Structure of the company’s governing body

C.1 Board of Directors

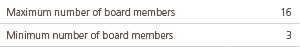

C.1.1 Indicate the maximum and minimum number of board members stipulated in the company Bylaws:

C.1.2 Complete the following table with the Board members:

Notwithstanding the above, on January 19, 2015, Aplidig S.L. (Prof. Mr. José B. Terceiro) resigned from all posts held on the Company’s Board of Directors and its commission. Mr. Antonio Fornieles Melero was appointed to replace it (him) as Independent Director, Second Vice-chairman and Lead Independent Director. Mr. Manuel Sánchez Ortega was appointed as First Vice–chairman, combining this office with that of CEO.

Indicate the terminations that occurred on the board of directors during the period being reported

None

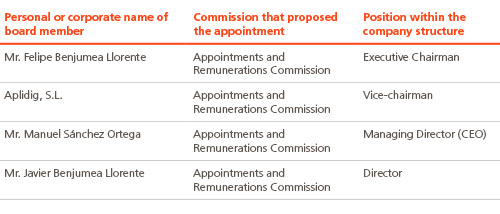

C.1.3 Complete the following tables on the board members and their different conditions:

Executive board members

Notwithstanding the above, on January 19, 2015, Aplidig S.L. (Prof. Mr. José B. Terceiro) resigned from all posts it (he) held on the Company’s Board of Directors and its commissions.

Total number of executive Board members 4

Total % of Board 25%

Independent External Directors

Total number of proprietary Board members 7

Total % of Board 43.75%

External Independent Board members

As already stated, on January 19, 2015 Mr. Antonio Fornieles Melero was appointed as Independent Director.

Total number of independent board members 5

Total % of board members 31.25%

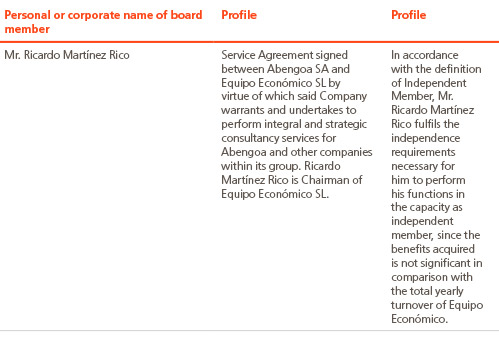

Indicate whether any director classified as independent receives any amount or benefit from the company or from his/her own group, in any concept other than in remuneration as board member, or whether he/she maintains or has maintained a business relation with the company or with any company within its group during the last financial year, in his/her own name or as significant shareholder, board member or top executive of a company that maintains or has maintained such relationship.

As the case may be, the board shall include a statement outlining the reasons why it deems that said board member can perform his/her duties in the capacity as independent board member.

Other External Board members

Not applicable

Explain the reasons why these cannot be considered independent or proprietary, and detail their connections with the company, its executives or shareholders:

Not applicable

Indicate the variations, as the case may be, that occurred during the period in the typology of each board member:

Not applicable

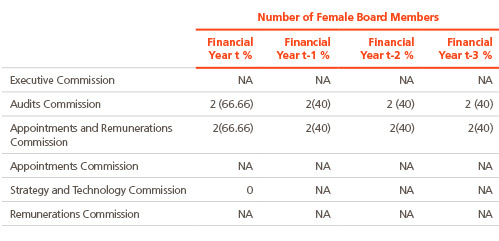

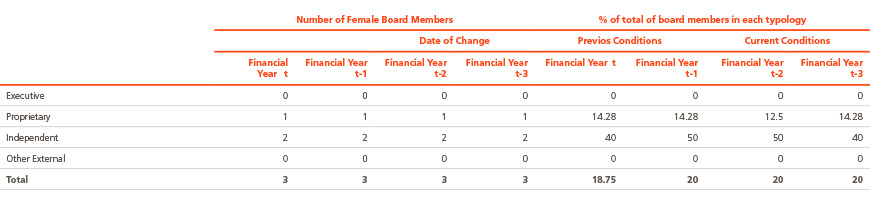

C.1.4 Complete the following table with the information on the number of female board members for the last four financial years, including the nature of such board members:

C.1.5 Explain, as the case may be, the measures taken by the company to ensure that females are included on the Board of Directors in a number that may ensure the male/female equilibrium.

Explanation of the measures

Five of the members of the Board of Directors are independent and two of those are female. The appointments and remunerations Commission promotes the inclusion of females on to the board of directors, specifically focusing on the posts of independent board member since the rest of the other member-posts that make up the Board are proprietary board member posts whose selections do not directly depend on the Commission. Thus, Abengoa ensured that the number of women is representative based on the number of independent members by applying the policy established in Article 1 letter a and b of the regulations of the Appointments and Remunerations Commission which specifically outlines the quest for equal opportunities: “Article 1 – Composition and Structure”. […] “The Appointments Commission shall establish procedures and, in the event of new vacancies, shall ensure that:

- the procedures for filling in board vacancies refrain from implicit bias against female candidates;

- the company makes a conscious effort to include females in the target profile among the candidates for board places.”

Moreover, through the company’s Equality Framework Plan, Abengoa has defined a corporate strategy in the field of equal rights between male and female. Thus, all Abengoa companies and work centres take and use this Plan as reference to develop and approve their own. In 2009, to ensure the practice of these values, Abengoa created the Equal Opportunity and Treatment Office (OITO) under the Equality Framework Plan. The mission of this office is to advocate gender equality with the whole organization, promoting, developing and managing the Equality Framework Plan and all plans associated with it.

