbon emissions and other greenhouse gases, a minimum biofuels content in fuels and the use of energy from renewable sources, among other constraints.

In some jurisdictions, renewable energy subsidies have been retracted on constitutional grounds (including claims that they represent state aid that is not allowed by the European Union). Similarly, some guarantee programs in the USA have been retracted on the basis that they breach certain federal laws.

Renewable energy production benefits from specific measures and tax incentives in some of the jurisdictions in which the company operates. These measures play an important role in the profitability of these projects. In the future, it is possible that part or all of these measures are cancelled, modified or not renewed.

Risks derived from compliance with strict environmental regulations

The company is subject to environmental regulations that require it to obtain environmental impact studies for future projects or changes to existing projects; licenses and permits; as well as to comply with the conditions that these impose, among other factors. Consequently, it is impossible to guarantee that the authorities will approve these environmental impact studies or that public opposition will not lead to delays, modifications or cancellations of licenses, or that laws will not be modified or interpreted in a way that increases the costs of the company’s operations.

Breaches of these regulations may, in some cases, give rise to significant liabilities with the imposition of fines and even closure of the plant. In general, government authorities are empowered to correct and mitigate the consequences of environmental damages, forcing the entity responsible to assume the cost of these actions.

In Brazil, environmental liability applies to private individuals and legal entities that directly or indirectly cause environmental damage via their actions or negligence. The courts can even ‘pierce the corporate veil’ in those cases in which a company tries to avoid paying compensation for damages.

Environmental regulations have changed rapidly in recent years and it is possible that there will be more changes in the future, including even stricter requirements. Consequently, the company cannot rule out the need to make additional investments in the future to comply with environmental regulations and such costs are difficult to predict.

Risk derived from a reliance on favorable regulation of the renewable energy business and bioethanol production

a) Solar power generation

Renewable energy is rapidly maturing but its cost of generating electricity is still significantly higher than conventional energy production (nuclear, coal, gas, hydroelectric). Governments have established support mechanisms to make renewable generation projects economically viable, in the form of subsidized tariffs (mainly in Spain), supplemented in specific cases with direct support for investment (mainly in the USA). These tariffs vary depending on the technology (wind, photovoltaic, STE, biomass) since they are at different stages of maturity and the regulator wants to promote the development of each type by giving developers sufficient economic incentive in the form of a reasonable return on their investment. Without this support, any renewable energy project would currently be unfeasible, although as the technology matures, the need for this support will diminish or even completely disappear over the long term.

b) Bioenergy consumption

The consumption of bioenergy for transport –one of the company’s activity areas– is also subject to regulation via specific public support policies both nationally and internationally. Biofuels cost more to produce than gasoline or diesel and therefore requires government support to incentivize their use. Biofuels offer a series of environmental and energy advantages compared to oil-based fuels, making them potentially useful tools for implementing European policies to combat climate change and reduce oil dependency.

Nevertheless, despite major support in the biofuels sector from governments and regulatory authorities in the jurisdictions in which Abengoa operates, and the fact that authorities have reiterated their intention to continue this support, it is still possible that certain existing policies may change over time.

Furthermore, biofuels are not the only alternative to oil-based fuels for use in transport, as shown by the recent development of electric vehicle technology. It is possible for different alternatives that have the potential to progressively substitute fossil fuels in transport to coexist. Future demand for all forms of transport could be covered with a combination of electricity (fuel cells) and biofuels as the main options; synthetic fuels (increasingly produced from renewable sources) as an intermediate solution; and methane as an additional fuel supplemented by liquid petroleum gas. Many of these alternative sources receive or will receive government support in the form of different types of incentives, which may reduce the amount of support available to biofuels. Furthermore, the level of public support can be influenced by external factors, such as public criticism in some countries of the alleged effect of biofuels on increasing food prices.

