General Shareholders’ Meeting

B.1 Indicate and detail the differences, if any, between the quorum required and what is set forth in the Spanish Corporate Law (LSC) for convening the General Shareholders’ Meeting.

No

Description of the Differences

B.2 Indicate and detail the differences, if any, with regards to the system contemplated in the LSC for signing corporate agreements.

No

Describe how it is different from the system envisaged by the LSC

B.3 Indicate the rules applicable to the amendment of the company’s bylaws. In particular, the majority required for the amendment of the bylaws and, as the case may be, report on the legal provisions for the protection of the rights of the partners in the amendment of the bylaws.

Article 11 of the rules and regulations of the General Meeting establishes a special quorum that may enable the ordinary or extraordinary general assembly to validly agree on bond issuance, on capital increase or decrease, on changing, merging or splitting of the company and, in general, on any amendments whatsoever to the Bylaws, thus requiring, on the first call, the attendance of shareholders present or represented with at least fifty percent of the subscribed equity with voting rights and, on the second call, only requiring the attendance of twenty-five percent of said capital. In the event of the attendance of shareholders with less than twenty-five percent of the subscribed capital with voting rights, decisions may only be taken with the favourable votes of two thirds of the capital present or represented in the Meeting”.

Article 8 of the bylaws establishes certain rules and regulations for the purpose of protecting minority shareholders in bylaw amendment matters:

“1t Separate voting in matters regarding the amendment of bylaws or agreements and other operations that may negatively affect class B shares

Bylaw or agreement amendments that may directly or indirectly damage or negatively affect the pre-emptive rights or privileges of class B shares (including any amendments to the precautionary bylaws regarding class B shares or any agreements that may damage or negatively affect class B shares in comparison with class A shares, or that may benefit or favourably affect class A shares in comparison with class B shares) shall require, in addition to being approved pursuant to the stipulations of these bylaws, the approval of a majority of class B shares in circulation at the time. For explanatory but by no means limiting purposes, said precaution shall entail as follows: the elimination or amendment of the precautions set forth herein on the principles of proportionality between the number of shares representing class A shares, those of class B and those of class C (if previously issued) over the total of the company’s shares in the issuance of new shares or securities or instruments that may give rise to conversion, exchange or acquisition, or in any other manner, that may suppose a right to receive the company’s shares; the partial or total exclusion, of a non-egalitarian nature for shares of class A, class B and class C (as the case may be), of the pre-emptive and other analogous rights that may be applicable by Law and by these bylaws; the repurchase or acquisition of the company’s own shares that may affect class A shares, class B shares and class C shares (as the case may be), in non-identical manner, in terms and conditions, in price or otherwise therein, and which may exceed what is produced under the framework of ordinary operation of treasury stock or which may cause amortization of shares or the reduction of capital in non-identical manner for class A, class B or class C shares (as the case may be); the approval of the company’s structural modification that does not amount to treatment identity in all of its aspects for class A and class B shares; the exclusion of the shares of the company from trading on any secondary stock exchange or securities market except through the presentation of an offer of acquisitions for the exclusion from trading as envisaged in the considerations for the class A, class B and class C shares (as the case may be); the issuance of class C or of any other class of preferred or privileged shares that may be created in future.

For that purpose, separate voting rights shall not be required for the various existing classes of shares to decide on whether to totally or partially exclude, as the case may be, the pre-emptive and other analogous rights that may be applicable pursuant to the Law and to these bylaws, simultaneously and identically for class A, class B and, as the case may be, class C shares””

[…]

“2nd Separate voting in matters regarding the amendment of bylaws or agreements and other operations that may negatively affect class B shares

Notwithstanding Article 103 of the Corporate Law, amendments of bylaws or agreements that may directly or indirectly damage or negatively affect the pre-emptive rights or privileges of class C shares (including any amendments to the precautionary bylaws relating to class C shares or to any agreement that may damage or negatively affect class C shares in comparison with class A and/or class B shares, or that may benefit or favourably affect class A and/or class B shares in comparison with class C shares) shall require, in addition to approval pursuant to the stipulations of these bylaws, approval by a majority of class C shares in circulation at the time. For explanatory but by no means limiting purposes, said precaution shall entail as follows: the elimination or amendment of the precaution set forth herein on the principles of proportionality between the number of shares representing class A shares, those of class B (if previously issued) and those of class C over the total of the company’s shares in the issuance of new shares or securities or instruments that may give rise to conversion, exchange or acquisition, or otherwise, that may suppose a right to receive the company’s shares; the partial or total exclusion, of a non-egalitarian nature for shares of class A and/or class B and class C of the pre-emptive and other analogous rights that may be applicable by Law and these bylaws; the repurchase or acquisition of the company’s own shares that may affect class A and/or class B shares with regards to class C shares, in non-identical manner, in terms and conditions, in price or in any other manner, and which may exceed what is produced under the framework of ordinary operation of treasury stock or which may cause amortization of shares or reduction of capital in non-identical manner for class A, class B (as the case may be) and class C shares; the approval of the company’s structural modification that does not amount to treatment identity in all of its aspects for class A, class B shares (as the case may be) with regards to class C; the exclusion of the shares of the company from trading on any secondary stock exchange or securities market except through the presentation of an offer of acquisitions for the exclusion from the trading as envisaged in the considerations for the class A, (class B as the case may be) and class C shares; the issuance of any other class of preferred or privileged shares that may be created in future.

Notwithstanding the provisions of Article 293 of the Corporate Law, whatever the case may be, the Company’s agreements on capital increase under whatsoever modality and under any formula that may give rise to the first issuance of class C shares shall, in addition to its approval in accordance with the legal provisions and with Article 30 of these Bylaws, require the approval of the majority of class B shares that may be in circulation.”

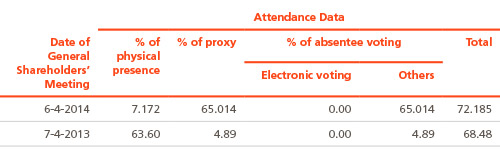

B.4 Give details of attendance at general meetings held during the financial year to which this report refers and during previous financial years

B.5 Indicate whether there are any restrictions in the Bylaws establishing a minimum number of shares needed to attend the General Shareholders’ Meeting:

Yes

Number of shares required for attendance to the General Shareholders’ Meeting 375

B.6 Indicate whether it was agreed that certain decisions entailing a structural modification of the company (“subsidiarization”, purchase-sale of essential operational assets, operations equivalent to liquidating the company…) shall be subject to the approval of the Shareholders’ General Meeting, even if not specifically required under Commercial Laws.

No

B.7 Indicate the address of and how to access the company’s Website to obtain corporate governance and General Meeting information that should be made available to the shareholders through the Company’s Website.

The address of the Abengoa SA Website is www.abengoa.com/.es and all the necessary and updated information relating to shareholders meetings can be found under the section of Shareholders and Corporate Governance.

The complete link to be followed:

http://www.abengoa.es/web/es/accionistas_y_gobierno_corporativo/juntas_generales/

In compliance with article 539.2 of the Corporate Law, Abengoa approved the regulations for the electronic forum for shareholders to facilitate communication between shareholders in connection with convening and holding each shareholder’s general meeting. Shareholders may send the following prior to each general meeting:

- Proposals intended for inclusion as part of the agenda outlined in the call for the general shareholders’ meeting.

- Requests for the inclusion of said proposals. .

- Initiatives for acquiring the sufficient percentage for the exercise of a minority voting rights

- Requests for voluntary representation.