In addition, the company created the Equal Opportunity and Treatment Commission, presided over by the Human Resources Director and integrated by the HR heads from the various areas and geographical locations of the business as well as by the CSR director as permanent members, for the purpose of worldwide follow-up, and subsequent development of the issues relating to equal opportunity among the male and female employees of Abengoa

C.1.6 Explain the measures, as the case may be, that the Appointments Commission may have agreed upon to ensure that selection procedures refrain from implicit bias that would otherwise impede the selection of female members, and that the company purposefully seeks to include and includes female candidates that meet the professional profile sought:

Explanation of the measures

The Appointments and Remunerations Commission objectively and transparently assess the potential candidates based on merit criteria, promoting male and female equality and rejecting all kinds of direct or indirect discrimination based on sex.

The Commission, which includes women in its rank and file, assesses the competences, knowledge and experience that the Board requires, and defines the aptitude and functions sought in the candidates to occupy the vacancy available, evaluating the time and dedication such candidates may require to be able to diligently perform their duties, and then decide by majority vote.

If albeit the measures implemented, as the case may be, the number of female board members is still scarce or non-existent, explain the reasons to justify such:

Explanation of Reasons

Not applicable

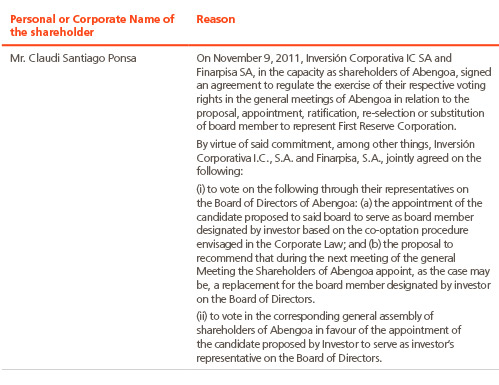

C.1.7 Explain the manner in which shareholders with significant shares are represented on the board.

Shareholders with significant shares are represented by proprietary (dominion) board members who exercise their functions based on the company’s code of conduct and on the rest of the standards and regulations deemed applicable to all members of the board.

C.1.8 Explain, where applicable, the reasons why proprietary members were appointed at the request of shareholders with stakes amounting to less than 5% of the share capital:

Detail any failure to address formal requests for board representation made by shareholders with stakes equal to or exceeding that of others at whose request proprietary members were appointed. If so, explain the reasons why the request was not entertained:

Not applicable

C.1.9 Indicate whether any board member resigned his/her post before the end of term of office, whether reasons were given to the Board and how, and, if in writing to the entire Board, at least explain the reasons given by the board member:

No

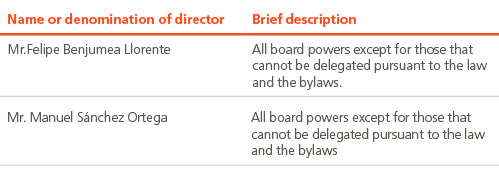

C.1.10 Indicate, as the case may be, the powers delegated by any Chief Executive Officers:

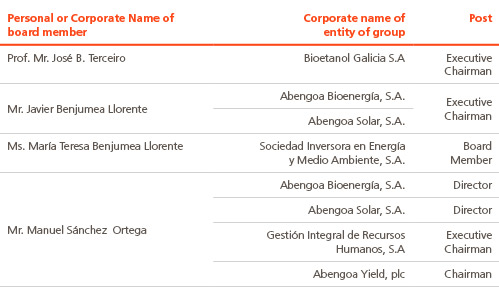

C.1.11 Identify, if possible, the board members holding administrator or management posts in other companies making up the group of companies listed on the stock market:

Notwithstanding the above, on January 19, 2015, Aplidig S.L. (Prof. Mr. José B. Terceiro) resigned from all posts it (he) held on the Company’s Board of Directors and its commissions.

C.1.12 Provide details, where applicable, of company Board members who also sit on the boards of other entities not belonging to the same business unit and are listed on the Spanish Stock Exchange, of which the company is aware:

Not applicable

C.1.13 Indicate, and if so, explain whether the company has established rules on the number of Boards on which its own Board members may sit:

No

Explanation of the rules

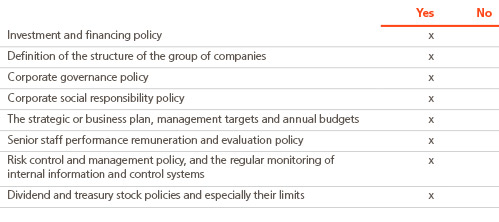

C.1.14 State the company’s general policies and strategies that the board reserved the powers to approve in plenary session:

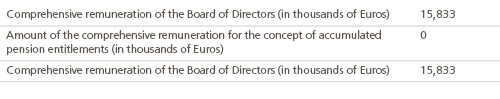

C.1.15 Indicate the comprehensive remuneration of the Board of Directors

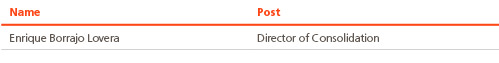

C.1.16 Identity any senior management staff who is not also an executive board member, and indicate the total remuneration payable thereto during the financial year:

Total of Remunerations for Senior Staff 11,351

Notwithstanding the above, effective February 1, 2015, Mr. Ignacio García Alvear replaced Bárbara Zubiría Furest as Co-CFO Capital Markets & IR. Furthermore, in 2015 Mr. Fernando Martínez Salcedo has also ceased to be member of the senior management.