Abengoa’s activities are subject to multiple jurisdictions with varying degrees of regulation, which require significant effort by the company to ensure compliance

Abengoa’s business is subject to strict regulation in the USA, Mexico, Spain, Peru and Brazil, and in every other country in which it operates. These laws and regulations require licenses, permits and other authorizations in relation to the company’s operations. This regulatory framework currently imposes a significant amount of daily limits, costs and risks on the company. In particular, the power plants and transmission lines that we operate in our Concession-type Infrastructures and Industrial Production activities are subject to strict international, national, state and local regulation in terms of their development, construction and operation. A breach of any of these numerous requirements could result in licenses being revoked, fines being imposed or penalties that prevent Abengoa from contracting with various public institutions. Compliance with these regulations, which could give rise to greater exposure to capital market regulations in the future, could result in significant costs for our operations that may not be recoverable.

The company could be affected by breaches of the US Foreign Corrupt Practices Act and similar anticorruption laws around the world

These laws usually prohibit a company and its intermediaries from making improper payments to public officials or other people in order to obtain new business. Abengoa’s internal policies comply with these regulations. The company operates in many parts of the world where political corruption exists and, in some circumstances, strict compliance with anticorruption laws is at odds with local customs and practices. The company trains its employees in anticorruption matters and informs its partners, subcontractors, suppliers, agents and other entities that it works with, that they must also comply with anticorruption laws. The company also has internal control mechanisms to ensure compliance with these regulations. However, it is impossible to guarantee that these internal rules and mechanisms will always protect the company from criminal actions carried out by its employees or agents.

Risks associated with concession-type infrastructure projects that operate under regulated tariffs or very long term concession agreements

Revenues obtained from concession-type infrastructure projects are highly dependent on regulated tariffs or, if applicable, long term price agreements. Abengoa has very little flexibility with regards to amending these tariffs or prices when faced with adverse operating situations, such as fluctuations in commodity prices, exchange rates, and labor and subcontractor costs, during the construction and operating phases of these projects. These projects are normally calculated with tariffs or prices that are higher than the operating and maintenance cost. In some cases, if certain pre-established conditions are breached, the government or client may be able to reduce the tariff, depending on the case in question. Similarly, the relevant authorities may unilaterally impose additional tariff restrictions during the life of a concession, subject to the regulatory framework that applies in each jurisdiction. Governments may also postpone tariff increases until a new tariff structure is approved, without compensating operators for lost revenues. Lastly, in certain cases regulatory changes may be made retroactively and expose the company to additional costs and cause financial planning problems.

4.1.2. Operational risk

Abengoa operates in an activity sector that is closely linked to the economic cycle

The global economic and financial situation, the ‘credit crunch’, the sovereign debt crisis, tax deficits and other macroeconomic factors may negatively affect demand from existing or potential clients.

Specifically, the reduction in national infrastructure expenditure is impacting Abengoa’s results, since a proportion of its projects are developed by the public sector, generating a volume of revenues for the company that would be difficult to replace with private investment, especially in the current economic environment.

As mentioned, although the economic cycle affects all of the company’s businesses, some activities are more dependent on the economic outlook than others.

The demand for bioenergy –like the demand for gasoline or diesel– is relatively inelastic and has not decreased in a significant way despite the high fuel prices.

However, Abengoa’s Concession-type Infrastructures activity is much less dependent on the economic outlook, since revenues from this activity primarily come from long-term agreements, which neutralize fluctuations associated with the economic situation. However, it is a capex intensive activity, like the Engineering and Construction activity, and could be affected by difficulties in accessing financing.

The products and services of the renewable energy sector are part of a market that is subject to strict competition rules

Abengoa’s STE (solar thermal electricity) business operates in a competitive environment. In general, renewable energy competes with conventional energy that is cheaper and more competitive. Renewable energy is currently subsidized in order to bridge the difference in cost and various specific implementation targets have been set. Consequently, as generation and production costs come down, the level of government support will probably also decrease for many projects, although those that are already operational should continue to benefit from tariffs and incentives. Nevertheless, a gradual but significant reduction in tariffs, premiums and incentives for renewable energy is expected to occur in the medium to long-term.

