Ownership structure

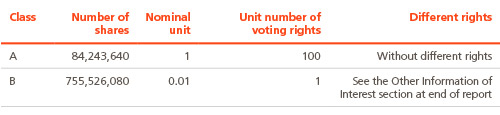

A.1 Complete the following table on the company’s share capital:

Indicate whether there are different types of shares with different associated rights:

Yes

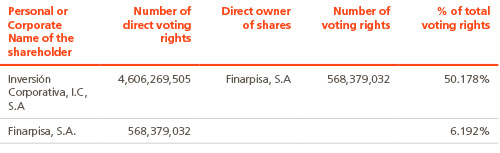

A.2 List the direct and indirect holders of significant ownership interests in your company at year-end, excluding board members

Indicate the most significant movements in the shareholding structure of the company during the year:

Not applicable.

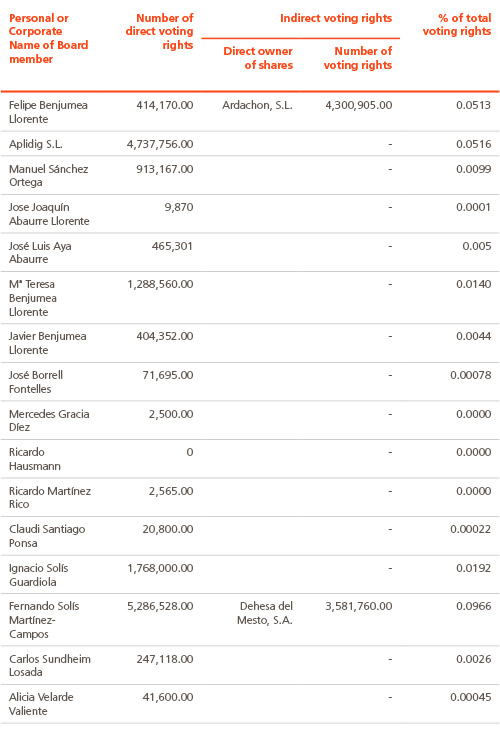

A.3 Complete the following tables on company board members with voting rights through company shares:

% total of voting rights held by board of directors 0.2561

Notwithstanding the above, following the close of the financial year, on January 19, 2015, Aplidig S.L. (Prof. Mr. José B. Terceiro) resigned from all posts it (he) held on the Company’s Board of Directors and its Commissions.

Likewise, in that same meeting of the Board of Directors and to fill in the vacancy originated as consequence of the resignation of Aplidig S.L. (Prof. Mr. José B. Terceiro), following a proposal of the Appointments and Remunerations Commission, the Board unanimously agreed to appoint Mr. Antonio Fornieles Melero as Independent Director, as Second Vice-chairman, as member of the Audit Commission, as member of the Appointments and Remunerations Commission and as Lead Independent Director, for the statutory period of four years. The number of voting rights held by Mr. Antonio Fornieles Melero is 0.

Finally, in that same meeting of the Board of Directors and following a proposal of the Appointments and Remunerations Commission, the Board unanimously agreed to appoint Mr. Manuel Sánchez Ortega as first vice chairman of the Company. Such an appointment does not affect his delegated powers as CEO. Consequently, Mr. Manuel Sánchez Ortega now holds both the offices of First Vice-chairman and CEO.

Complete the following tables on members of the company’s Board of Directors with rights over company shares:

Not applicable

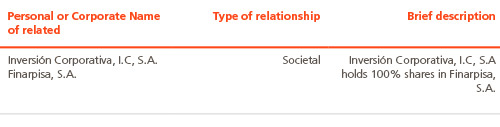

A.4 Indicate, where applicable, any family, business, contractual or corporate relations between owners of significant shareholdings, insofar as these are known by the company, unless they bear little relevance or arise from ordinary trading or course of business:

A.5 Indicate, as the case may be, any commercial, contractual or corporate relations between owners of significant shareholdings on the one hand, and the company and/or its group on the other, unless these bear little relevance or arise from ordinary trading or course of business:

Not applicable

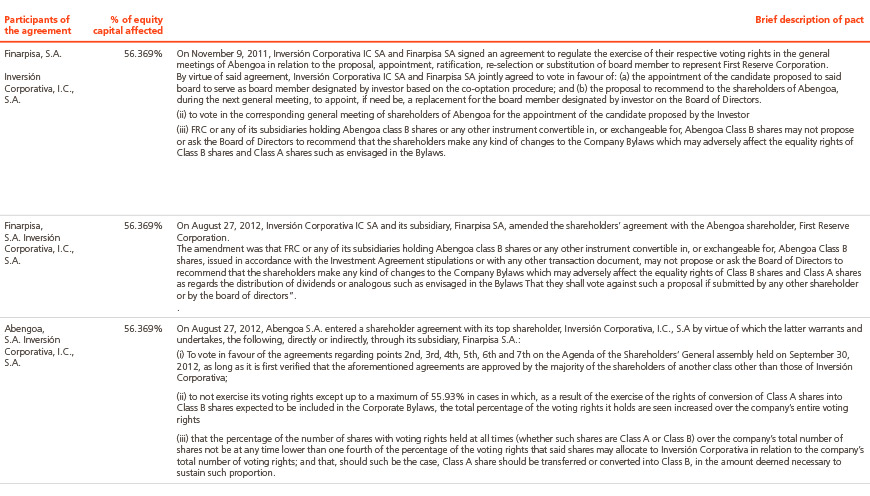

A.6 Indicate whether any shareholders’ agreements affecting the company have been communicated to the company pursuant to Art. 530 and 531 of the Spanish Law on Corporations. If so, provide a brief description and list the shareholders bound by the agreement:

Specify whether the company is aware of the existence of any concerted actions among its shareholders. If so, provide a brief description:

Not applicable

Expressly indicate any amendments to, or terminations of such accords or concerted actions during the year:

No

A.7 Indicate whether any individual or corporate body currently exercises, or could exercise control over the company pursuant to Article 4 of the Spanish Securities Market Act. If so, please identify:

Yes

Personal or Corporate Name

Inversión Corporativa, I.C, S.A.

Comments

Inversión Corporativa, I.C, S.A. is the direct holder of 50.178% of the equity capital of Abengoa, S.A. and an indirect holder of 6.192% through its subsidiary, Finarpisa S.A. Inversión Corporativa, I.C, S.A. is bona fide owner of the 100% shares of Finarpisa S.A.

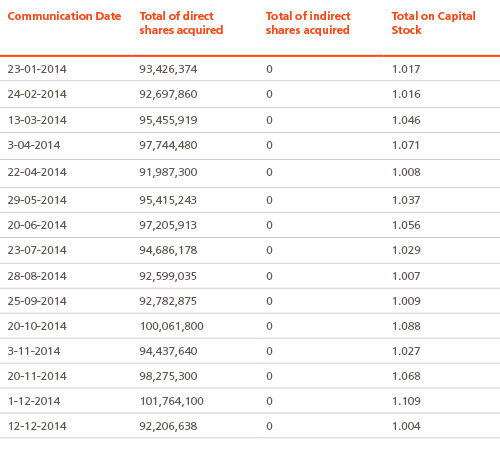

A.8 Complete the following tables on the company’s treasury stock:

At year end:

Provide details of any significant changes during the year, in accordance with Royal Decree 1362/2007:

A.9 Provide details of the conditions thereof and the current timeframes thereto that shareholders conferred upon the Board of Directors to issue, repurchase or transfer treasury stock.

The Ordinary General Meeting of Shareholders held on April 6 2014 authorized the Board of Directors to buy back the Company’s shares either directly or through its subsidiary or investor companies up to the maximum permitted by current laws at a rate set between one hundredth part of a Euro (€0.01) as a minimum and twenty Euros (€20) as maximum, with the specific power of substitution in any of its members. Said power shall remain in force for eighteen (18) months from this very date, subject to article 144 and following of the Corporate Law.

Thus, the authorization conferred upon the Board of Directors for the same purposes, by virtue of the decision taken at the Shareholders’ Ordinary General Meeting held on April 7, 2013, was specifically revoked.

On November 19 2007, the company signed a Liquidity Agreement regarding Class A shares with Santander Investment Bolsa, S.V. In replacement of said Liquidity Agreement, on January 10 2013, the company signed a Liquidity Agreement regarding class A shares, pursuant to the conditions set forth in Circular 3/2007, of December 19, of the CNMV.

On November 8 2012, the company signed a Liquidity Agreement regarding Class B shares, with Santander Investment Bolsa, S.V., pursuant to the conditions set forth in Circular 3/2007, of December 19, of the CNMV.

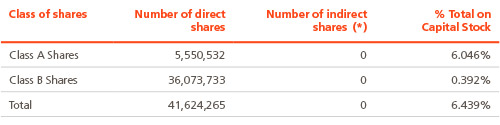

On December 31 2014 the treasury stock amounted to 41,624,265 shares, out of which 5,550,532 are Class A and 36,073,733 are Class B.

Regarding transactions performed during the financial year, the acquired treasury stock amounted to 183,363,281, out of which 14,237,018 were Class A and 169,126,263 Class B, and treasury stock sold amounted to 181,748,323, out of which 14,069,382 were Class A while 167,678,941 were Class B, The net result of the transactions amounted to 1,614,958 shares.

A.10 Indicate whether there are any restrictions on the transferability of stocks and/or any restrictions on the voting rights. In particular, issue report on the existence of any kind of restrictions that could impede complete takeover of the company through the acquisition of its shares on the market.

No

Description of the Restrictions

A.11 Indicate whether the General Shareholders’ Meeting agreed to implement any neutralization measures to prevent public takeovers pursuant to the provisions of Law 6/2007.

No

Where applicable, explain the approved measures and terms under which restrictions will be rendered ineffective:

A.12 Indicate whether the company has issued securities not negotiated on the community regulated market.

Yes

If so, indicate the various classes of shares and, for each class of shares, the rights and obligations entailed therein.

Class B shares are also listed in NASDAQ Global Select Market through “American Depositary Shares” represented by“American Depositary Receipts” (with five class B shares interchangeable by one American Depositary Share).