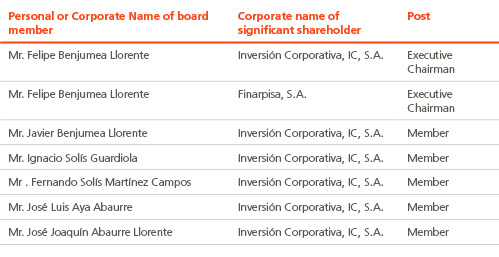

C.1.17 Identify, as the case may be, the members of the Board of Directors who are also members of the board of directors of significant shareholding companies and/or in entities of their group:

Provide details, where applicable, of any relevant relations other than those contemplated in the previous section, between members of the board of directors and significant shareholders and/or group entities:

Not applicable

C.1.18 Indicate whether any of the rules and regulations of the board were amended during the financial year:

Yes.

Description of Amendments

By virtue of the Board of Directors decision taken on October 20 2014, Article 29 of the Board of Directors Regulations was added to reflect the creation of the Strategy and Technology Commission. Said commission shall comprise of three Board Members minimum, appointed by the Board of Directors. More than half of them shall be non-executive Board Members. The appointment shall be for a period of four years, renewable for same periods maximum. Their primary functions will be to:

- Analyse basic issues relating to technology and strategy, in consensus manner, that may affect Abengoa, including the studying or entrusting the study of products and services that make up of may make up Abengoa’s portfolio.

- Prospectively analyse the possible evolution of Abengoa’s business based on its own or third party technology developments.

- Supervise the R+D policy and investments and Abengoa’s strategic lines of technology development.

- Analyse and supervise the main activities related to technology in Abengoa, such as patent portfolios, their management, innovation introduction, etc.

- Gather information on the organization and personnel of the company through the Executive Chairman of Abengoa.

- Inform the Board of Directors, or its Executive Chairman, on whatsoever matters it may require in relation to Abengoa’s strategic and technology development.

- All other matters relating to aspects of its authority that may be requested of it by the Board of Directors or its Executive Chairman

Likewise, after the fiscal year close, by virtue of the Board of Directors decision taken on January 19 2015, Article 22 of the Board of Directors Regulations was amended to add the following paragraph:

“The Board of Directors will be entitled to designate the lead independent director referred to in article 529 septies of the Companies Act as second vice-chairman of the board of directors”.

C.1.19 Indicate the procedures for the selection, appointment, reappointment, appraisal and removal of Board members. Provide details of the authorised bodies, the procedures to follow and criteria to employ in each of the procedures.

The Appointments and Remunerations Commission is the body authorised in all cases to provide the Board of Directors with duly substantiated proposals, applying the criteria of independence and professionalism as established in the regulations governing the Board and the Commission.

The performance of the board members and of the executive board members is assessed on the Appointments Commission’s proposal through substantiated reports filed to the Board during the meeting held in the subsequent first quarter that follows the closing of the previous financial year and after obtaining or at least knowing the accounting estimate for the financial year closing and upon receipt of the auditor’s report since both are essential as assessment criteria.

The Audit Commission and the Appointments and Remunerations Commission were formed on December 2, 2002 and on February 24, 2003, respectively. On the same date, the board of directors prepared a proposal to amend the bylaws for the purpose of incorporating provisions for the Audit Commission, the proposal for regulating meetings of Shareholders, the partial amendments to board of directors’ regulations and, finally, the internal regulations of the audits Commission and of the appointments and remunerations Commission, approved by the general shareholders’ meeting held on June 29, 2003.

In February 2004 the composition of both Commissions was modified to permit independent board members from outside the company to become members of said commissions. Consequently, the Audit Commission and that of Appointments and Remunerations now comprised of non-executive board members, all of them independent, as required in the Financial System Reforms Law. Since there was as yet no appointments commission, the first two independent board members were appointed by the board of directors, as is logical. Said independence is also ratified on annual basis by the Appointments Commission. Once created, it was entrusted with the duty to propose the appointment of board members, and since then it has remained in charge of proposing to the Board of Directors

With regards to the procedures for selecting and appointing independent board members, the appointments and remunerations Commission is the body in charge of selecting profiles that best represent the needs of the different interest groups among professionals of different fields and of renowned national and international prestige. The procedure for selecting them is based on merits and on the intention to cover any vacancy with professional profiles that are not linked to any specific interests.

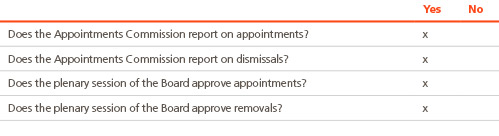

Thus, the appointments and remunerations Commission performs annual inspections to verify the sustenance of the conditions met for the appointment of the board member and the nature and typology assigned to said member, and then includes the information in the annual report of the corporate governance. The appointments commission likewise strives to ensure that the selection procedures for filling in vacancies refrain from implicit biases that may hinder the inclusion of females that fit the required profile into the potential candidates. Its functions also include reporting to the Board of Directors on appointments, re-elections, terminations and remunerations of board members and posts, as well as the general policy of remunerations and incentives for board members and for the senior management and to inform the board of directors beforehand on all proposals to be submitted to the general shareholders for the appointment or dismissal of board members, even in cases of co-optation by the board of directors itself.