The company is also facing considerable competition from other renewable energy suppliers. In the solar industry, competition will increase due to new suppliers entering the market as well as the existence of alternative renewable energy sources. It is possible that some of the company’s current competitors or new participants in the market could respond more quickly to regulatory changes or develop technology with significantly different production costs. Furthermore, existing or future competitors may be able to dedicate more financial, technical and management resources to developing, promoting and selling their electricity.

The results of the Engineering and Construction activity significantly depend on the growth of the company’s Concession-type Infrastructures and Industrial Production activities.

The Engineering and Construction business is Abengoa’s most important activity in terms of revenues. A significant part of this business depends on the construction of new assets for the Concession-type Infrastructures activity (especially power plants, transmission lines and water infrastructures) and the Industrial Production activity (bioenergy plants).

If Abengoa is unsuccessful in winning new contracts in its Concession-type Infrastructures activity, the revenues and profitability of the Engineering and Construction activity will suffer.

Risks derived from a shift in public opinion about Abengoa’s activities

Certain people, associations or groups may oppose Abengoa’s projects, such as the construction of renewable energy plants, recycling plants (this activity was performed by Abengoa until it sold Befesa), etc. Regulations may also restrict the development of renewable energy plants in some regions.

Although carrying out these types of projects generally requires an environmental impact study and a public consultation process prior to granting the corresponding administrative authorizations, the company cannot guarantee that a specific project will be accepted by the local population. Moreover, in those areas in which facilities are located next to residential areas, opposition from local residents could lead to the adoption of restrictive rules or measures regarding the facilities.

If part of the population or a particular company decides to oppose the construction of a project or takes legal action, this could make it difficult to obtain the corresponding administrative authorizations. In addition, legal action may give rise to the adoption of precautionary measures that force construction to stop, which could cause problems for commissioning the project within the planned time frame or for achieving Abengoa’s business objectives.

Furthermore, hostile public opinion about the use of grain and sugar cane should not be readily dismissed either (albeit to a lesser extent in bioethanol production) since these are basic consumer goods that are significantly associated with shortages in the food market. In response to public pressure, governments may adopt measures to ensure that grain and sugar is diverted into food production instead of bioethanol, causing problems for existing production activities and Abengoa’s future expansion plans.

Internationalization and country risk

Abengoa operates in a series of locations around the world, including Australia, Latin America (including Brazil), China, India, North America, the Middle East and Africa, and it hopes to expand its operations into new locations in the future. The company therefore faces a series of risks associated with operating in different countries, which include but are not limited to risks derived from the need to adapt to the regulatory requirements of different countries; to adapt to changes in the laws and regulations applicable to foreign companies; the uncertainty of judicial processes; the loss or non-renewal of favorable treaties or agreements with local institutions or policies; as well as political, economic and social instability which can result in disproportionate demands being made on the company’s managers and employees. It is therefore impossible to guarantee the success of future international operations.

Abengoa also has businesses in various emerging countries around the world. Operations in these countries involve risks that are less common in more developed markets, such as political, economic and social instability, changes to laws and regulations, nationalization or expropriation of private property, payment difficulties, social problems, fluctuations in interest rates and exchange rates, changes to the tax system, the unpredictability of enforcing contractual agreements, currency control measures that limit the repatriation of funds and other restrictions and interventions imposed by public authorities.

Latin American governments frequently intervene in the economies of their respective countries and occasionally make major changes to their regulatory framework. Government action in some Latin American countries to control inflation often involves price controls, currency devaluations, capital controls and import restrictions. Furthermore, in recent months political instability, social unrest and –in some cases– regime changes and armed conflicts have taken place in countries of the Middle East and Africa, including Egypt, Iraqi, Syria, Libya and Tunisia, which has increased political and economic instability in some of the Middle Eastern and African countries in which we operate.

Abengoa’s policy is to cover country risk using insurance policies and to transfer risk to financial institutions by means of the corresponding financing agreements and other mechanisms.

