Connected transactions and intragroup transactions

D.1 Specify the organ authorised and explain, as the case may be, the procedure for approving associate and intra-group transactions.

Explain whether the approval of transactions between associate parties was assigned. If so, state the organ to which or persons to whom it was assigned.

No

D.2 Give details of transactions deemed significant due to the amount or relevant due to the aspect between the company and companies of its group, and the significant shareholders in the company:

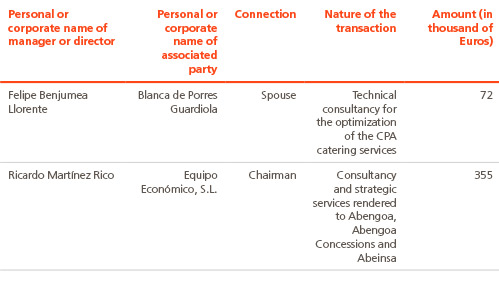

D.3 Give details of transactions that are significant due to amount or relevant due to the nature between the company and companies of its group, and the managers or directors of the company:

D.4 Report on the significant transactions between the company and other entities belonging to the same group provided they are not eliminated during the preparation of the consolidated financial statements and are not part of the normal company transactions with regards to its purpose and conditions.

At any rate, report shall be issued on any intra-group transaction with entities in countries or territories classified as tax havens:

Not applicable

D.5 Indicate the amount of the transactions with other connected parties..

Not applicable

D.6 Provide details of any mechanisms in place to detect, determine and resolve possible conflicts of interest between the company and/or its group and its Board members, executives or significant shareholders

The audits Commission is the body responsible for monitoring and resolving conflicts of interest. In accordance with the provisions of the Board of Directors Regulations, board members are obliged to inform the board of any situation of potential conflict, in advance, and to abstain thereof until the commission reaches a decision.

D.7 Is more than one company of the group listed in Spain?

No. However, Abengoa Yield, plc., a company pertaining to the Group, is listed in the US, in Nasdaq.

Indicate whether the respective business lines and possible business relations among such companies have been publicly and precisely defined, as well as those of the listed subsidiary with the other companies in the group;

Define any business relations between the parent company and the listed subsidiary company, and between the latter and the other companies in the group.

Abengoa Yield, Plc. is a subsidiary of Abengoa, S.A. in which the latter holds 51,10%.

Abengoa Yield, Plc has entered into the following agreements:

- A ROFO agreement entered into between Abengoa Yield, Plc and Abengoa, S.A. regarding any proposed sale, transfer or other disposition of any of Abengoa’s contracted renewable energy, conventional power, electric transmission or water assets in operation located mainly in the United States, Canada, Mexico, Chile, Peru, Uruguay, Brazil, Colombia and the European Union.

- Executive services agreement (resolved on 15 January 2015) between ACSL and Abengoa Yield

- Support services agreement between Abengoa Yield and ACSL

- Trademark license agreement between Abengoa and Abengoa Yield.

- Call 12% agreement between Abengoa and Abengoa Yield

- MOU non-binding between Abengoa and Abengoa Yield.

State the mechanisms envisaged to resolve any conflicts of interests between the listed subsidiary and the other companies in the group:

Mechanisms to resolve possible conflicts of interest

Protocol for Authorizing and Supervising related Transactions between Abengoa, S.A.and Abengoa Yield plc. approved by the Board of Directors of Abengoa, S.A. based on the proposal by its Audit Commission on May, 26, 2014.