In relation with the above, external auditors issue annual verification reports that are independent from the report issued by the corporate governance of Abengoa S.A., evaluating whether its contents conform both with the recommendations of the report of the special work group on the good governance of listed companies (Unified Code of Good Governance) as well as with the amendments fostered in by virtue of Law 2/2011, of 4th March, on Sustainable Economy

C.1.20 Indicate whether the Board of directors made any efforts to assess its activities during the financial year

Yes

If so, explain to what extent the self-assessment has given rise to significant changes in its internal organization and regarding the procedures followed in its activities:

Description of Amendments

There were no amendments

C.1.21 Indicate the cases in which Board members are obliged to resign.

Directors are removed from office when the term for which they were appointed comes to an end, and in all other cases deemed appropriate by law, the bylaws or the regulations.

Board Members are obliged to surrender their posts to the board of directors and to formalize their resignation, if the board deems it convenient, in the following cases:

- If they are involved in any of the supposed incompatibilities or prohibitions

envisaged by law. - If deemed severely liable by any public authority for infringing upon their obligations as board members.

- If the board itself requests it so because board member is deemed to have infringed upon his/her obligations thereof.

Thus, Article 13 (Board Member Termination) of the Board of Directors Regulations establishes that:

- 1.Board Members duties shall be terminated if the duration period of the appointment expires or if all other assumptions deemed appropriate by the Law, the Bylaws, and the Regulations, occur.

- 2.Board Members are obliged to surrender their posts to the board of directors and to formalize their resignation, if the board deems it convenient, in the following cases:

- If they are involved in any of the supposed incompatibilities or prohibitions envisaged by law.

- If deemed severely liable by any public authority for infringing upon their obligations as board members.

- If the board itself requests it so because board member is deemed to have infringed upon his/her obligations thereof.

- 3.When the period expires or duty is terminated, whatever the reason, said board member may not render any services to any other competing entity for a period of two years, except if the board of directors release him/her from this obligation or shortens the duration.”

C.1.22 Indicate whether it is the chairman of the board of directors who also serves as the company’s chief executive. If so, outline the measures taken to limit the risks entailed in concentrating powers in a single person:

Yes

Measures to limit risks

In accordance with the provisions of article 44 bis of the Company’s Bylaws, on December 2, 2002 and on February 24, 2003, the board of directors set up the audits Commission and the appointments and remunerations Commission, respectively.

These Commissions are vested with the necessary non-delegable powers inherent in the responsibilities assigned them by law, by the bylaws and by their respective internal regulations, which makes them organs of monitoring and supervision of issues within their power.

Both are presided over by independent, non-executive board members, and are exclusively comprised of independent and non-executive board members.

On December 10, 2007, the board of directors decided to appoint Prof. Mr José B. Terceiro Lomba (representing Aplidig SL), coordinator-board member, as Executive Deputy Chairman of the board of directors, with the consent of all the other board members and especially the independent members. Notwithstanding the above, on January 19, 2015, Aplidig S.L. (Prof. Mr. José B. Terceiro) resigned from all posts it (he) held on the Company’s Board of Directors and its commissions.

On October 25, the board of directors also decided to appoint Mr. Manuel Sánchez Ortega as CEO sharing his executive duties with Mr. Felipe Benjumea Llorente. Said appointment was ratified by the General Shareholders’ Meeting on April 10, 2011. Based on the explanation above, with four executive board members, and an ample majority of independent or external board members, all the decisions taken by the top executive are subject to effective monitoring to ensure that power is not concentrated in the top executive, to boost decision-making and to allow the company governance to function properly.

Indicate and, if so, explain whether rules were established to empower any independent board member to request the convening of a board meeting, or to include new items on the agenda, in order to coordinate and echo the concerns of external board members and to oversee the assessment by the board of directors.

Yes

Explanation of the rules

There are currently sixteen members on the board of directors. The Board of Directors Regulations governs the composition, functions and internal organization of the governing body. The company also has an Internal Code of Conduct that bounds the board of directors, the senior management and all other employees deemed affected by virtue of the positions or powers that may be held in matters relating to the Stock Market. The Shareholders’ General Meeting Regulations governs the formal aspects and the internal system for holding shareholders’ meetings. Lastly, the board of directors is assisted by its audits Commission, the appointments and remunerations Commission and, more recently, the strategy and technology commission, each of which has its own respective internal regulations. All the rules and regulations, set fought in the consolidated text of the company’s Internal Good Governance Rules, are available on the company’s website at www.abengoa.es and wwww.abengoa.com.