Risks derived from the difficulty of winning new projects or extending existing ones

The company’s capacity to maintain its competitive position and achieve its growth objectives largely depends on its ability to update its existing plants and to acquire or lease new plants in strategic locations. The company’s capacity to win new plants or expand existing ones is limited by regulatory and geographical considerations. All kinds of governmental restrictions can limit the potential locations for plants. The development, construction and operation of traditional power plants, renewable energy plants, desalination plants, water treatment plants, power transmission lines, as well as other projects that Abengoa carries out, involve a highly complex process that depends on a large number of variables. The company may be unable to obtain all of the authorizations and licenses required or it may have to agree to stricter conditions in order to obtain them. Public opposition may also delay or even prevent expansions or new projects.

Solar plants, for example, can only be constructed in specific locations with high levels of solar radiation, access to water and suitable geographic characteristics. There are a limited number of suitable locations for these types of facilities and the recent rise in the number of market operators has increased competition for potential sites. Moreover, regardless of the fact that we carry out studies to determine the performance of plants in specific locations, they do not necessarily perform as expected.

The development, construction and operation of new projects may be affected by factors commonly associated with those projects

The development, construction and operation of conventional power plants, renewable energy plants, water infrastructure plants, transmission lines and other types of projects can take long periods of time and be extremely complex. When developing and funding a project, government authorizations and sufficient financing must be obtained as well as signing agreements for land use, the design and execution of the project, supplies, etc. Factors that can impact the company’s ability to construct new projects include delays in obtaining licenses, shortages or changes in the price of equipment and materials as well as cost overruns, adverse changes in the political and regulatory framework in different jurisdictions, adverse weather conditions and problems obtaining financing under favorable terms, among many others.

Risks derived from associations with third parties when executing certain projects

When Abengoa decides to make acquisitions or financial investments to expand or diversify its business, the necessary financing may come from borrowing. It is impossible to guarantee that the company will be capable of completing all or part of the expansion or diversification operations that it carries out in the future. These operations expose the company to risks inherent in integrating an acquired business and its personnel; problems in achieving the expected synergies; difficulties in maintaining uniform standards, controls, procedures and policies; recognition of unforeseen liabilities and costs, and regulatory complications that can arise in these types of operations. Similarly, the terms and conditions of the financing of these operations may restrict the way the business is managed.

Abengoa has made investments in certain projects in collaboration with third parties that include both public institutions and private organizations. In some cases these projects take the form of joint ventures in which the company has only partial or joint control. These types of projects are subject to the risk that the company’s partner may block decisions that may be crucial to the success of the project or about investment in the project, and it runs the risk that these third parties may in some way implement strategies that are contrary to Abengoa’s economic interests, resulting in a lower return.

Operations with third parties expose the company to credit risk

The company is exposed to credit risk derived from a counterparty default. Despite the fact that the company actively manages these risks using non-recourse factoring and credit insurance, these measures may not cover the whole risk.

The delivery of products and the provision of services to clients, and compliance with the obligations assumed with these clients, can all be affected by problems related to third-parties and suppliers

In some contracts, the provision of the company’s products and services depends on subcontracting them from third parties. Failures or delays by the company’s subcontractors could cause Abengoa to breach its obligations with its clients.

The unauthorized use of our products by third parties may reduce their value and prevent the company from competing efficiently

The company bases its business on a combination of industrial secrecy and intellectual property laws (which in some countries do not offer sufficient protection), non-disclosure agreements and other types of agreements designed to protect the company’s property rights. These measures may be insufficient to protect its technology from third-party breaches and, regardless of the solutions that may be put in place, the company may become less competitive and potentially lose market share.

Similarly, the company is exposed to the risk of claims from third parties for intellectual property infringements.

Risks derived from the company’s inability to effectively defend itself against third-party claims

Abengoa’s projects involve complex engineering, procurement and construction works. The company may encounter difficulties during these processes –some of which will be beyond its control– which could affect its ability to fulfil the contract under the agreed terms and conditions. The company also collaborates with third parties that help it to fulfil these contracts. The company may have to deal with claims against third-parties –and vice versa– in relation to these contracts. These claims may give rise to long and costly legal proceedings if they are not resolved during the negotiation phase.

Revenues from long term agreements: risks derived from the existence of termination and/or renewal clauses of the concession agreements managed by Abengoa; cancellation of pending projects in Engineering and Construction; and the non-renewal of distribution agreements in Bioenergy

- Concessions

Some of Abengoa’s activities are performed under concession agreements with different government entities. They are responsible for regulating the services provided in this way and they have extensive powers to supervise compliance with concession agreements, including demanding technical, financial and administrative information. These government entities can therefore demand compliance with various requirements that these same entities may change at a later date. A breach of concession agreements or the requirements established by these government entities may result in the concession not being awarded, revoked or not renewed.

- Bioenergy distribution agreements

Abengoa sells bioenergy through medium and long term agreements, mainly in Europe. However, it cannot guarantee that these agreements will be renewed.

- Backlog in the Engineering and Construction activity

It is important to note that the term ‘backlog’ usually refers to projects, operations and services for which the company has commitments, but also includes projects, operations and services for which it does not have firm commitments. Some new project contracts are conditional upon other factors, usually the process of obtaining third party financing.

Abengoa’s backlog is the management’s estimate of the amount of awarded contracts that are expected to be converted into future revenues. A project for which a contract has been signed will be included in the backlog calculation. A signed contract implies a legally binding agreement, which represents a secure source of revenues in the future. Nevertheless, taking into account the method of calculating the backlog, it is impossible to guarantee that planned revenues in the backlog will ultimately materialize or, if they do, that they will generate a profit. It is not possible to predict with certainty when or if the backlog will materialize, due to project terminations, cancellations and modifications to their scope. It is impossible to guarantee that additional cancellations will not occur. Moreover, even when revenues are expected, it is possible that the client pays late or does not pay at all.

Risks arising from delays or cost overruns in the Engineering and Construction activity due to the technical difficulty of projects and the long term nature of their implementation

In the Engineering and Construction activity, it is important to note that –with few exceptions– all of the agreements that Abengoa has entered into are ‘turnkey’ construction agreements (also known as EPC agreements). Under the terms of these agreements the client receives a completed facility in exchange for a fixed price. These projects are subject to very long construction periods of between one and three years. This type of agreement involves a certain amount of risk since the price offered prior to beginning the project is based on cost estimates that can change over the course of the construction period, which can make certain projects unprofitable or even cause significant losses. Furthermore, in most EPC contracts Abengoa is responsible for every aspect of the project, from the engineering through to the construction, including the commissioning of the project. In addition to the general responsibilities for each project, Abengoa must also assume the technical risk and the associated guarantee commitments. Delays can result in cost overruns, deadlines being missed or penalty payments to the client, depending on what has been negotiated.

Risks derived from lawsuits and other legal proceedings

In the ordinary course of its business, the company is exposed to the risk of legal claims and enforceable demands, as well as all types of regulatory proceedings. The outcomes of these demands and proceedings cannot be accurately predicted.

The nature of the Engineering and Construction business exposes the company to potential liability claims

This business involves carrying out operations in which design, construction or systems failures may cause damages to third parties. In addition, the nature of this activity often involves claims from clients and subcontractors for costs incurred above the budgeted amount. These types of claims arise in the ordinary course of the company’s business.

Risks derived from variations in the cost of energy

Some of Abengoa’s activities, especially ethanol production and recycling (the latter was performed by Abengoa until it sold Befesa) require significant energy consumption.

The profitability of activities that are highly reliant on these inputs is therefore sensitive to fluctuations in their prices. Despite the fact that agreements to purchase gas and other sources of energy normally include adjustment or hedging mechanisms against a rise in prices, the company cannot guarantee that these mechanisms will cover all of the additional costs that could be incurred from a rise in the price of gas or its other energy inputs (especially in long term agreements signed with clients and in agreements that do not include these adjustment clauses).

Risks derived from the exposure of power generation revenues to electricity market prices

In addition to relying on regulatory incentives, revenues from some of Abengoa’s projects partially rely on electricity market prices that can be volatile and affected by various factors, including commodities prices, and on the demand and price of greenhouse gas emission rights.