Since it was formed, the appointments and remunerations Commission has been analysing the structure of the company’s governing body and adapting it to the recommendations of corporate governance, especially to the historic and special configuration of said bodies within Abengoa. In February 2007, based on this analysis, the commission recommended the creation of the post of Lead Director, and the elimination of the Board of Directors’ Advisory Board. The first measure was in order to incorporate the corporate governance recommendations prepared in Spain in 2006; the second, because it was deemed that said Advisory Board had already performed the duty for which it was originally created and that its coexistence with the corporate bodies could lead to conflicts of power. Both proposals were approved at the Board of Directors’ meeting held in February 2007 and at the General Shareholders’ Meeting held on April 15 of the same year. Thus, Prof. Mr José B. Terceiro was appointed (on behalf of Aplidig, S.L.) as Lead Director, in his capacity as independent member, until January 19, 2015, when he (it) was replaced by Mr. Antonio Fornieles Melero. On a final note, in October 2007 the commission proposed that the board should accept the resignation of Mr. Javier Benjumea Llórente from his post as Deputy Chairman and should also revoke his delegated powers, and should likewise accept the appointment of a new natural person to represent Abengoa and Focus-Abengoa Foundation in entities or companies where representation is required.

The commission then decided to revisit the study of the number and characteristics of the Deputy Chairman of the board of directors within the current structure of governing bodies.

As a result, the commission thought it necessary to restrict the powers of the Deputy Chairman of Abengoa to those conferred under the Spanish Corporate Law with regards to the organic representation of the company on the one hand, and as balance to the Chairman’s functions on the board of directors, on the other. Thus, it was considered that the coordinating board member – with the functions assigned by the resolutions of the board of directors (February 2007) and the shareholders’ general meeting (April 2007) – was the ideal figure, given the corporate governance recommendations and the company structure, as well as the composition and diversity of its directors. The coordinating board member has already been entrusted with the task of coordinating the concerns and motivations of the other board members, and empowered to convene board meetings and to include new items on the agenda. In its role as the visible protector of the interests of the Board members, it holds more of a de facto than of a de jure kind of representation on the Board, such that it seemed appropriate to confirm and expand this representation by making the post both institutional and organic. For the reasons outlined above, the commission proposed Aplidig, S.L. (Aplidig, represented by Prof José B. Terceiro Lomba), the then Lead Director, as the new Executive Deputy Chairman to the Board of Directors. In addition, and within the functions of organic representation, the executive deputy chairman, jointly with the chairman of the board of directors, has been put forward as the physical representative of Abengoa, in its capacity as the Chair of the Board of the Focus-Abengoa Foundation, as well as in any other foundations and institutions in which the company is or should be represented.

In view of the above, on December 10, 2007, the board of directors agreed to appoint Aplidig, S.L. (represented by Prof José B. Terceiro Lomba), the then Lead Director, as Executive Deputy Chairman of the Board of Directors, and the independent board members unanimously consented to it retaining its post as coordinating board member in spite of its new appointment as Executive Deputy Chairman. In addition, and within the functions of organic representation (conferred through a power of attorney granted by the board of directors on July 23, 2007), the Executive Deputy Chairman, together with the Chairman of the Board of Directors, was proposed as joint physical representative of Abengoa, in its capacity as the Chair of the Board of Focus-Abengoa Foundation, and of any other foundations and institutions in which the company is or should be represented.

Notwithstanding the above, as indicated, on January 19, 2015, Aplidig S.L. (Prof. Mr. José B. Terceiro) was replaced by Mr. Antonio Fornieles Melero as Lead Independent Director, with the powers set forth in article 529 septies of the Companies Act, and Second Vice-chairman, the latter being non-executive.

C.1.23 Does the company require reinforced majorities other than the legal majorities for any type of resolution? If so, provide a description of the differences.

No

Description of the differences

C.1.24 Explain whether there are specific requirements other than those relating to Board members for being appointed Chairman of the board of directors.

No

C.1.25 Indicate whether the Chairman has a deciding vote:

Yes

Matters in which there is a deciding vote:

In the event of draws.

C.1.26 Indicate whether the bylaws or board regulations establish any age limit on board members:

No

C.1.27 Indicate whether the bylaws or board regulations establish a limited mandate for independent board members, other than established in the law:

No

Maximum number of years of mandate

C.1.28 Indicate whether the bylaws or the board of directors’ regulations establish specific regulations for delegating voting rights on the board of directors, how it is done and, in particular, the maximum number of delegations that may be conferred on a board member, as well as whether it has been made compulsory to delegate in a board member of similar class If so, provide brief details of said regulations.

The second section of Article 10 of the Regulations of the Board of Directors establishes the following:

“Each board member may confer his/her representation upon another board member without it limiting the number of representations that each may hold for attendance to the board. The representation of the absent board members may be conferred in writing by any means whatsoever, including telegram, telex or telefax addressed to the chair.”

C.1.29 Indicate the number of board meetings held during the financial year. Likewise indicate, where applicable, the number of times the Board met without the chairman in attendance: Proxies granted with specific instructions for the meeting shall be counted as attendances:

Number of board meetings 18

Number of board meetings without the attendance of the Chairman 0

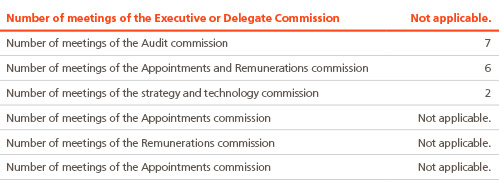

Indicate the number of meetings held by the different board commissions during the financial year:

C.1.30 Indicate the number of board meetings held during the year with the attendance of all its members. Proxies granted specific instructions for meetings shall be counted as attendances:

Attendance of Board Members 16

% of attendance of total votes cast during the year 96.11

C.1.31 Indicate whether the individual and consolidated financial statements submitted for approval to the board of directors are first certified:

Yes

Identify, as the case may be, the person or persons who certified the company’s individual and consolidated financial statements, for their approval by the Board:

C.1.32 Explain, if any, the mechanisms that the board of directors put in place to prevent the board-prepared individual and consolidated financial statements from being presented at shareholders’ general meeting with reservations in the audit report.