In some of the jurisdictions in which the company operates, it is exposed to remuneration schemes that combine regulatory and market components, in which the regulatory element does not offset fluctuations in market prices, making the overall remuneration highly volatile.

Risks derived from a lack of available power transmission capacity, potential increases in transmission network access costs and restrictions in other systems

Power plants need to be connected to the transmission network to be able to deliver the power they generate to the company’s clients. A lack of capacity in these transmission systems could limit the size of projects, cause delays in their implementation or increase the cost.

Insurance policies taken out by Abengoa may be insufficient to cover the risks arising from projects and the cost of insurance premiums may rise

Abengoa’s projects are exposed to various types of risk that require appropriate coverage in order to mitigate their potential effects. Despite Abengoa’s attempts to obtain the correct coverage for the main risks associated with each project, it is impossible to guarantee that it is sufficient for every type of potential loss.

Abengoa’s projects are insured with policies that comply with sector standards in relation to various types of risk, such as risks caused by nature; incidents during assembly, construction or transport; and loss of earnings associated with such events. All of the insurance policies taken out by Abengoa comply with the requirements demanded by the institutions that finance the company’s projects and the coverage is verified by independent experts for each project.

Furthermore the insurance policies taken out are reviewed by the insurance companies. If insurance premiums increase in the future and cannot be passed on to the client, these additional costs could have a negative impact for Abengoa. However, no significant increases have occurred in the cost of premiums in the last 12 months.

The company’s activities may be negatively affected by catastrophes, natural disasters, adverse weather conditions, unexpected geological conditions or other environmental circumstances, as well as by acts of terrorism at any of its sites

In the event that an Abengoa site is affected by a fire, flood, adverse weather conditions or any other type of natural disaster, acts of terrorism, power outages and other catastrophes, or in the event of unexpected geological conditions or other unexpected environmental circumstances, the company may be unable or only partially able to continue operating these facilities. This could result in lower revenues from the affected site while the problem exists and lead to higher repair costs.

Abengoa has taken out insurance against natural risks or acts of terrorism and the loss of earnings that may arise from stoppages.

The analysis of whether the IFRIC 12 ruling applies to certain contracts and activities, and determination of the appropriate accounting treatment in the event that it is applicable, involves various complex factors and is influenced by diverse legal and accounting interpretations

The company recognizes some of its concession-type assets as concession arrangements in accordance with IFRIC 12. The analysis of whether IFRIC 12 does or does not apply is influenced by a wide range of legal and accounting interpretations of certain arrangements with public entities. The application of the IFRIC 12 rule requires an in-depth interpretation of the following, among other issues, (i) identification of certain infrastructures and agreements within the scope of IFRIC 12; (ii) an understanding of the nature of the payments in order to classify the infrastructure as a financial asset or an intangible asset; and (iii) the schedule and recognition of income from the construction and concession activity.

The recovery of tax losses depends on obtaining profits in the future, which in turn depends on uncertain estimates

The management assesses the recovery of tax losses on the basis of future profit estimates. These estimates are derived from the forecasts included in the 5 and 10 year strategic plan that is prepared every year and reviewed every two years. According to its current estimates, the company expects to generate sufficient profits to be able to benefit from its tax credits. Nevertheless, income may be affected by circumstances that arise during the ordinary course of its business.

Tax evasion and product tampering in the fuel distribution market in Brazil could distort market prices

In recent years, tax evasion and product tampering have been one of the main problems for fuel distributors in Brazil. In general, such practices combine both tax evasion and fuel tampering by mixing gasoline with solvents or adding anhydrous ethanol in quantities greater than the 25% allowable by law (taxes on anhydrous ethanol are lower than those for hydrated ethanol and gasoline). Taxes account for a very significant proportion of the cost of fuel sold in Brazil.

Risks derived from turnover in the senior management team and among key employees or from an inability to hire highly qualified personnel

The company’s future success relies on the involvement of the senior management team and key employees, who have extensive experience in every business area. The company’s ability to retain these people and attract qualified personnel will affect its capacity to manage its business and expand in the future.