The risk control system, the internal audit services and the audits Commission to which the others report, are set up as frequent and regular monitoring and supervision mechanisms that prevent and, if appropriate, resolve potential situations which, if not addressed, could give rise to incorrect accounting treatment. Thus, the audits Commission receives regular information from the external auditor on the Audits Plan and on the results of its execution, and ensures that senior management acts on its recommendations.

C.1.33 Is the secretary to the Board also a board member?

No

C.1.34 Explain the procedures for the appointment and removal of the secretary to the board, indicating whether they are proposed by the appointments commission and approved by plenary session of the Board.

Appointment and Removal Procedure

The appointments and remunerations Commission makes the proposal

Is the Secretary to the Board entrusted with the duty of ensuring that the recommendations on good governance are followed?

No

Comments

The compliance officer is in charge of ensuring follow-ups on corporate good governance recommendations and at the same time in charge of ensuring compliance with the internal rules and regulations.

C.1.35 Indicate, as the case may be, the mechanisms established by the company to preserve the independence of the external auditors, the financial analysts, the investment banks and the rating agencies.

Article 27 of the Board of Directors Regulations establishes the function of the audits Commission as being to ensure the independence of the external auditor, which includes ensuring an inspection of the services rendered, the limits on the concentration of the auditor’s business, and in general, other regulations in existence to ensure the independence of the auditors. With regards to financial analysts and investment banks, the company maintains an internal procedure for issuing a request for three offers that may be contracted, at the same time the company prepares a mandate letter which reflects the specific terms of the work contracted. As regards credit rating agencies we have the ratings of three agencies plus their mandate letters.

C.1.36 Indicate whether the company changed its external auditor during the financial year. If so, identify the incoming and outgoing auditors:

No

In the event of disagreements with the outgoing auditor, please provide details:

No

Explanation of the disagreements

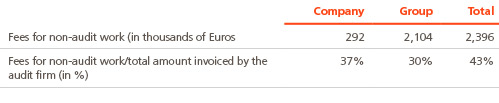

C.1.37 Indicate whether the audit firm performs other non-audit work for the company and/or its business group and, If so, state the total fees paid for such work and the percentage this represents of the fees billed to the company.

C.1.38 Indicate whether the audit report on the annual accounts for the previous financial year contains reservations or qualifications. If so, detail the reasons given by the Chairman of the Audit Commission to explain the content and scope of such reservations or qualifications.

No

Explanation of the reasons

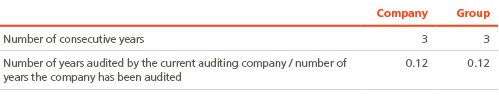

C.1.39 State the number of consecutive years for which the current audit firm has been auditing the annual accounts of the company and/or its business group. Also indicate the percentage of years the current audit firm has been auditing the accounts over the total number of years the annual accounts have been audited:

C.1.40 Indicate and, if possible, provide detail of the procedure by which directors may seek external consultancy:

Details of the procedure

The Secretary to the Board of Directors exercises the functions legally attributed to that position Currently, the office of secretary and legal consultant are not vested in the same person responsible for ensuring that meetings are validly convened and that resolutions are validly adopted by the Board. In particular, he/she advises board members on the legality of the deliberations and motions put forward and on compliance with the Internal Corporate Governance Regulations, which renders him/her the guarantor of the principle of formal and material legality that governs the actions of the Board of Directors. The secretary to the Board of Directors, as a specialized guarantor of the formal and material legality of the board’s conduct, has the full support of the latter to execute its functions with complete independence of criteria and stability, and is responsible for ensuring compliance with the internal regulations on corporate governance. Single-handedly, or through the board members, he/she channels the external consultancy necessary for the due training of the board.

The Board of Directors has access to external, legal or technical consultants, depending on its needs, which may or may not be arbitrated through the Board secretary. The second paragraph of Article 19 of the Regulations of the Board of Directors sets forth that.

“Through the Chairperson of the Board of Directors, Board Members shall be empowered to submit a proposal by majority to the Board of Directors to engage the services of a legal, accounting, technical, financial, commercial or any other kind of consultants deemed necessary in the interests of the Company to provide assistance in the exercise of their duties in dealing with specific problems of certain magnitude and complexity linked with the exercise of such duties.”

C.1.41 Indicate and, as the case may be, provide detail of the procedure by which board members can obtain the necessary information in advance to prepare for meetings of the governing bodies:

Yes

Details of the procedure

Remitting of documents and/or making them available at the Board headquarters in advance of Board Meetings. Also, in compliance with the stipulations in recommendations 24 and 25 of the Unified Code of Good Governance, the company prepared a handbook of basic internal regulations applicable to the functions and responsibilities of the board member to be issued to each new board member appointed, to provide vast knowledge of the company and its internal rules.

C.1.42 Indicate and, as the case may be, provide detail of whether the company established rules that oblige directors to report and, where appropriate, resign in cases where the image and reputation of the company may be at stake:

Yes

Explain the rules

Article 13 of the Board of Directors Regulations establishes that “Board members must offer to resign and, if the Board of Directors considers it appropriate, resign under the following circumstances: if deemed to be involved in any of the legally envisaged suppositions of incompatibility or prohibition.”