Construction projects related to the Engineering and Construction activity and the facilities of the Concession-type Infrastructures and Industrial Production activities are hazardous workplaces

Employees and other personnel that work on Abengoa’s construction projects for the Engineering and Construction activity and at the facilities of the Concession-type Infrastructures and Industrial Production activities are usually surrounded by large scale mechanical equipment, moving vehicles, manufacturing processes or hazardous materials, which are subject to wide-ranging regulations when they are used (for example, occupational health and safety legislation and other applicable regulations). At most projects and facilities, the company is responsible for safety and must therefore implement safety procedures. A failure to implement these procedures, or if they are implemented inefficiently, could give rise to injuries and increase the costs of a project.

Projects may involve the use of hazardous or highly regulated materials that, if not handled correctly or spilt, could expose the company to claims that result in all types of civil, criminal and administrative liabilities (fines or Social Security benefits surcharges).

Despite the fact that the company has functional groups that are exclusively responsible for monitoring the implementation of the necessary health and safety measures, as well as working procedures that are compatible with protecting the environment, throughout the organization (including at construction and maintenance sites), any failure to comply with these regulations could result in liability for the company. Similarly, Abengoa may be unaware or unable to ensure compliance with occupational health and safety regulations in the companies that it subcontracts. In the event of non-compliance Abengoa could be found liable.

Historical safety levels are a critical part of Abengoa’s reputation. Many of its clients expressly require the company to comply with specific safety criteria in order to be able to submit bids, and many contracts include automatic termination clauses or withdrawal of all or part of the contractual fees or profits in the event that the company fails to comply with certain criteria. Consequently, Abengoa’s inability to maintain adequate safety standards could result in lower profitability or the loss of clients or projects.

As at the date of these Consolidated Financial Statements, no agreements have been terminated, no penalties have been imposed and no material decreases in earnings have occurred due to failures to comply with safety-related obligations.

Abengoa operates with high levels of debt and could take on additional borrowing

Abengoa’s operations are capital intensive and the company therefore operates with a high level of indebtedness.

The main ratio that Abengoa must observe is the ratio of its net debt over EBITDA, excluding the debt and EBITDA of projects financed under project debt formats, as defined in its main corporate finance agreements. As at December 31, 2014, this ratio was 2.11x with the maximum limit being 2.5x until December 30, 2015.

At the end of 2014 the covenant ratio for Net Debt and corporate EBITDA, according to the clauses of the syndicated loan, was 2.11x. This ratio is obtained by calculating the total liquidity of the companies with project debt; the amount of the reserve account for debt servicing is included as debt; and R&D+i expenses for the period are not included in corporate EBITDA.

In relation to the project debt of project companies, it should be noted that the majority of the company’s projects are developed in regulated environments, in which the debt is repaid over a long time frame according to the concession agreement, a regulated tariff or, if appropriate, power or water purchase agreements, so that the degree of leverage (meaning the proportion of debt to capital) of these projects is higher than in financing with recourse to the parent company or other group companies (corporate financing). Since project debt is used for most projects, it makes sense to analyze debt on two separate levels (non-recourse and corporate, since the parent company is only liable for corporate debt).

As a result of implementing the new accounting standards in IFRS 10, companies that do not meet the conditions of effective control during the construction phase are excluded from the consolidation scope of Abengoa’s financial statements, in accordance with the capital method. However, these projects are expected to be included in the consolidation once they come into operation and control over them is returned, which will mean significant increases in long-term project debt, among other issues.

Notwithstanding the above, a breach of the payment obligations assumed by borrowers (usually the project companies) could have major consequences for the company and its group, including but not limited to lower dividends, lower interest or payments to be received by Abengoa (which Abengoa then uses to repay corporate debt) or even losses in the event that guarantees provided by project companies under project debt agreements are enforced.