Section (p) of Article 14.2 of the same Regulation also establishes the obligation of the board members to inform the company of all legal and administrative claims and of any other claims that, given the magnitude, may severely affect the reputation of the company.

C.1.43 Indicate whether any member of the Board of Directors informed the company that he/she was tried or formally accused of any of the offences stipulated in Article 213 of the Spanish Corporate Law:

No

Indicate whether the Board of Directors analysed the case. If the answer is yes, explain the reasons for the decision taken on whether or not the board member should continue to hold its post or, as the case may be, state the actions that the Board of Directors have taken up to the date of this report or the report intended to be issued later.

Not applicable

C.1.44 List the still valid significant agreements signed by the company, whether modified or terminated in the event of a change in the company’s control through a hostile takeover bid, and its effects.

The Company has not entered into any significant agreements that become effective, are amended or concluded as a consequence of a change in the company’s control through a hostile takeover bid. However, the Company has entered into a bulk of agreements and financial contracts that could be terminated in case of a change in the control majorities of the Company, change that does not always occur in case of a takeover bid.

C.1.45 Identify in sum and provide detail of the agreements signed between the company and its administrative, management or employee posts with compensations, guarantees or protection clauses, in the event of resignation or unlawful dismissal or if contractual relationship is abruptly halted because of a hostile takeover bid or other kinds of transactions.

Not applicable

Indicate whether the governing bodies of the company or its group must be informed of and/or must approve such contracts:

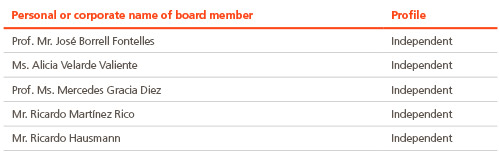

C.2 Commissions of the Board of Directors

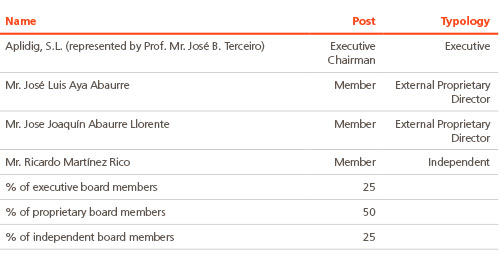

C.2.1 Give details of all Commissions of the board of directors, their members and the proportion of proprietary and independent board members on such Commissions:

Audits Commission

Appointments and Remunerations Commission

On January 19, 2015, the Independent Director, Mr. Antonio Fornieles Melero, was appointed as member of this Commission.

Strategy and Technology Commission

On January 19, 2015, Aplidig, S.L. (represented by José B. Terceiro Lomba) was replaced as chairman by Mr. José Borrell Fontelles

C.2.2 Complete the following table using the information relative to the number of female board members who have served on the Board of Directors Commissions over the past four financial years:

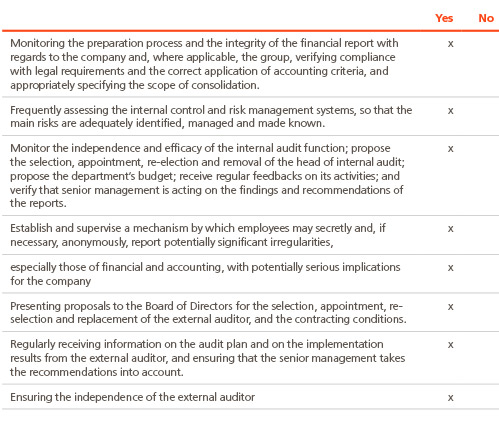

C.2.3 Indicate whether the following functions are vested in the Audit Commission:

C.2.4 Describe the rules of organization and function, as well as the responsibilities attributed to each of the Commissions of the board of directors.

Committee name

Appointments and Remunerations Commission

Brief description

To report on and propose the appointment, re-selection or dismissal of members of the Board of Directors and the International Advisory Board and their posts pursuant to the legal and bylaw provisions and to the general policy of remunerations and incentives for them and for senior management.

To issue prior report on all proposals that the Board of Directors may submit to the general shareholders for the appointment or dismissal of board members, even in cases of co-optation by the board of directors itself.

To approve the remuneration policy for the company’s senior management and for members of the Board of Directors and the International Advisory Board

To evaluate the abilities, knowledge and experience necessary on the board, defining the roles and capabilities required of the candidates to fill each vacancy, and deciding on the time and dedication necessary for them to properly perform their duties.

To examine or organize the succession of the chairman and chief executive and, if need be, to issue recommendations to the board to ensure the planned and orderly fashion of said succession;

To report on the appointments and dismissals of senior staff as proposed by the chief executive to the Board.

To report to the Board on the aspect of gender and diversity

To make the following proposals to the Board of Directors: (i) The remuneration policy for board members and senior management; ii) individual remuneration of board members and the approval of contracts that company may sign with each executive board member; (iii) The standard conditions for senior management employment contracts.

To ensure compliance with the remuneration policy set forth by the company.

To consult the company’s Chairman or chief executive, especially on matters relating to executive board members and senior staff.

To analyse requests that may be issued by any Board Member for the purpose of considering potential candidates to cover Board membership vacancies.

To prepare an annual report on the activities of the Appointments and Remunerations Commission, to be included in the management report.

Committee name

Audits Commission

Brief description

1st In relation to the internal monitoring and reporting systems:

- To know the process of the company’s financial reporting and internal monitoring systems.

- To report on the Annual Accounts, as well as on the quarterly and half-yearly financial statements that must be issued to the regulatory or supervisory bodies of the securities markets, with express mention of the internal control systems, verification of compliance and monitoring through internal audit and, when applicable, on the accounting criteria applied.

- Monitoring the preparation process and the integrity of the financial report with regards to the company and, where applicable, the group, verifying compliance with legal requirements and the correct application of accounting criteria, and appropriately specifying the scope of consolidation.

- Frequently review the systems for the internal monitoring, internal auditing and risks management, so that the main risks are identified, managed and properly disclosed.

- Supervise and ensure the independence and effectiveness of the duties of internal audits and supervising them, with full access to said audits, propose the selection, appointment, re-selection and dismissal of heads of internal audits, propose the budget for said unit, and set the salary scale of its Director; obtain regular information on the activities and the budget of the unit; and ensure that the senior management considers the conclusions and recommendations in its reports.

- Establish and supervise a mechanism by which staff can confidentially and, if necessary, anonymously report any irregularities detected in the course of their duties, in particular financial or accounting irregularities, with potentially serious implications for the company.

- Summon any company employee or manager, and even order them to appear before the Commission without the presence of any other senior officer.

- Supervise compliance with the Internal Code of Conduct in relation to the Securities Market and the Policy on the Use of Relevant Information and the Rules of Corporate Governance.

- Before the Board of Directors take the relevant decisions, the Audits Commission must have informed said board on the following points:

- The financial information that all listed companies must periodically disclose. The Commission must ensure that interim statements are drawn up under the same Accounting principles as the annual statements and, to this end, may ask the external auditor to conduct a limited review.

- The creation or acquisition of shares in special purpose vehicles or entities resident in countries or territories considered tax havens, and any other comparable transactions or operations with complexities that might impair the transparency of the group.

- Associated transactions.

- Of any change in the accounting criteria, and any risks either on or off the balance sheet.

- Inform the Shareholders’ General Meeting on matters and questions posed by shareholders, on issues within its powers.

- Summon any Board Members as deemed appropriate to attend Commission meetings, to report on whatsoever the Audits Commission may require thereof.

- To prepare annual reports on the activities of the Audits Commission itself and to include it in the Management Report.

2nd In relation to external auditors:

- To propose the selection, appointment, re-selection and replacement of external auditors, including the conditions of their hiring, to the Board of Directors to submit said proposal to the General Meeting of Shareholders for approval.

- To regularly obtain information on the audits plan and its results from the external auditors, and on any other activities relating to the financial auditing, and to ensure that senior management act upon the recommendations.

- To ensure the independence of the external auditor and, for that purpose:

- The company must issue notice to the CNMV of any change of auditor as a significant event. Said notice must include a statement on any disagreements with the outgoing auditor and, if so, what it entails;

- The Commission must ensure that both company and auditor adhere to current regulations on providing services other than auditing, to the limits on the concentration of the business of the auditor and, in general, to other standards and regulations set forth to ensure the independence of auditors;

- If an external auditor resigns the Commission must investigate the circumstances leading to the resignation.

- Ensure that the group auditor is entrusted with conducting the audits for the individual group companies.

- To liaise with the external auditors in order to obtain information on any matters that could jeopardize their independence and on any other matters that may be in relation to the financial auditing process.

Commission name

Strategy and Technology Commission

Brief description

The Strategy and Technology Commission shall comprise of at least three Directors appointed by the Board of Directors. More than half of the members shall be non-executive. The term of appointment shall be four years maximum, renewable for periods of equal duration.

The duties of the Strategy and Technology Commission are:

- To jointly analyse any basic matters relating to technology and strategy that can affect Abengoa, including the preparation or assignment of studies on products and services that constitute or may constitute Abengoa’s portfolio.

- To perform prospective analysis on the possible evolution of Abengoa’s businesses based on either personal or third party technological developments.

- To supervise Abengoa’s R+D policy and investments and its strategic lines of technological development.

- To analyse and supervise the main activities relating to technology in Abengoa, such as patent portfolio, its management, implementation of innovations, etc.

- To gather information on the organization and people of the company, through the Chairman of Abengoa.

- o report whatsoever information thereto that may be required thereof by the Board of Directors or its Chairman, in relation to Abengoa’s strategic and technological development.

- Any others relating to any duty of its competence that may be requested by the Board of Directors or its Chairman.

C.2.5 Indicate, as the case may be, the existence of regulations of commissions of the Board, where they can be reached for consultations and any amendments that may have been made during the financial year. Also state whether annual reports were voluntarily prepared on the activities of each commission.

Commission name

Appointments and Remunerations Commission

Brief description

The appointments remunerations commission regulations, last amended on December 16, 2013, available on the company’s website and at the CNMV, prepares its own annual report on activities, which is published as part of the Annual Report.

Commission name

Audits Commission

Brief description

The audits Commission regulations, last amended on December 16, 2013, available on the company’s website and at the CNMV, prepares its own annual report on activities and publishes it as part of the Annual Report.

C.2.6 Indicate whether the composition of the executive commission reflects the participation of the different categories based on their condition on the board:

Not applicable

If no, explain the composition of the executive commission