In addition, the current high level of borrowing could increase in the future due to capex investments, fluctuations in operating results and potential acquisitions or joint ventures, among other possibilities. This high level of debt could divert a significant part of the company’s operational cash flow in order to repay the debt, thereby reducing the capacity to finance working capital, future capex, investment in R&D+i or other general corporate objectives, as well as limiting the company’s capacity to obtain additional financing. Similarly, the high level of debt could make it difficult for the company to meet its obligations or refinance its debt; it could increase its vulnerability to downturns in the economy or the sector; restrict its ability to pay dividends on its own shares and its subsidiaries; limit its flexibility to plan and react to changes in the business and the market in which it operates; and put it at a disadvantage in relation to other companies that operate with less debt.

If debt should increase in the future as a result of developing multiple new projects (including the interest payments associated with this), operating cash flow, cash and other resources may be insufficient to cover the company’s payment obligations when they fall due or to finance its liquidity needs.

In addition to the current high degree of leverage, the terms of the agreements for issuing debt and other financing agreements that regulate debt issuance, permit both Abengoa and its subsidiaries, joint ventures and associated entities to access a significant amount of additional debt in the future, including secured debt, which could increase the aforementioned risks.

As at the date of these Consolidated Financial Statements, Abengoa has not breached any of its corporate financing agreements, which could give rise to the early cancellation of these agreements.

Nevertheless, it should be noted that a breach of these obligations (for example, the requirement to maintain certain financial ratios, restrictions on dividend payments, restrictions on granting loans and guarantees, and restrictions on the availability of assets) agreed by the company with various financial institutions that have provided third party financing, could lead to the early cancellation of payment obligations under the corresponding finance agreements (and other associated agreements) and, if applicable, the enforcement of guarantees that may have been granted in their favor. Likewise, such a breach could give rise to the early termination not only of the aforementioned agreements, but also those that have specific cross-default clauses (which the majority of corporate borrowing agreements have) caused by a payment default.

It should also be remembered that Abengoa could be forced to repay the debt borrowed under financing agreements early or to redeem convertible notes and bonds (should the note and bondholders demand it) in the event of a change of control in the company.

Lastly, the company also depends on short-term credit lines to finance its working capital needs. If these lines are reduced or cancelled in some way, the company would be required to look for alternative sources of financing which could increase its level of borrowing.

Risks derived from the need to make significant levels of investment in fixed assets (CAPEX)

The company has to invest significant amounts in fixed assets (CAPEX), which require continuous access to the global capital markets, as well as in R&D+i and major construction projects. The amounts invested in fixed assets (CAPEX) and R&D+i depend on the number and type of projects that will be contracted in the future. The company is committed to make specific investments in fixed assets (CAPEX) in the future, pursuant to concession and other agreements. These investments in fixed assets (CAPEX) and R&D+i will be recovered over a relatively long period of time. The company may also be unable to recover the investments in these projects as a result of delays, cost overruns or timing issues related to the investment recovery schedule.

The perception of the market in relation to the instability of the euro, a potential return to national currencies in the Eurozone or the complete disappearance of the euro could affect the company’s business

Following the credit crisis in Europe, the European Commission created the European Financial Stability Facility and the European Financial Stabilization Mechanism to provide funds to Eurozone countries experiencing financial difficulties. The measures adopted helped to stabilize the euro between late 2012 and 2014. Nevertheless, the recent market instability in Europe related to sovereign debt could occur again and additional stabilization measures could be necessary in the future.

There is still uncertainty about the debt of certain Eurozone countries and certain regional governments, and the solvency of some financial institutions and their respective capacity to meet their future financial obligations. The difficult market conditions have raised doubts about the stability of the euro and its suitability as a single currency considering the diverse range of economic and political circumstances of its member states. This and other circumstances could lead to a return to national currencies and, in extreme circumstances, the disappearance of the euro. The consequences of this disappearance for holders of euro denominated notes would be defined by laws specifically passed for this purpose.

Risks derived from a cut in the company’s credit rating

Credit ratings affect the cost and the terms under which the company can obtain financing. Credit rating agencies regularly assess the company and its ratings depend on a series of factors, including the credit rating of the Kingdom of Spain. Any fall in the credit rating of Spain, the group or its non-convertible notes could affect the company’s ability to obtain financing under reasonable terms.

The evolution of interest rates and the company’s hedging may affect its results